BTC

$105,400.50

+

0.12%

ETH

$2,635.08

+

0.73%

USDT

$1.0003

–

0.01%

XRP

$2.2643

+

2.77%

BNB

$669.44

+

0.36%

SOL

$156.53

–

2.19%

USDC

$0.9997

–

0.01%

DOGE

$0.1958

+

0.38%

TRX

$0.2714

+

0.38%

ADA

$0.6980

+

0.52%

HYPE

$36.13

–

1.50%

SUI

$3.2415

–

2.29%

LINK

$14.33

+

1.75%

AVAX

$21.31

+

0.48%

XLM

$0.2752

+

1.33%

LEO

$8.8484

+

3.02%

BCH

$406.07

+

0.82%

TON

$3.1854

–

0.89%

SHIB

$0.0₄1311

–

0.58%

HBAR

$0.1728

+

0.25%

By Ian Allison|Edited by Parikshit Mishra

Jun 4, 2025, 8:33 a.m.

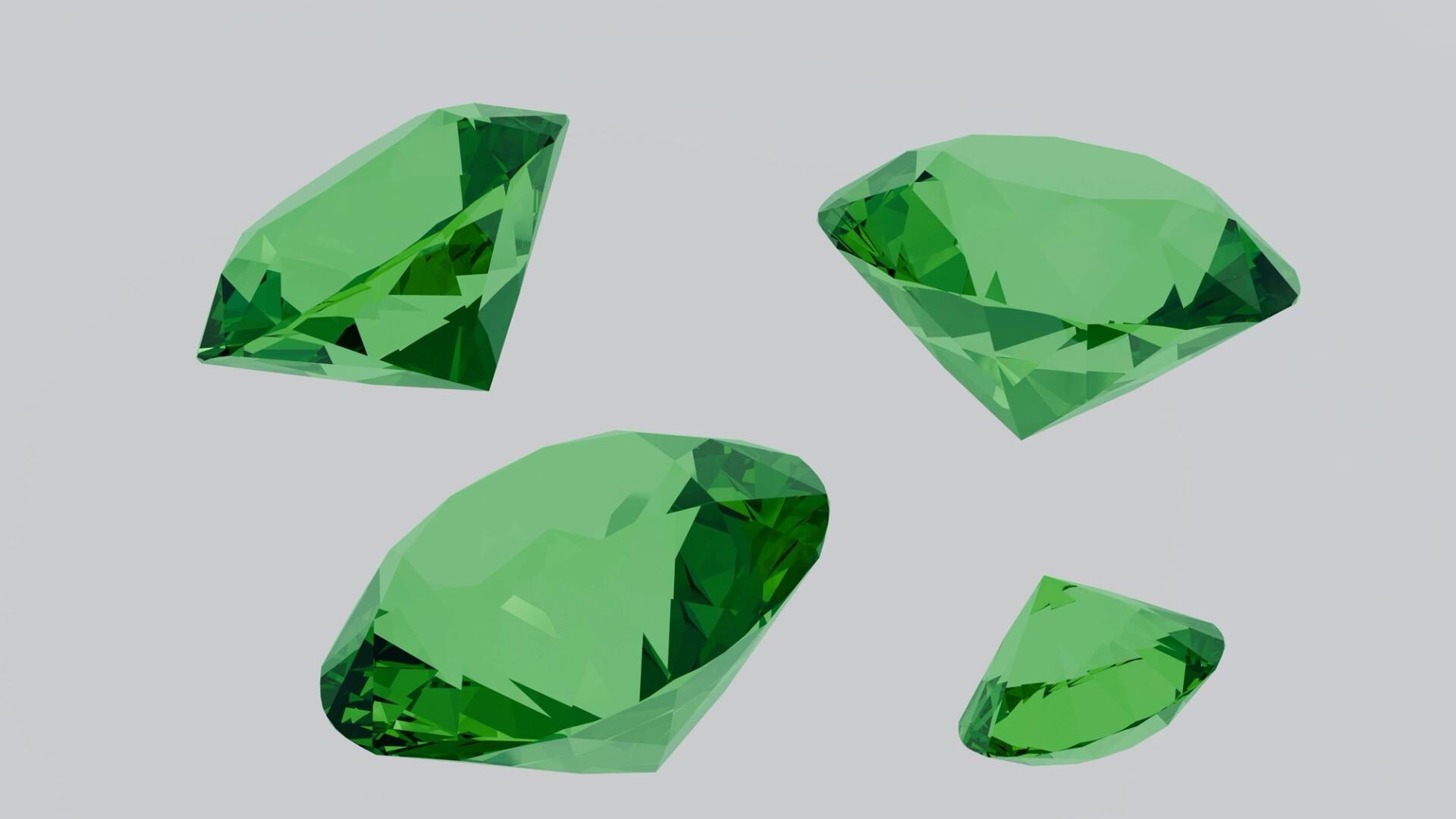

- The EmGemX token is a way for institutional investors to receive fractional ownership in a diversified portfolio of high-quality emeralds.

- Physical emeralds, stored in special vaults, which have seen an average annual appreciation of around 9%.

Zodia Custody, the crypto custodian backed by big banks like Standard Chartered and SBI, will handle the safekeeping of tokenized emeralds, through a partnership with GEMx, a Swiss fintech company that specializes in blockchain-based co-ownership of the precious stones.

The partnership allows access to the gemstone market through the EmGemX token, a way for institutional investors to receive fractional ownership in a diversified portfolio of high-quality emeralds, according to a press release on Wednesday.

STORY CONTINUES BELOW

The tokenization of real world assets (RWAs) is bringing the blockchain world closer to traditional finance. In this case, physical emeralds, which have seen an average annual appreciation of around 9%, are stored in vaults and subject to regular, independent appraisals, the release said.

“Partnering with Zodia Custody is a major milestone in our mission to bring institutional trust and stability to the gemstone investment market,” said Paul Poltner, CEO and co-founder of GEMx.

“With GEMx, we’ve built a framework that delivers real-world value through digital innovation that is secure, auditable, and has been historically inflation-resistant,” Poltner said.

Ian Allison is a senior reporter at CoinDesk, focused on institutional and enterprise adoption of cryptocurrency and blockchain technology. Prior to that, he covered fintech for the International Business Times in London and Newsweek online. He won the State Street Data and Innovation journalist of the year award in 2017, and was runner up the following year. He also earned CoinDesk an honourable mention in the 2020 SABEW Best in Business awards. His November 2022 FTX scoop, which brought down the exchange and its boss Sam Bankman-Fried, won a Polk award, Loeb award and New York Press Club award. Ian graduated from the University of Edinburgh. He holds ETH.