-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Token faces critical support test amid massive liquidations and weakening institutional demand across major exchanges.

By CD Analytics, Oliver Knight

Updated Sep 4, 2025, 3:55 p.m. Published Sep 4, 2025, 3:55 p.m.

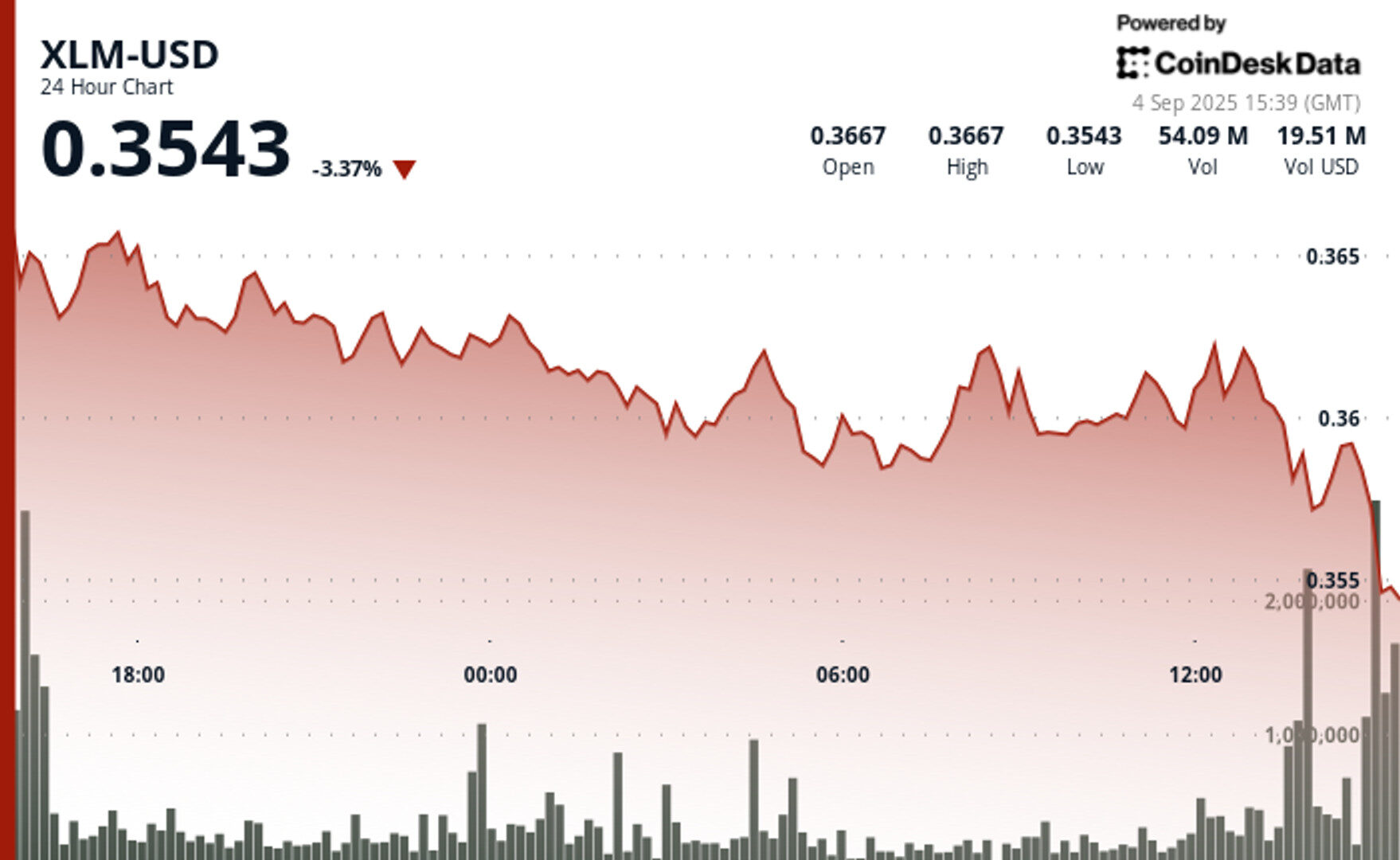

- XLM lost 2.72% in 24 hours, dropping from $0.368 to $0.358, with strong resistance capping gains at $0.362.

- Macro headwinds and liquidations are driving downside pressure, despite the Protocol 23 upgrade.

- Stellar faces a test at $0.32–$0.30 support, a level that may decide its near-term trajectory.

Stellar XLM$0.3551 continued to slide lower over the past 24 hours, with price action underscoring a clear bearish bias. Between Sept. 3 at 15:00 and Sept. 4 at 14:00, XLM shed 2.72%, falling from $0.368 to $0.358.

The move came within a tight $0.012 range, reflecting 3.26% intraday volatility. Sellers consistently rejected attempts to push above the $0.362 level, particularly during the Sept. 4 13:00 session, while the $0.357–$0.358 area briefly provided support. Still, mounting downside pressure suggests that the zone may not hold, leaving room for extended weakness.

STORY CONTINUES BELOW

Market forces appear to be exacerbating Stellar’s recent decline. Despite several bounce attempts, resistance near $0.362 remains firmly intact. These dynamics coincided with the rollout of Stellar’s Protocol 23 network upgrade on Sept. 3, but the technical milestone failed to provide the kind of bullish catalyst needed to counteract prevailing macro pressures.

Institutional sentiment also reflects the cautious tone. On Sept. 2, a wave of liquidations worth roughly $192,000 occurred as XLM slipped from the $0.40–$0.45 range, highlighting traders’ vulnerability to sudden downside moves. That liquidation cascade has since set the stage for the ongoing retreat, which aligns with larger patterns of risk-off positioning by major market players amid geopolitical and monetary uncertainty.

Looking ahead, Stellar faces a crucial test of support. After repeated rejection at the $0.45 resistance level, the token is now drifting toward the $0.32–$0.30 demand zone. Whether this level can attract sufficient buying interest will likely determine XLM’s near-term trajectory. For now, technical and macro signals both point to sustained bearish momentum unless broader sentiment stabilizes.

Technical Indicators Signal Further Weakness

- Price declined from $0.368 to $0.358, representing a 2.72% drop over 24-hours.

- Overall trading range reached $0.012, equivalent to 3.26% volatility.

- Clear resistance established at $0.362 level with multiple rejection attempts.

- High volume of 21.47 million during 4 September 13:00 session exceeded 24-hour average of 16.23 million.

- Support zone identified around $0.357-$0.358 appears fragile.

- Accelerating decline in final trading hours suggests continued selling pressure.

- Volume decreased from peak 28.5 million to 16.7 million shares indicating weakening momentum.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

45 minutes ago

Hedera’s token tumbled from $0.22 to $0.21 as selling pressure, profit-taking and broader market weakness drove traders out of risk assets.

What to know:

- HBAR broke below the key $0.212–$0.214 support zone after resistance at $0.222 capped early gains.

- A massive 179.34 million tokens traded during the 13:00 hour, with a single-minute spike of 42.37 million at 13:50 signaling capitulation.

- Despite recent rallies, risk-off sentiment and stop-loss cascades dominated price action, leaving traders cautious around the $0.213 stabilization level.