BTC

$117,415.09

+

3.24%

ETH

$2,987.77

+

5.58%

XRP

$2.7823

+

11.44%

USDT

$1.0002

–

0.01%

BNB

$694.86

+

2.87%

SOL

$163.69

+

1.80%

USDC

$0.9999

+

0.02%

DOGE

$0.2102

+

12.61%

TRX

$0.3009

+

3.23%

ADA

$0.7312

+

11.10%

HYPE

$46.13

+

7.05%

SUI

$3.4575

+

0.91%

XLM

$0.3698

+

24.15%

LINK

$15.68

+

6.62%

BCH

$532.94

+

4.55%

WBT

$46.51

–

0.04%

AVAX

$21.25

+

6.65%

RYO

$4.3129

+

3.01%

HBAR

$0.1987

+

9.58%

LEO

$8.9961

–

1.06%

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

Jul 11, 2025, 4:04 p.m.

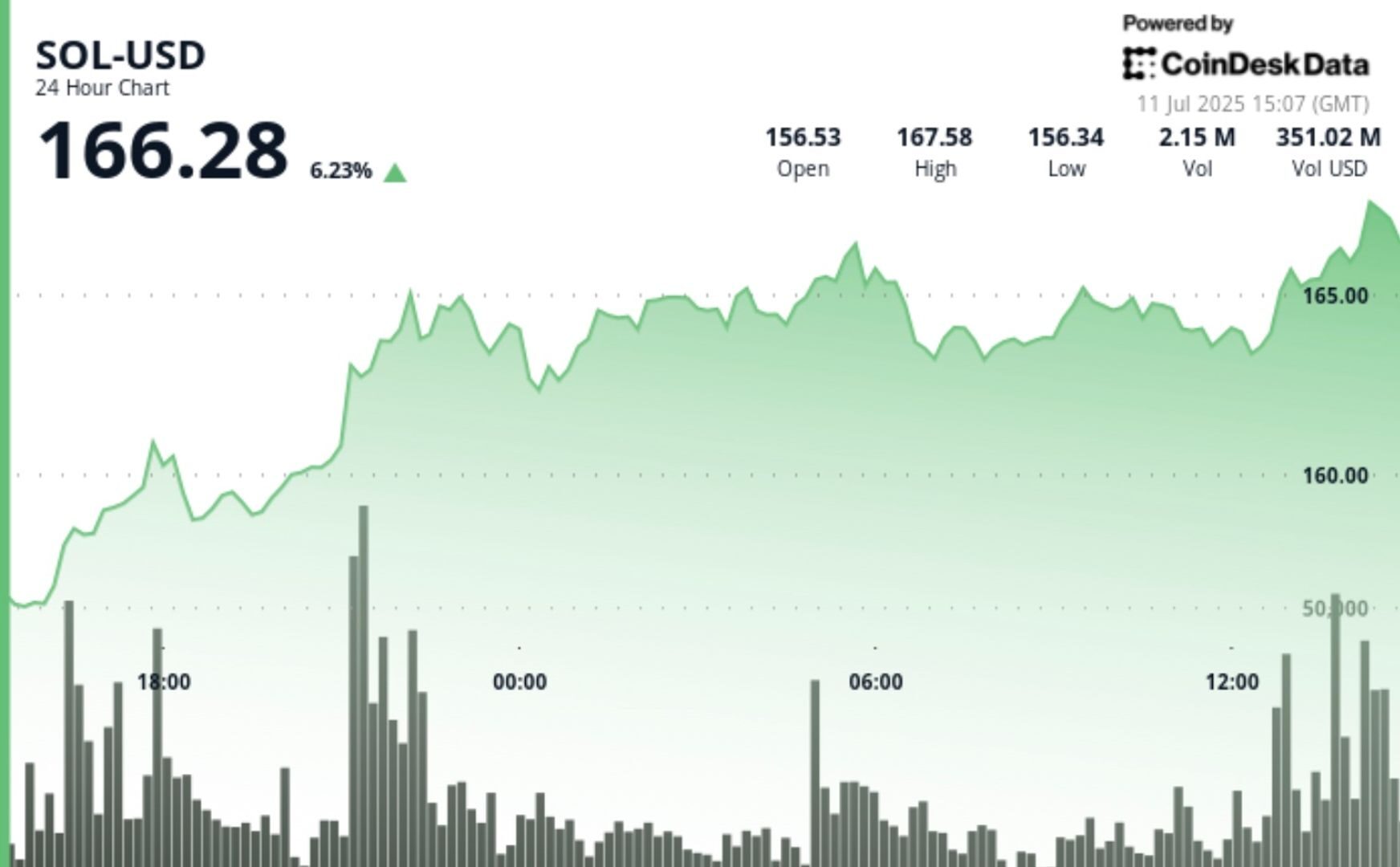

- SOL surged 7% throughout the 24-hour period from 10 July 15:00 to 11 July 14:00, ascending from $156.45 to $166.65 amid escalating institutional engagement and exchange-traded fund speculation

- Firms like DeFi Dev Corp, BIT Mining, and Upexi are expanding their Solana exposure through sizable treasury allocations and investment commitments.

- Trading turnover increased 19% to approximately $4.90 billion as market analysts maintain 95% probability estimates for Solana ETF authorisation by October

At the time of writing, solana

is trading at around $166.28, up 6.23% in the past 24-hour period, according to CoinDesk Research’s technical analysis model.

Upexi (UPXI), a Tampa-based consumer brands company listed on Nasdaq, announced Friday it has secured approximately $200 million in new financing through a combination of equity and convertible note offerings. A portion of the proceeds will support Upexi’s existing operations, while the rest will be used to grow its cryptocurrency treasury, with a specific focus on Solana

.

STORY CONTINUES BELOW

As part of the equity component, Upexi raised $50 million from accredited and institutional investors, including its CEO Allan Marshall. Shares were sold at $4.00 each, with management purchasing at a premium of $4.94. The company said the equity deal is expected to close around July 14.

Separately, Upexi entered into agreements to issue $150 million in convertible notes to institutional investors. The notes are backed by SOL as collateral and carry a 2% annual interest rate. They are convertible into Upexi stock at a fixed price of $4.25 per share and mature in 24 months. The notes are expected to close around July 16, at which point the associated SOL will be added to the company’s holdings.

