BTC

$104,206.14

–

0.62%

ETH

$2,492.25

–

0.65%

USDT

$1.0004

–

0.01%

XRP

$2.1472

–

0.35%

BNB

$639.96

–

0.39%

SOL

$143.11

–

1.75%

USDC

$1.0001

–

0.02%

TRX

$0.2737

+

1.10%

DOGE

$0.1681

–

0.11%

ADA

$0.5916

–

0.63%

HYPE

$36.34

–

6.71%

WBT

$49.26

+

0.75%

BCH

$485.20

+

4.31%

SUI

$2.8194

+

1.46%

LINK

$12.97

+

0.57%

LEO

$8.8765

–

2.78%

XLM

$0.2484

–

0.49%

AVAX

$17.76

–

3.23%

TON

$2.9226

+

0.65%

SHIB

$0.0₄1151

–

0.98%

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

Updated Jun 19, 2025, 3:46 p.m. Published Jun 19, 2025, 3:43 p.m.

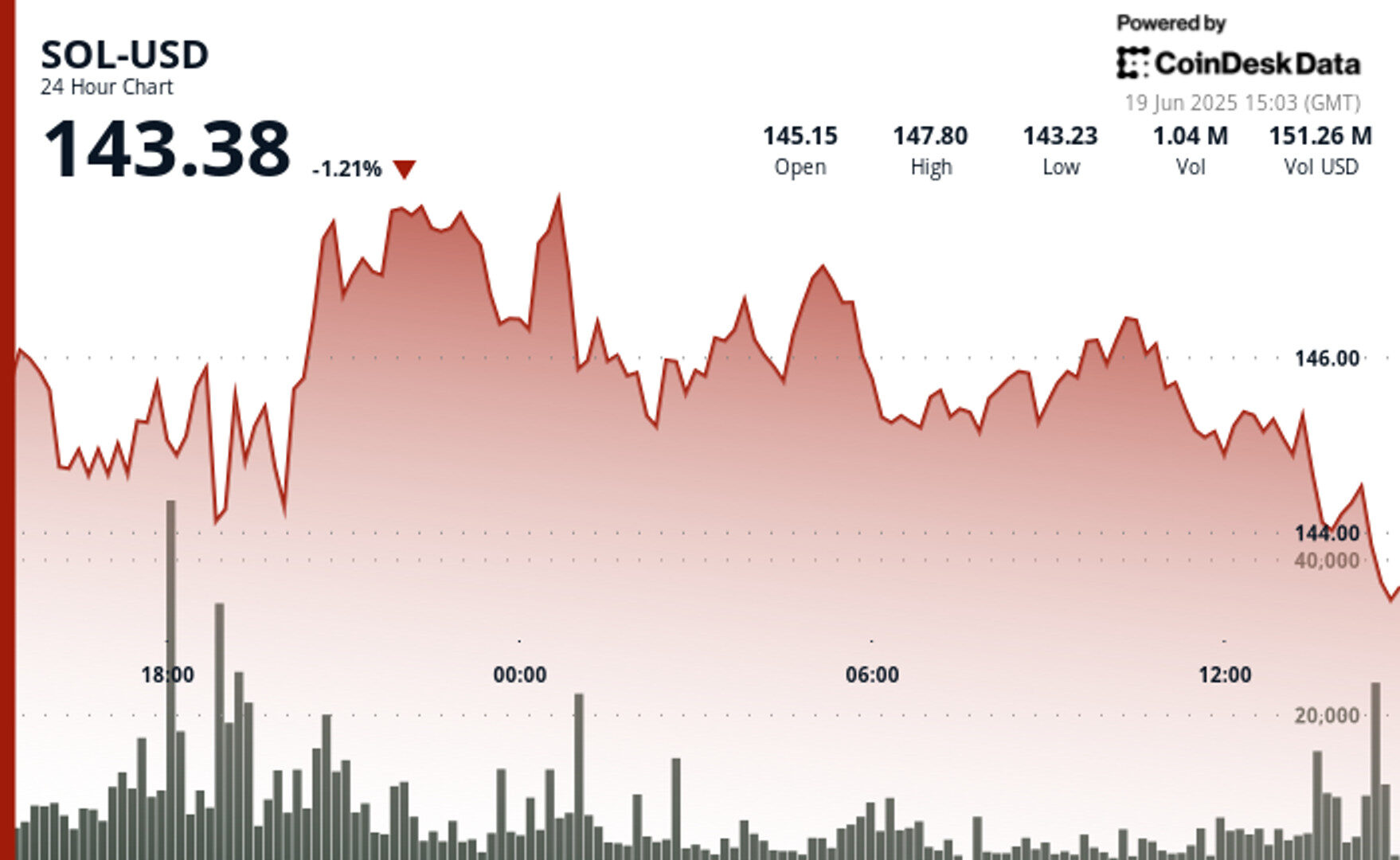

- Solana (SOL) fell 1.21% to $143.38 after losing momentum above $147.80, ending near session lows despite strong institutional support.

- Canadian firm Sol Strategies filed with the SEC on June 18 to list on Nasdaq under the ticker STKE, aiming to fund its Solana ecosystem strategy.

- The firm holds more than 420,000 SOL, valued at over $61 million, but price action shows bears remain in control near critical support levels.

Solana’s native token, SOL

, dropped to $143.38 Tuesday, down 1.21%, closing near the day’s low after failing to hold above $147, according to CoinDesk Research’s technical analysis model.

The weakness came even as the ecosystem drew fresh institutional backing: Canadian blockchain investor Sol Strategies filed with the U.S. Securities and Exchange Commission on June 18 to pursue a Nasdaq listing under the ticker STKE.

STORY CONTINUES BELOW

While the filing itself is not an immediate market mover, it highlights a growing institutional commitment to Solana’s long-term outlook. Sol Strategies disclosed earlier this month that it holds more than 420,000 SOL, worth over $61 million, and has made SOL the centerpiece of its treasury strategy. The firm is also seeking regulatory approval in Canada to raise up to $1 billion, in addition to an earlier $500 million convertible note issuance in April used to acquire and stake SOL.

Despite these bullish signals, SOL continues to trade defensively. Price action has been confined to a horizontal band for much of the past week, with the most recent breakout attempt above $147.80 failing to generate follow-through. Bears regained control during the final hours of trading, pushing SOL below the $144 psychological support. With price trending below major moving averages and volume tapering off mid-session, sentiment remains fragile even as long-term backing intensifies.

Technical Analysis Highlights

- SOL traded in a 24-hour range from $143.23 to $147.80, a 2.83% swing.

- Resistance held at $147.80 after a failed breakout during the 22:00 UTC candle on June 18.

- Price declined steadily to $143.38, closing near the low after weak recovery attempts.

- Sellers were active between 13:46–14:00 UTC, with a drop from $144.62 to $143.38 on strong downside momentum.

- The $144–$145 zone remains critical; failure to reclaim it may open a path toward deeper support near $140.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.