MSTR Eyes Global Credit Expansion With Focus on International Markets

By James Van Straten|Edited by Jamie Crawley

Updated Oct 31, 2025, 11:51 a.m. Published Oct 31, 2025, 11:21 a.m.

- The company reported $12 billion in operating income and $8.6 billion in net income for the first nine months of 2025, reversing last year’s losses and achieving earnings per share of $27.71.

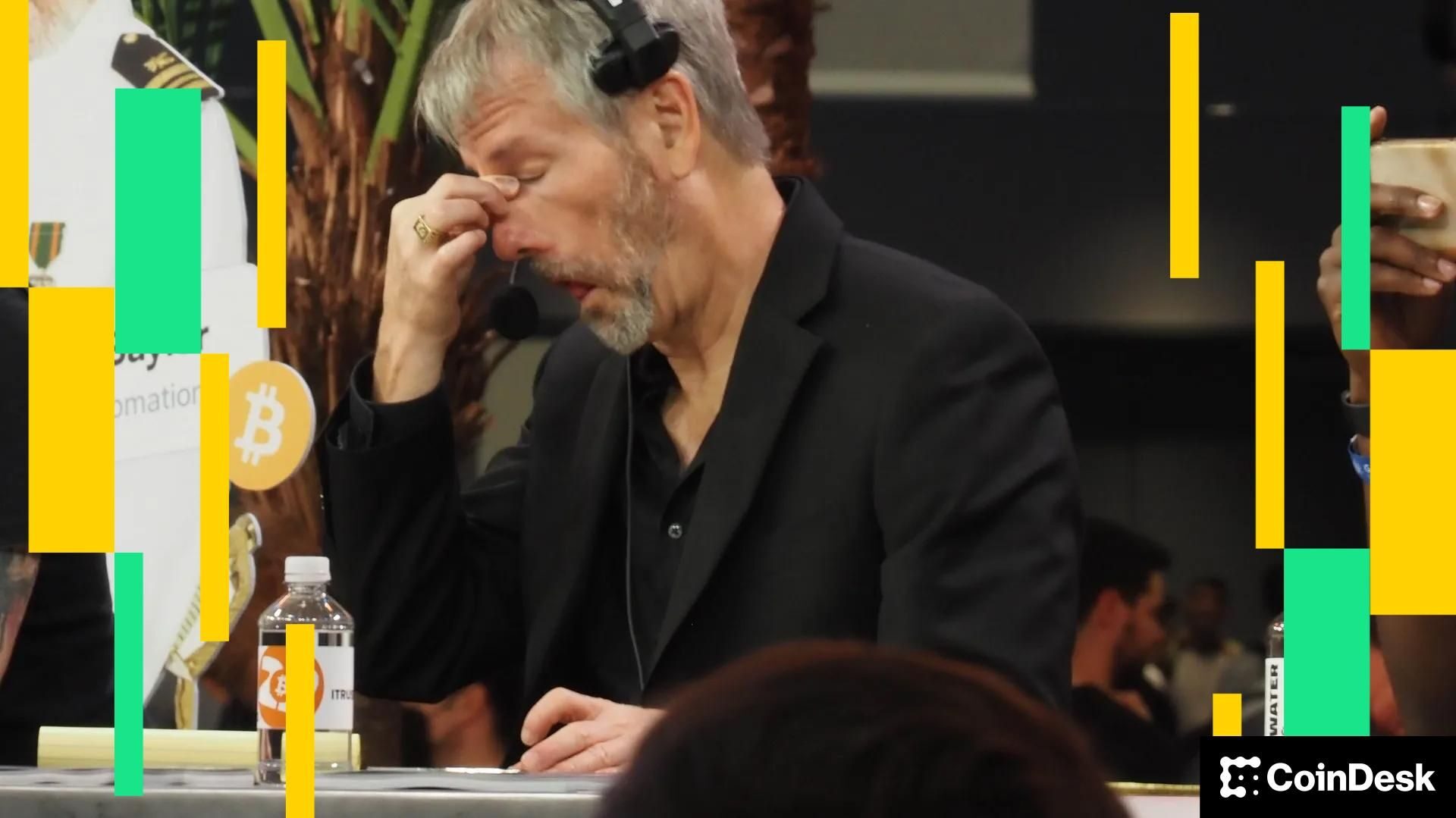

- CEO Phong Le and Executive Chairman Michael Saylor emphasized convertible debt reduction by 2029 and digital credit expansion globally.

- For the second consecutive quarter, Strategy (MSTR) has qualified for potential inclusion in the S&P 500.

Michael Saylor’s bitcoin BTC$110,229.77 treasury company Strategy (MSTR) is exploring credit securities opportunities in international jurisdictions as part of its goal to become the dominant global credit issuer.

“We are also actively laying the groundwork for credit securities in international jurisdictions, positioning Strategy to become a dominant credit issuer globally”, said Phong Le, president and CEO, during the company’s Q3 earnings call on Thursday.

STORY CONTINUES BELOW

This move underscores Strategy’s ambition to expand its financial footprint beyond the United States and position itself as a leader in other markets for bitcoin-backed and digital asset-based credit instruments.

Strategy reported operating and net income in Q3 of $3.9 billion and $2.9 billion respectively. These compare to losses of $432.6 million and $340.2 million for the same quarter a year ago. Earnings per share in was $8.42 compared to $1.72 in Q3 2024.

For the first nine months of 2025, Strategy’s operating income was $12 billion compared to a loss of $0.8 billion a year earlier, while net income rose to $8.6 billion from a $0.5 billion loss and earnings per share surged to $27.71 from -$2.71.

The company has $689 million in annual dividend and interest obligations, comprising $522 million from cumulative preferreds (STRF $124 million, STRK $111 million, STRC $294 million) and $125 million from non-cumulative STRD.

Convertible bonds total $8.2 billion in notional value with a blended interest rate of 0.421%, translating to about $35 million in annual interest, and 39% of this debt is in the money while the 2029 and 2030 zero-coupon tranches remain out of the money ($5 billion) until their 2028 put dates; these notes collectively have a market value of $10.6 billion.

CEO Phong Le reaffirmed the goal of having no convertible debt by 2029, a point noted by S&P in Strategy’s credit rating, giving the company a B- credit rating.

While Executive Chairman Michael Saylor highlighted that the company’s multiple to net asset value (mNAV) sits around 1.25 its weakest level since the start of 2024. Saylor puts this compression to a number of factors such as a maturing bitcoin market with reduced volatility, the success of IBIT, and the growing influence of derivatives which dampens volatility, though Saylor expects digital credit expansion via the preferred equities to lift mNAV over time.

Strategy has raised $20 billion year-to-date across six different securities (common stock, perpetual preferreds, and convertible debt), nearly matching the $22.6 billion raised in 2024.

On the regulatory side, the firm clarified that under Treasury and IRS interim guidance issued Sept. 30, it does not expect to be subject to the Corporate Alternative Minimum Tax on unrealized bitcoin gains.

For the second consecutive quarter, Strategy (MSTR) has qualified for potential inclusion in the S&P 500.

MSTR shares are up 6% pre-market trading at $270 per share.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Sam Reynolds|Edited by Jamie Crawley

3 hours ago

The disgraced FTX founder resurfaced on social media with a sprawling self-defense arguing that customers could have been made whole in 2022.

What to know:

- Sam Bankman-Fried claims FTX was never insolvent and blames bankruptcy lawyers for the company’s collapse.

- The document he posted suggests FTX’s assets could be worth over $100 billion today, contradicting financial filings.

- Bankman-Fried’s efforts to reshape his image include seeking a presidential pardon, though his chances are currently low.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language