Michael Saylor and Strategy Hike STRC Dividend Again

By James Van Straten|Edited by Stephen Alpher

Dec 3, 2025, 3:37 p.m.

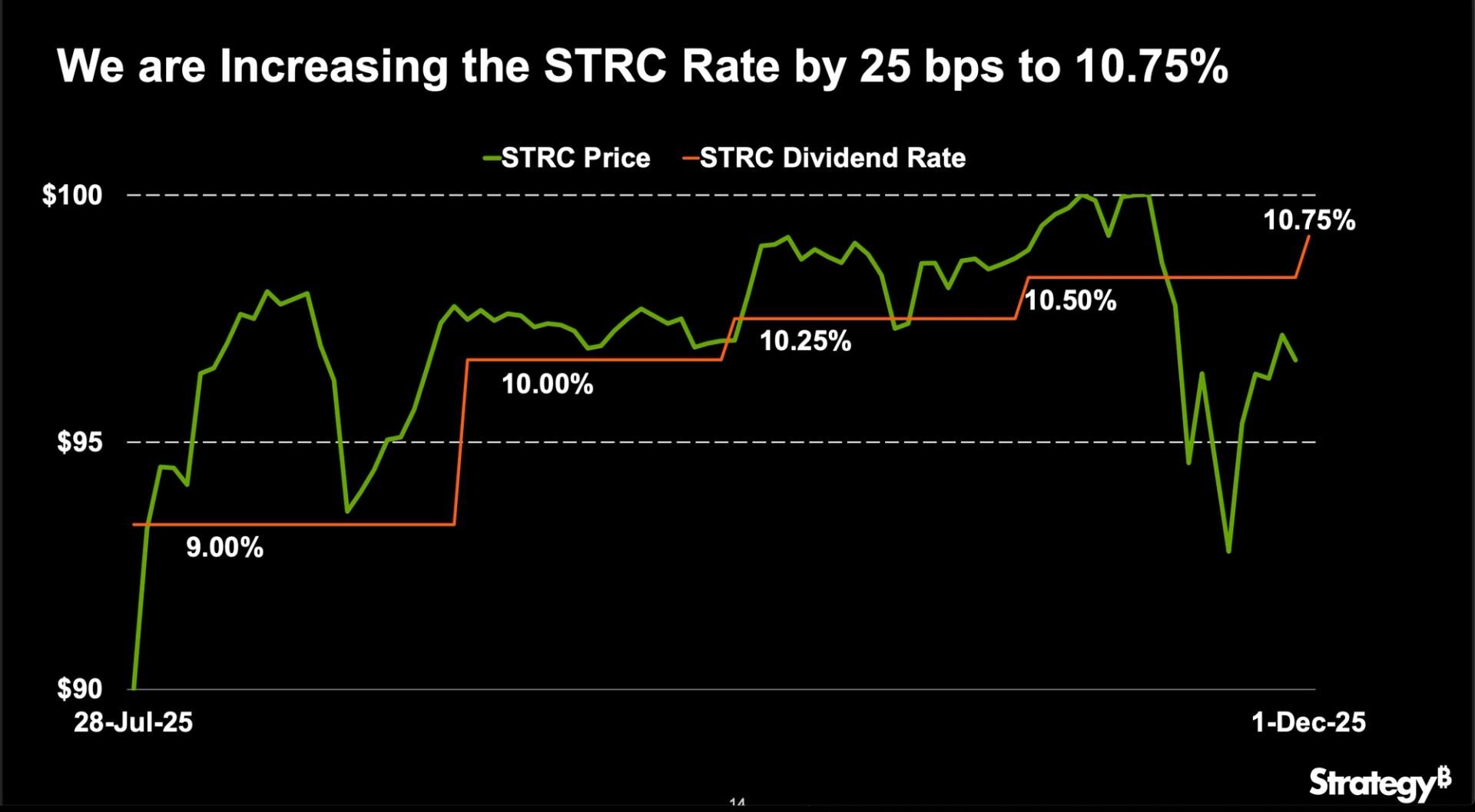

- Strategy (MSTR) raised the dividend on its STRC preferred series by 25 basis points to 10.75%, the third such raise since the product was introduced.

- The company’s aim is to keep STRC’s price in a very narrow range around the $100 level, but the combined recent difficulties in both MSTR and bitcoin spread to STRC, which dipped into the mid-$90 range.

- Strategy on Monday announced $1.44 billion cash buffer to support preferred dividend payments for nearly two years.

Strategy (MSTR) on Monday announced a further 25 basis point increase in the dividend rate of its STRC preferred series to 10.75%. This is the fourth increase since the IPO launch at the end of July.

One of Strategy’s perpetual preferred stocks, STRC, or “Stretch,” is designed to offer short duration characteristics with high yield exposure. It currently pays a 10.75% annual dividend, distributed monthly in cash. The dividend rate is adjusted each month to encourage trading near STRC’s $100 par value and to limit price volatility.

STORY CONTINUES BELOW

When launched in July, STRC initially carried a 9% dividend rate at the IPO price of $90. The company then raised the dividend rate twice to 10.25%, although STRC still did not reach par. A third increase finally got the price to $100, but the tumble in the price of bitcoin and Strategy’s common stock touched STRC, which at one point in the November panic fell as low as about $90, setting in motion this latest increase.

STRC was trading at $98.43 at press time.

The updated dividend rate was announced along with news of a $1.44 billion cash buffer intended to fund perpetual preferred dividends. The total annualized dividend obligation across all perpetual preferred shares is about $800 million. According to the investor presentation, the company has 74 years of dividend coverage when measured against its $59 billion bitcoin reserve. Even so, the $1.44 billion cash reserve is expected to be the primary source of near term dividend funding.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Aoyon Ashraf

1 hour ago

STON.fi, TON’s largest DeFi protocol, launched a fully onchain DAO, enabling users to vote on governance decisions and receive tokens representing voting power.

What to know:

- TON’s price climbed 3.7% to $1.605, driven by increased trading volume and developments in decentralized governance and AI infrastructure.

- STON.fi, TON’s largest DeFi protocol, launched a fully onchain DAO, enabling users to vote on governance decisions and receive tokens representing voting power.

- The TON ecosystem is also seeing growth with Cocoon, a decentralized AI platform that allows users to rent out unused GPU power in exchange for TON, with Telegram as its first major customer.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language