-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

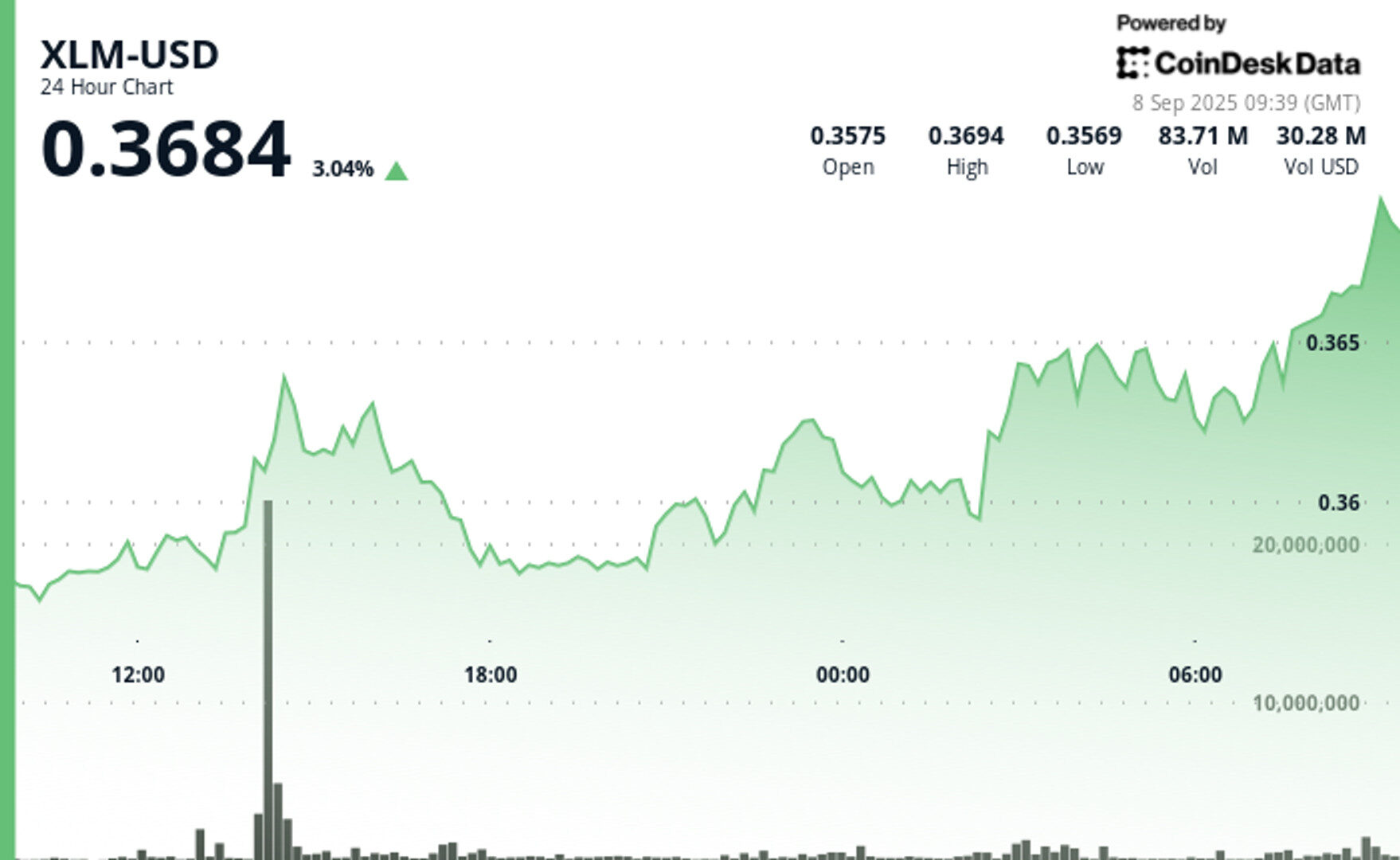

XLM held firm in a tight trading band, with strong volumes and fresh corporate activity signaling sustained institutional confidence and room for further upside.

By CD Analytics, Oliver Knight

Updated Sep 8, 2025, 10:05 a.m. Published Sep 8, 2025, 10:05 a.m.

- XLM traded between $0.36 support and $0.37 resistance over the 24-hour window, posting a 2.32% gain.

- Peak volume of 129.15 million tokens on Sept. 7 and steady buying above $0.36 point to continued institutional interest.

- Paxos’ launch of USDH on Stellar, aligned with upcoming GENIUS Act and MiCA rules, reinforces regulatory credibility and strengthens corporate adoption prospects.

Stellar’s native token, XLM, posted a 2.32% gain in the 24-hour window from September 7 at 09:00 to September 8 at 08:00, climbing from $0.36 to $0.37. The cryptocurrency traded within a narrow $0.01 band, with lows at $0.36 and highs at $0.37, marking a 2.66% intraday range.

Trading activity peaked at 14:00 on September 7, when 129.15 million tokens changed hands. Analysts note that maintaining support above $0.36 reflects sustained institutional buying interest, a trend that has underpinned the asset’s recent stability.

STORY CONTINUES BELOW

For Stellar, Paxos’ entry into its ecosystem marks a strategic milestone. With a decade of experience in regulated stablecoin issuance and a recent acquisition of Molecular Labs, Paxos is positioning USDH to comply with both the GENIUS Act and Europe’s MiCA regulations.

While ongoing debates around the GENIUS Act create some uncertainty, analysts say Stellar’s ability to hold above the $0.36 support level leaves room for further upside. Technical indicators suggest that a push beyond the $0.37 resistance could open the door to additional gains, supported by institutional flows and strengthening corporate confidence in blockchain-based financial infrastructure.

- XLM established a defined trading range between $0.36 support and $0.37 resistance during the 24-hour observation period.

- Peak trading volume of 129.15 million units at 14:00 on September 7 reinforced price support at the $0.36 threshold.

- Sustained trading activity above $0.36 suggests ongoing institutional accumulation and potential for additional price appreciation.

- Final hour trading data from September 8, 07:24 to 08:23, showed volume exceeding 2.5 million units supporting the advance to $0.37.

- Technical indicators point to established support at $0.36 with upward price channel formation suggesting continued bullish sentiment among institutional investors.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Oliver Knight

1 hour ago

Hedera’s token held firm at $0.22 after a surge in institutional activity, with corporate interest in blockchain rising as global trade disputes intensify.

What to know:

- HBAR traded within a narrow 2% range, supported at $0.22 during a 23-hour stretch ending Sept. 8.

- Institutional buyers drove volumes to 67.40 million units, more than double the 24-hour average, helping stabilize prices.

- Escalating global trade tensions are pushing corporations toward blockchain adoption, boosting interest in Hedera’s enterprise-grade network.