In a June 26 press release, Upexi disclosed that it held 735,692 SOL as of June 24, an 8% increase from the 679,677 SOL reported on May 28. Upon closing of the new financing, Upexi expects to more than double its current SOL position.

The offerings were conducted privately and are not registered with the SEC.

Technical Analysis

- SOL demonstrated exceptional resilience throughout the preceding 24-hour period from 10 July 15:00 to 11 July 14:00, progressing from $156.45 to $166.65, constituting a substantial 6.52% appreciation with an aggregate trading range of $10.99 extending from $155.78 to $166.76.

- The price dynamics unveiled distinctive accumulation sequences with considerable volume-backed support materialising at $160.31 during the 21:00 hour advancement, where extraordinary volume of 3.23 million substantially surpassed the 24-hour mean of 1.34 million, corroborating institutional capital deployment.

- Pivotal resistance emerged proximate to $165.30, subjected to multiple examinations between 22:00 and 03:00, whilst the conclusive breakthrough above $166.00 transpired with amplified volume of 2.26 million, intimating persistent bullish conviction.

- The technical architecture suggests SOL has consolidated a superior trading corridor with robust volume validation, establishing foundations for prospective advancement towards the $170.00 psychological threshold.

- Throughout the concluding 60-minute interval from 11 July 13:05 to 14:04, SOL encountered considerable volatility whilst preserving its overarching bullish disposition, oscillating within a $2.90 bandwidth from $164.24 to $166.76 and settling at $165.87, representing a marginal 0.44% contraction from the hour’s commencement at $165.92.

- The period manifested quintessential consolidation attributes encompassing two discrete phases: an initial retreat to $164.28 circa 13:33 accompanied by intensified distribution pressure of 45,017 volume, succeeded by a vigorous recovery commencing at 13:48 where volume escalated to 81,740 during the ascent towards $166.76, validating renewed accumulation interest.

- Fundamental support crystallised near $164.30 with multiple successful examinations, whilst resistance materialised around $166.50-$166.75, establishing a well-delineated trading corridor that suggests constructive price discovery following the antecedent 24-hour advance, positioning SOL for potential continuation of its broader upward trajectory upon completion of this consolidation phase.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.