WisdomTree introduces Europe’s first physically-backed Stellar exchange-traded product amid heightened competition in digital payments infrastructure.

By CD Analytics, Oliver Knight

Updated Oct 16, 2025, 4:45 p.m. Published Oct 16, 2025, 4:45 p.m.

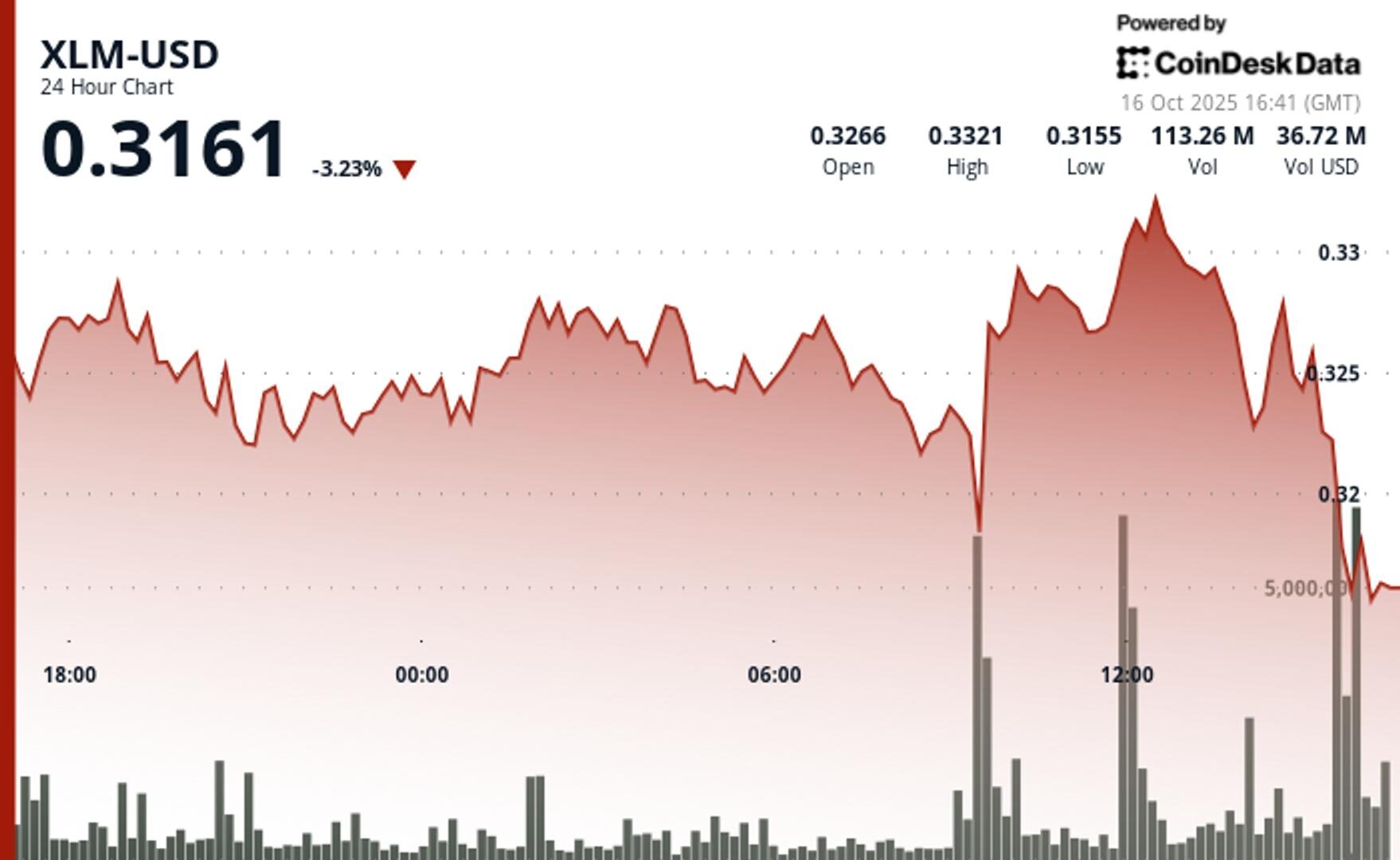

- LM fluctuated between $0.32 and $0.33 from Oct. 15–16, with heavy intraday swings reflecting fragile market sentiment.

- WisdomTree debuted Europe’s first physically backed Stellar Lumens ETP, broadening regulated investor access.

- Emerging fintech platforms like Digitap are pressuring legacy blockchain payment networks such as Stellar and Ripple.

Stellar Lumens (XLM) experienced pronounced volatility during the 23-hour trading session ending Oct. 16, moving within a 5% range between $0.32 and $0.33. After early weakness, institutional buying helped the token rebound toward midday, with volumes signaling renewed corporate participation.

The momentum faded late in the session, as XLM fell from $0.33 to just under $0.32 in the final hour of trading, erasing earlier gains. The decline marked a key break below established support levels, highlighting the market’s sensitivity to shifting liquidity conditions.

STORY CONTINUES BELOW

Institutionally, Stellar’s ecosystem advanced as WisdomTree launched Europe’s first physically backed Stellar Lumens ETP, trading across Swiss SIX and Euronext exchanges. The move enhances regulated exposure to XLM, underscoring growing institutional interest despite near-term volatility.

Meanwhile, competitive pressures are mounting in the digital payments space. New entrants like Digitap are leveraging streamlined compliance models to challenge incumbents such as Stellar and Ripple, reshaping the enterprise blockchain payments landscape.

- Stellar maintained trading within a $0.02 band, representing a 5% differential between session highs of $0.33 and lows of $0.32

- The cryptocurrency demonstrated recovery capacity following a decline to $0.32 at 09:00 on October 16

- Upward momentum reached peak levels at $0.33 during midday trading, supported by substantial volume of 73.74 million units during the initial rebound

- Price support materialized around the $0.32 level, where consistent buying interest emerged

- Resistance established near $0.33, with the asset concluding the period at $0.33

- Trading volume patterns indicated heightened institutional engagement during critical price movements, notably a 0.97 million unit surge at 13:31-13:32

- Session conclusion marked by diminished volume activity, suggesting potential liquidity constraints and confirming breakdown below established support parameters

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Oct 10, 2025

Combined spot and derivatives volumes fell 17.5% in September, continuing a four-year seasonal trend

What to know:

- Trading activity falls 17.5% in September slowdown: Combined spot and derivatives volumes dropped to $8.12 trillion, marking the first decline after three months of growth. September has now seen reduced trading volume for the fourth consecutive year.

- Open interest reaches record high despite derivatives market share decline: Total open interest surged 3.2% to $204 billion and peaked at an all-time high of $230 billion during the month.

- Altcoins on CME outperform as Bitcoin and Ether futures decline: While CME’s total derivatives volume stayed flat at $287 billion (-0.08%), SOL futures jumped 57.1% to $13.5 billion and XRP futures rose 7.19% to $7.84 billion. BTC and ETH futures fell 4.05% and 17.9% respectively.

More For You

By CD Analytics, Oliver Knight

53 minutes ago

Hedera’s HBAR token saw a dramatic 5% intraday swing as institutional investors drove heavy volatility, with early gains erased by late-session corporate liquidation pressure.

What to know:

- 5% enterprise price range: HBAR traded between $0.176 and $0.185 from Oct. 15–16, showing heightened institutional activity and profit-taking.

- Heavy corporate volume: Trading exceeded 129 million during morning hours before a steep sell-off hit in the final 60 minutes.

- Support and resistance tested: Key support formed at $0.176–$0.178, while resistance near $0.183–$0.185 capped the rebound.