BTC

$106,115.77

–

0.97%

ETH

$2,416.55

–

2.83%

USDT

$1.0003

–

0.01%

XRP

$2.1819

–

4.25%

BNB

$647.36

–

1.57%

SOL

$146.92

–

5.61%

USDC

$1.0001

+

0.00%

TRX

$0.2789

–

0.13%

DOGE

$0.1589

–

4.14%

ADA

$0.5447

–

5.81%

HYPE

$37.65

–

7.59%

BCH

$513.75

+

0.08%

WBT

$43.97

–

0.65%

SUI

$2.6994

–

3.11%

LINK

$12.93

–

3.80%

LEO

$8.9027

–

1.44%

AVAX

$17.13

–

4.69%

XLM

$0.2259

–

5.89%

TON

$2.7979

–

4.47%

SHIB

$0.0₄1122

–

2.08%

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

Updated Jul 1, 2025, 8:56 p.m. Published Jul 1, 2025, 8:26 p.m.

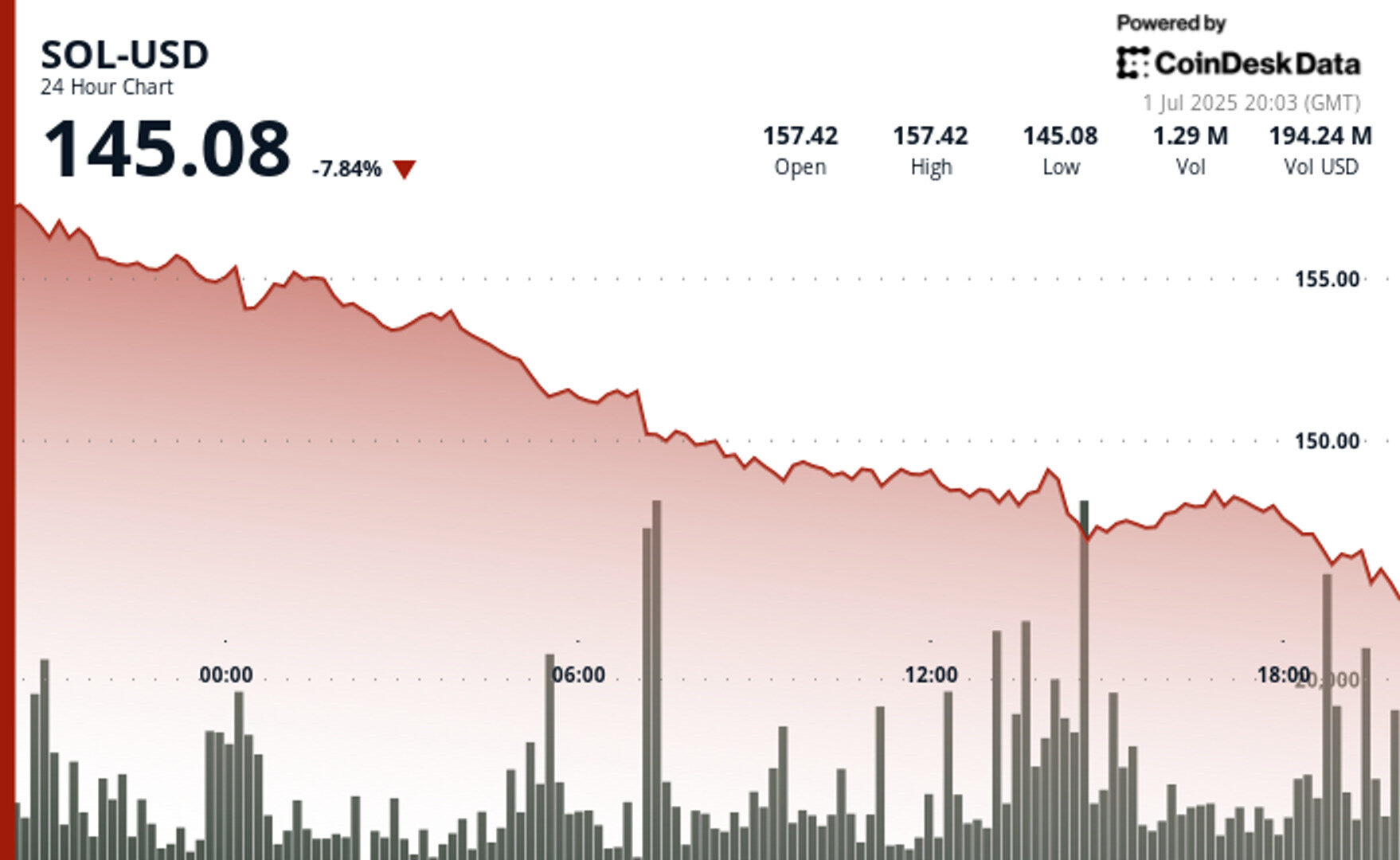

- SOL dropped 7.84% in the past 24 hours, falling to $145.08 as of 20:03 UTC.

- The REX-Osprey SOL + Staking ETF will launch on July 2, offering U.S. investors staking yield under the 1940 Act.

- Despite the drop, support emerged near $146.55 with high volume, suggesting potential accumulation ahead of the ETF launch.

Solana

declined 7.84% over the past 24 hours, trading at $145.08 as of 20:03 UTC on July 1, 2025, according to CoinDesk Research’s technical analysis model; during the same period, the broader crypto market, as indexed by the CoinDesk 20, went down only 0.24%.

SOL’s sharp drop comes just one day before a major milestone for the ecosystem: the launch of the REX-Osprey SOL + Staking ETF.

STORY CONTINUES BELOW

Set to debut on July 2, 2025, the REX-Osprey SOL + Staking ETF (ticker: SSK) is the first U.S.-listed exchange-traded fund to provide direct exposure to Solana’s native token while also offering access to staking rewards. Unlike traditional crypto ETFs that only track price, this fund enables holders to passively benefit from Solana’s proof-of-stake reward system.

Approximately 80% of the ETF’s assets will be allocated to SOL, with roughly 50% of those tokens actively staked. The fund is structured under the Investment Company Act of 1940, a framework generally viewed as more favorable from a regulatory standpoint than the 1933 Act. The 1940 Act structure may improve investor protections and expedite approvals, which could influence broader institutional participation.

Analysts say this launch represents a major step for Solana’s credibility among U.S. financial institutions. By integrating yield generation directly into the ETF, it offers a more comprehensive exposure to the asset than spot-tracking funds. Some market participants believe it could serve as a catalyst for long-term adoption, particularly as other firms including Grayscale, VanEck, and Bitwise pursue similar SOL ETF applications.

However, despite the ETF’s pending launch, SOL saw broad-based selling pressure on Monday, underscoring the market’s cautious stance ahead of the event.

Technical Analysis Highlights

- SOL declined $12.34 over the past 24 hours, dropping from $157.42 to $145.08 — a 7.84% loss with a price range of $12.34.

- Strong resistance was encountered at $157.42 during the first hour of the analysis window, followed by consistent selling pressure throughout the session.

- The largest volume spike occurred during the 06:00 UTC hour, exceeding 1.57 million units, with price rejection near $151.50.

- upport emerged at $146.55 during the 14:00 UTC hour, also coinciding with elevated volume, indicating accumulation interest around that level.

- In the final hour of the analysis window from 19:01 to 20:00 UTC, SOL declined further from $146.31 to $145.08, hitting its lowest price of the day.

- Price action formed a well-defined descending channel, characterized by lower highs and lower lows across the entire trading period.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.