BTC

$105,379.28

+

0.89%

ETH

$2,615.11

+

5.29%

USDT

$1.0004

+

0.01%

XRP

$2.2051

+

2.41%

BNB

$666.92

+

2.16%

SOL

$160.96

+

4.43%

USDC

$0.9997

+

0.00%

DOGE

$0.1953

+

2.59%

TRX

$0.2708

+

0.91%

ADA

$0.6954

+

4.00%

HYPE

$37.70

+

15.36%

SUI

$3.3237

+

1.65%

LINK

$14.12

+

2.71%

AVAX

$21.24

+

4.26%

XLM

$0.2717

+

2.63%

BCH

$403.12

+

0.02%

TON

$3.2354

+

4.01%

LEO

$8.5937

+

2.37%

SHIB

$0.0₄1320

+

3.68%

HBAR

$0.1735

+

3.24%

By AI Boost, Siamak Masnavi|Edited by Aoyon Ashraf

Jun 3, 2025, 10:02 a.m.

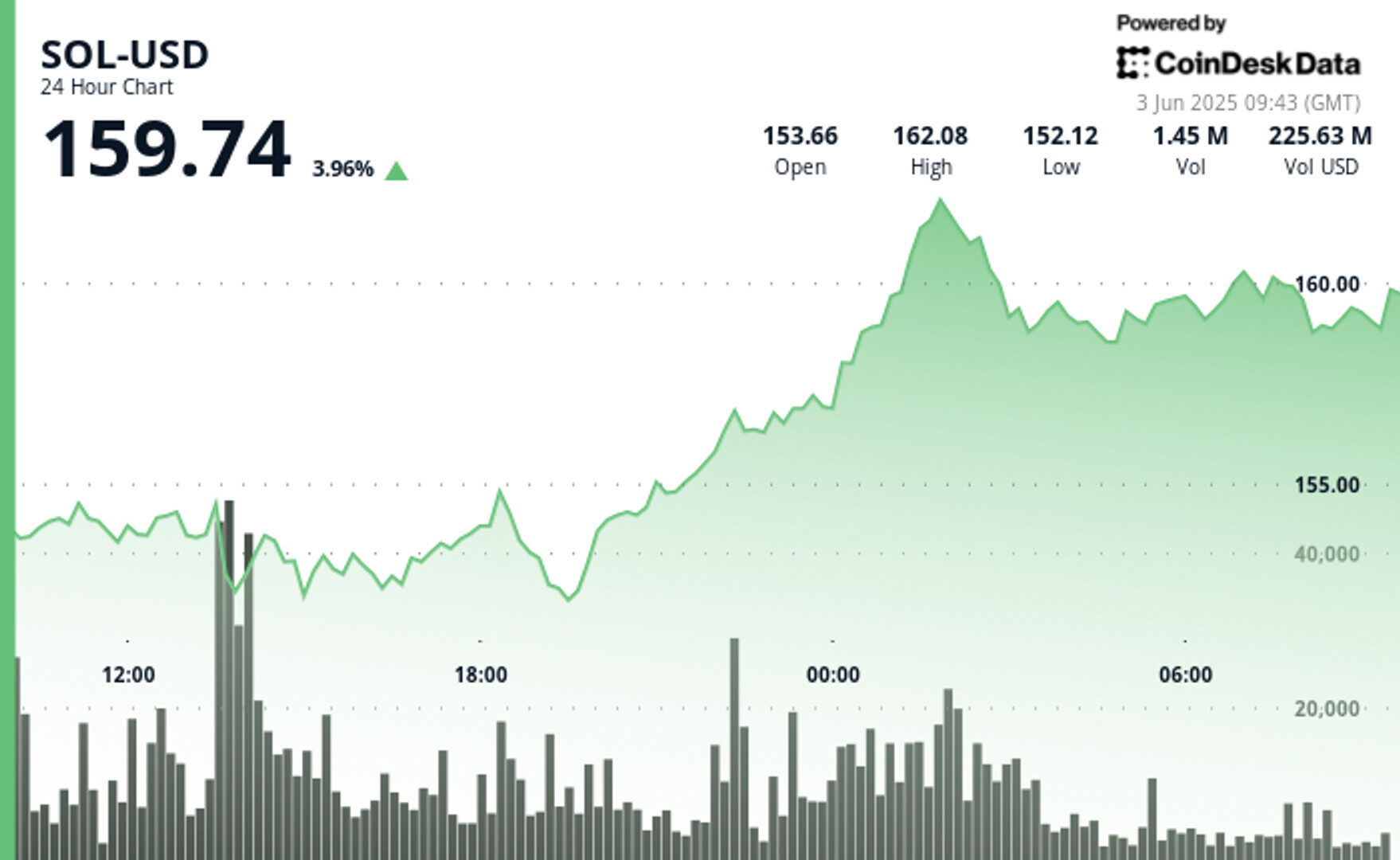

- SOL jumped 6.9% from $153.66 to $159.92 as bulls broke past key resistance.

- On-chain data shows daily active addresses at all-time highs and growing throughput.

- $162.46 has been tested twice, with $165 emerging as the next key target.

Solana is leading the crypto rebound as bulls drive the token toward $160, buoyed by surging user activity and rising on-chain engagement. Despite broader market jitters, SOL has rallied nearly 7% over 24 hours, helped by record transaction throughput and a spike in daily active addresses.

The rally gained steam after SOL bounced from a mid-day dip, with accumulation visible on key pullbacks, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Technical structure remains constructive, supported by healthy volume and higher lows. Analysts say the breakout remains valid as long as prices hold above recent support, with $165 emerging as the next upside target if momentum persists.

Technical Analysis Highlights

- SOL surged from $153.66 to $159.92 over 24 hours, marking a 6.9% gain and a $10.57 range.

- Key breakout above $155.55 confirmed by rising volume, initiating strong upside momentumNew resistance formed at $162.46 after two failed retests, with a double-top pattern near $160.20.

- Support held at $151.89–$152.21, validated by high-volume accumulation during the 13:00–14:00 hour.

- $159.85 now acting as short-term support; buyers defended this level during the final session.

- 61.8% Fibonacci retracement at $159.73 reinforced as intraday floor.

- Consolidation just below $160 signals continuation potential if bulls reclaim $162

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.