BTC

$101,497.91

–

2.69%

ETH

$2,492.25

–

3.39%

USDT

$1.0004

+

0.03%

XRP

$2.1163

–

3.87%

BNB

$637.35

–

3.43%

SOL

$145.05

–

5.78%

USDC

$1.0002

+

0.06%

DOGE

$0.1724

–

7.57%

TRX

$0.2713

–

0.47%

ADA

$0.6370

–

3.92%

HYPE

$33.05

–

3.73%

SUI

$2.9642

–

5.99%

LINK

$13.06

–

4.16%

AVAX

$19.12

–

4.39%

XLM

$0.2582

–

2.65%

LEO

$8.6912

–

2.69%

BCH

$388.38

–

2.10%

TON

$3.0625

–

2.32%

SHIB

$0.0₄1219

–

3.91%

HBAR

$0.1606

–

2.92%

By CD Analytics, Siamak Masnavi|Edited by Aoyon Ashraf

Jun 5, 2025, 7:33 p.m.

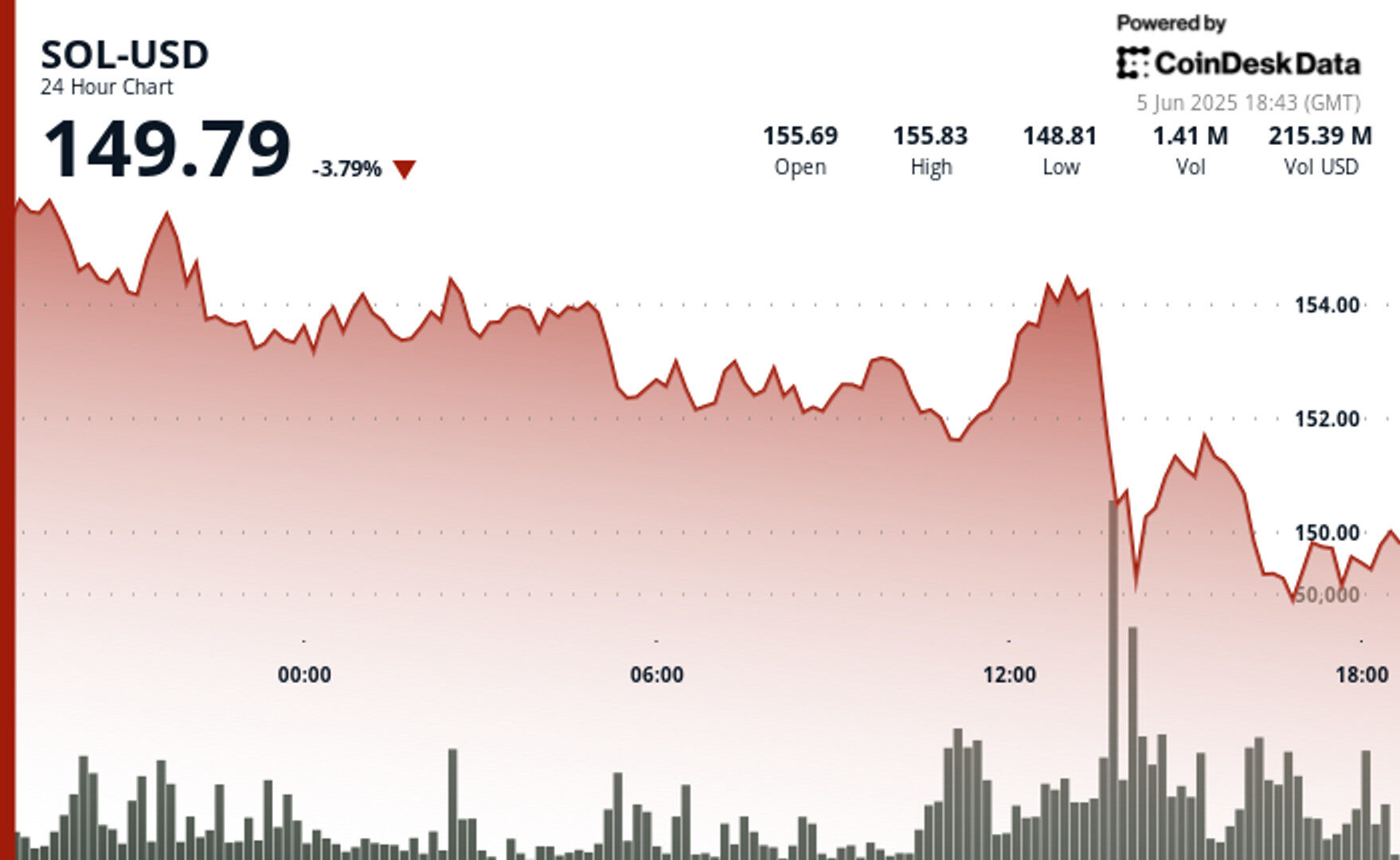

- SOL dropped 5.2% from $157.98 to $149.79 amid surging exchange volume and failed support at $150, according to CoinDesk Research’s technical analysis data model.

- Whale outflows reached 3 million SOL over three days, signaling declining investor confidence.

- Strong fundamentals persist with 7 million daily wallets and over 100 million daily transactions on the Solana network.

Solana (SOL) continues to face mounting bearish pressure as the price slid below the psychological $150 level, marking a 5.2% drop in the past 24 hours.

The sell-off intensified during the early afternoon session with high-volume trades flooding exchanges. Analysts attribute the decline to more than 3 million SOL tokens being transferred to centralized platforms over the past three days, coinciding with more than $468 million in estimated outflows.

STORY CONTINUES BELOW

This significant shift in on-chain activity has cast doubt on short-term recovery prospects, even as the Solana network continues to post strong usage metrics.

With over 100 million transactions and 7 million daily active addresses, the fundamentals suggest long-term strength, but price action remains disconnected from protocol performance.

Analysts say reclaiming resistance at $153 and stabilizing above $150 is now critical to preventing a deeper retracement.

Technical Analysis Highlights

- SOL-USD posted a $8.19 range from the high of $157.98 to a low of $149.79.

- Price breached psychological support at $150 during a massive 182K volume spike at 13:56.

- Resistance remained firm at $153.00 as repeated recovery attempts failed during the late session.

- A descending channel has developed with lower highs and lower lows dominating the chart.

- Volume surges at 13:39 (21K), 13:45 (66K), 13:51 (89K), and 13:56 (182K) confirm aggressive selling.

- Modest buy interest is emerging around $149.50-$150.60, but downside risk persists if bulls cannot hold the current floor.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.