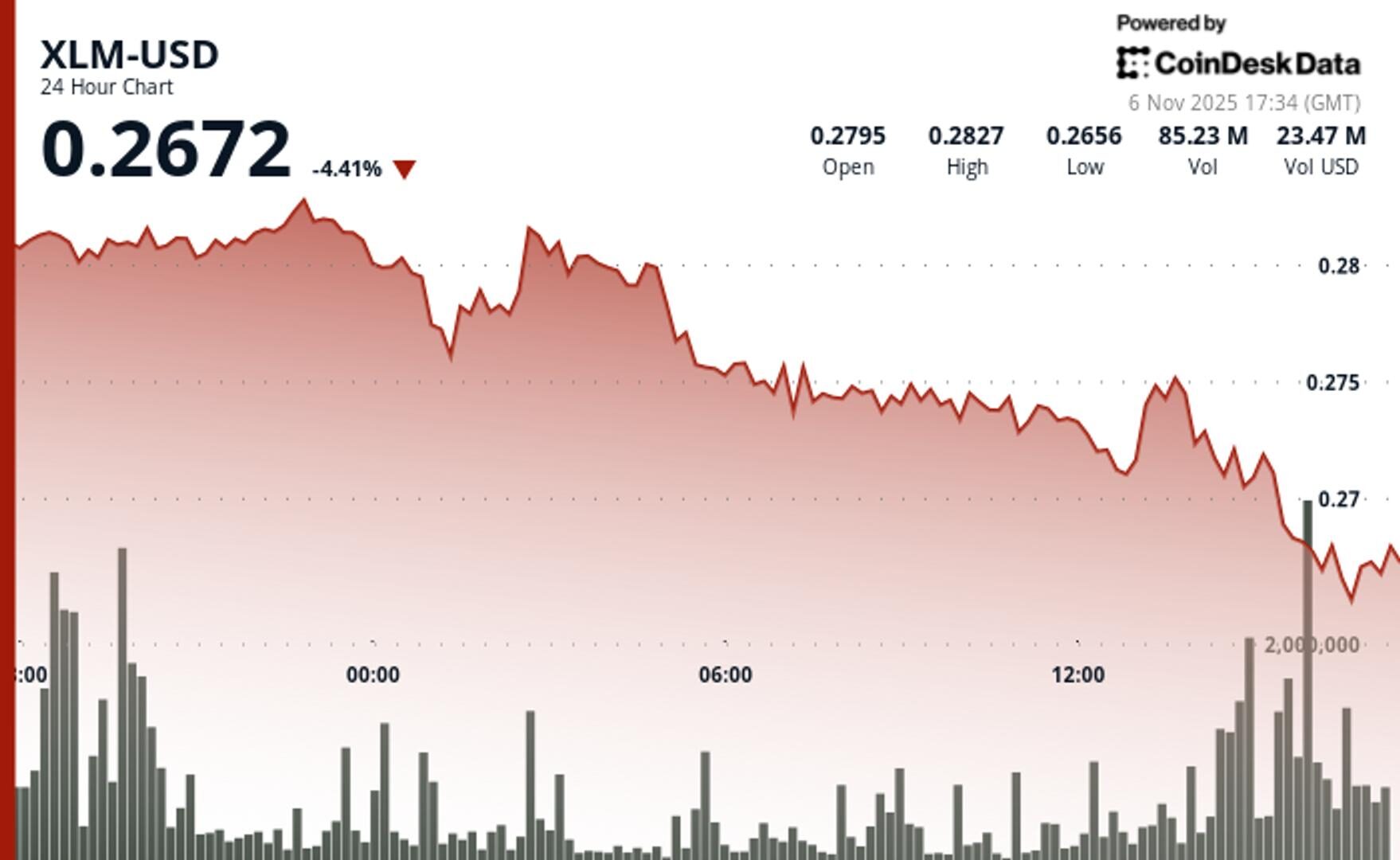

Stellar Drops 2.2% to $0.2727 as Key Resistance Rejects Rally

Stellar (XLM) slid 2.2% amid heavy selling at the $0.2815 resistance level, confirming continued bearish momentum as volume spiked.

By CD Analytics, Oliver Knight

Updated Nov 6, 2025, 5:47 p.m. Published Nov 6, 2025, 5:47 p.m.

- XLM fell from $0.2789 to $0.2727, marking its latest lower-high formation and reinforcing a short-term downtrend.

- Trading volume surged 62% above average to 42.6M tokens at resistance, where sellers firmly rejected a breakout attempt.

- A break below $0.2709 could open the door to further downside, while resistance remains entrenched near $0.2815.

Stellar (XLM) extended its recent slide on Tuesday, falling 2.2% from $0.2789 to $0.2727 as resistance at $0.2815 once again capped upside momentum. The token traded within a $0.0124 range, reflecting 4.5% intraday volatility, while a series of lower highs confirmed the prevailing bearish bias. Support remains near $0.2709, bolstered by repeated tests of the psychological $0.27 level.

Trading volume spiked to 42.6 million tokens at the $0.2815 resistance zone, a 62% jump above the 24-hour moving average. The surge coincided with institutional selling pressure that rejected further gains and signaled a potential distribution phase. This combination of rising volume and price rejection reinforced the dominance of sellers and underscored waning bullish conviction.

STORY CONTINUES BELOW

On the 60-minute chart, a brief recovery attempt between $0.2720 and $0.2755 during early afternoon trading gave way to a sharp reversal minutes later. The failed breakout triggered a swift drop to $0.2724, accompanied by more than 1 million tokens in sell-side volume within a three-minute window. The pattern confirmed a false breakout scenario and the continuation of the broader downtrend.

As trading momentum faded into the close, overall volume contracted to just 18% of the session average, highlighting depleted buying interest. Without a fresh catalyst or a volume-backed breakout above $0.2815, XLM remains vulnerable to further downside pressure, with short-term traders eyeing the $0.2709 support level as the next key test.

Support/Resistance Analysis:

- Primary resistance is at $0.2815 with volume-confirmed seller interest.

- Support zone holds around $0.2709–$0.2720 after multiple successful tests.

- The psychological $0.27 level provides a temporary floor amid session volatility.

Volume Analysis:

- Peak trading of 42.6M tokens marked the resistance rejection point.

- Heavy selling pressure topped 1M tokens during the afternoon reversal.

- Volume collapse to 18% of average confirms momentum deceleration.

Chart Patterns:

- A downtrend is established through consecutive lower highs formation.

- A false breakout pattern was completed within a 60-minute timeframe.

- A reversal candle confirms institutional distribution at resistance.

Targets & Risk Management:

- Immediate support target sits at the $0.2720 zone based on recent action.

- A break below $0.2709 accelerates the decline toward the next technical level.

- Resistance remains firm at $0.2815 until a volume-backed breakout emerges.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

2025년 11월 3일

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

알아야 할 것:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

작성자 CD Analytics, Oliver Knight

17분 전

Hedera’s native token rebounds after a sharp 2.6% drop, with rising volume and a confirmed double-bottom pattern signaling potential upside toward $0.1730.

알아야 할 것:

- HBAR fell from $0.1736 to $0.1691 in the past 24 hours, but strong support at $0.1688 triggered a rebound.

- Trading volume spiked 32% above average to 63.6M tokens, suggesting renewed institutional interest.

- A double-bottom pattern and higher lows point to an early trend reversal, with targets set at $0.1720–$0.1730.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language