-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

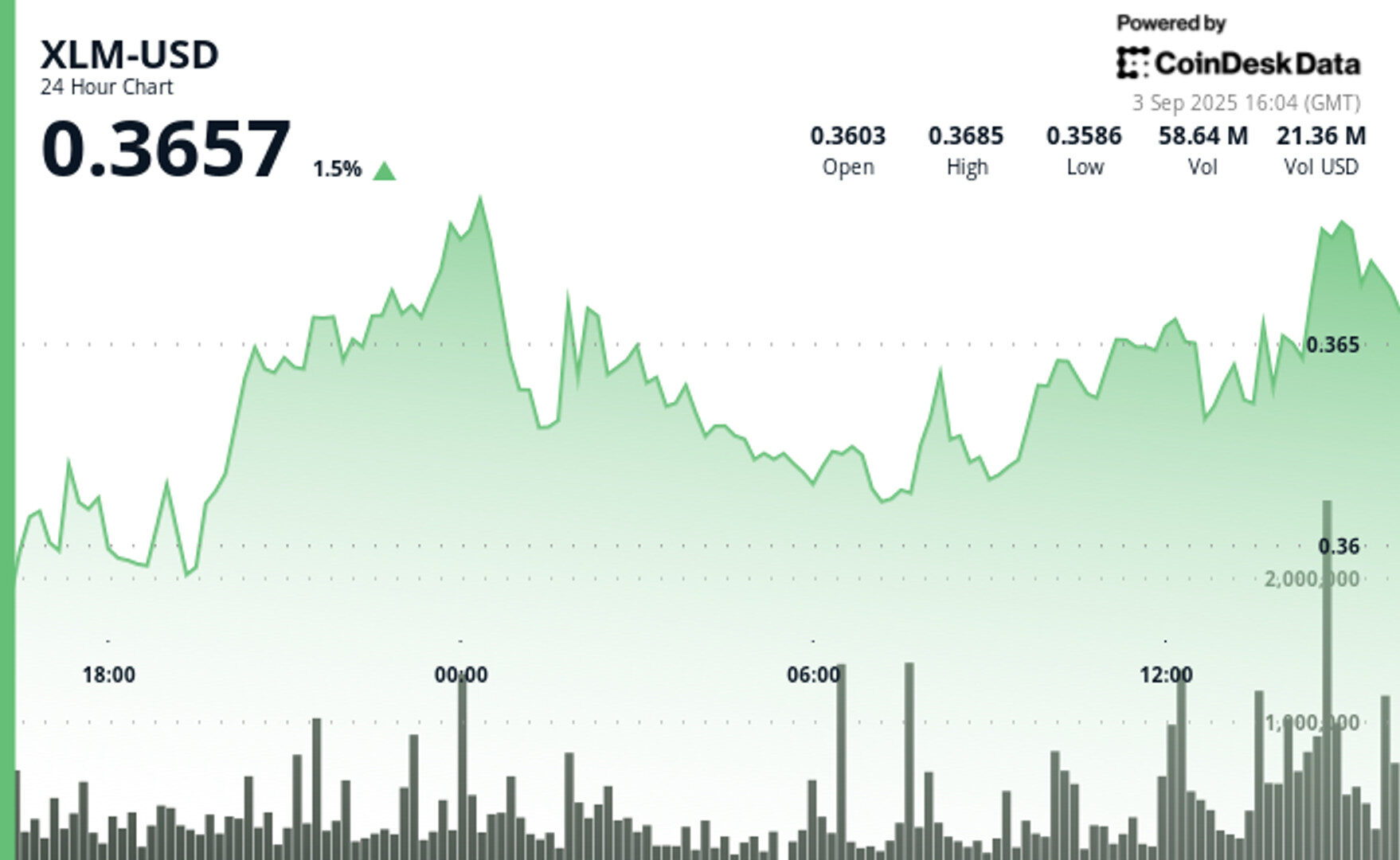

South Korea’s largest exchange pauses operations as Stellar prepares for a major network overhaul, with XLM price action showing resistance at $0.37.

By CD Analytics, Oliver Knight

Updated Sep 3, 2025, 4:15 p.m. Published Sep 3, 2025, 4:15 p.m.

- Upbit suspended XLM trading as Stellar’s Protocol 23 upgrade began on Sept. 3, aiming to safeguard stability during the network overhaul.

- XLM price consolidated between $0.36 and $0.37, with repeated but unsuccessful attempts to sustain gains above resistance.

- Traders eye $0.45 resistance and $0.30–$0.32 support as key levels to watch following the upgrade’s rollout.

South Korean crypto exchange Upbit temporarily suspended trading in Stellar’s XLM token on Tuesday, a precautionary move as the Stellar network readies for its Protocol 23 upgrade.

The scheduled modernization, set for Sept. 3, is expected to enhance scalability and accelerate transaction speeds, prompting several exchanges to adopt stability measures during the transition.

STORY CONTINUES BELOW

XLM traded in a narrow band between $0.36 and $0.37 in the 24 hours leading up to the upgrade, with volume spikes coinciding with tests of resistance at the upper end of that range.

Despite multiple attempts to break through $0.37, selling pressure kept prices capped, while strong support formed at $0.36. Analysts suggest this consolidation reflects institutional accumulation, with market participants watching closely for a decisive breakout.

The final hour of trading before the suspension saw heightened volatility, with XLM briefly touching $0.37 before slipping back to $0.36. The price action underscores the network’s importance in cross-border payments and the growing institutional focus on digital asset infrastructure.

Broader momentum is also being fueled by rising interest in central bank digital currencies (CBDCs) and enterprise blockchain adoption, including partnerships involving Hedera.

With Stellar’s Protocol 23 upgrade underway, traders are eyeing two critical levels: the $0.45 resistance, which XLM has failed to clear on four separate occasions since June, and the $0.30–$0.32 support zone, seen as a potential accumulation area. Market observers say the outcome of the upgrade could dictate whether Stellar finally breaks through its ceiling or retreats to rebuild support at lower levels.

- Price Parameters: XLM traded within a $0.36-$0.37 corridor during the 24-hour period with 3% aggregate volatility.

- Volume Assessment: Peak trading activity of 28.91 million during resistance examination at the $0.37 threshold.

- Support/Resistance Dynamics: Robust resistance established at $0.37 with support maintaining integrity around $0.36.

- Breakout Configurations: Multiple unsuccessful attempts to sustain valuations above the $0.37 resistance threshold.

- Institutional Participation: Volume surges coinciding with key technical levels suggest accumulation patterns amongst sophisticated market participants.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

18 minutes ago

The advance came as broader crypto markets rose and after CEA Industries announced it expanded its BNB stash to 388,888 tokens worth $330 million.

What to know:

- BNB rose 1.5% to near multisession highs, testing the $860 mark, on unusually strong buying pressure.

- The gains came as broader crypto markets rose, with the CoinDesk 20 index up 2.7%, and after CEA Industries announced it expanded its BNB stash to 388,888 tokens worth $330 million.

- The rally in BNB comes as traditional markets deal with concerns over swelling government debt.