-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

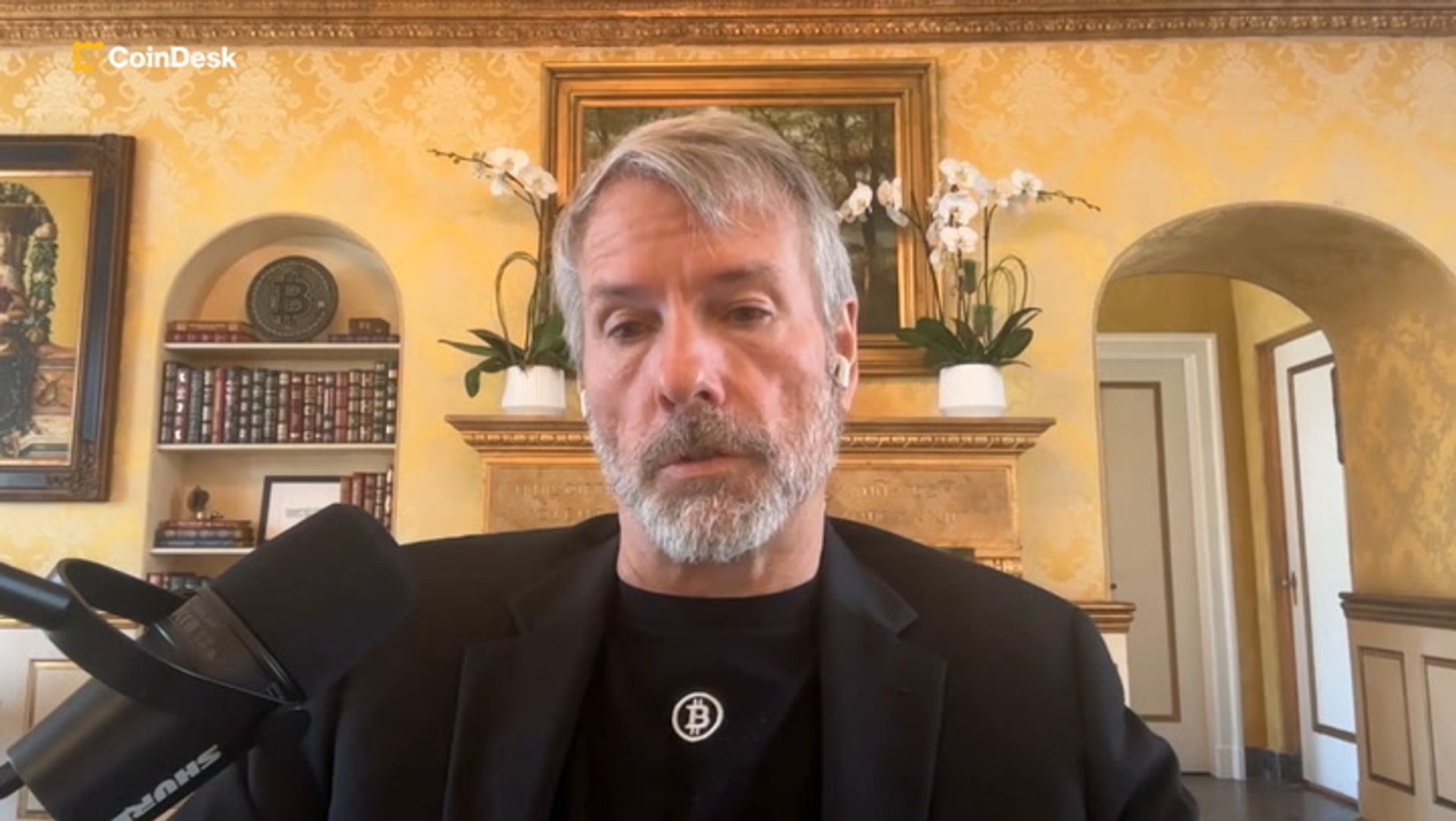

Analyst Mark Palmer reiterated his buy rating and $705 price target on the Michael Saylor-led company, which is more than a double from current levels.

By Will Canny, AI Boost|Edited by Stephen Alpher

Updated Sep 2, 2025, 1:16 p.m. Published Sep 2, 2025, 12:55 p.m.

- Strategy’s share-price weakness reflects a narrowing premium to its bitcoin holdings, not mismanagement, according to Benchmark analyst Mark Palmer.

- The company has consistently adapted its balance sheet, pioneering instruments like perpetual preferred stock that provide permanent capital and expand demand for bitcoin-linked securities.

- With S&P 500 inclusion now in play, Strategy remains the cleanest, most liquid way to gain exposure to bitcoin, Palmer said.

Strategy’s (MSTR) recent share-price weakness has drawn criticism from retail investors who accuse executive Executive Chairman Michael Saylor of undermining discipline by loosening a self-imposed rule against issuing equity when the company’s premium to its bitcoin holdings (mNAV) fell below 2.5x.

That criticism, however, misreads the situation, Benchmark analyst Mark Palmer said in a research report Tuesday.

STORY CONTINUES BELOW

The stock’s underperformance has more to do with market dynamics, namely a compressing premium to its bitcoin net asset value and broader volatility in crypto and macro markets, than with capital mismanagement, Palmer wrote.

By updating its guidance on Aug. 18 to allow tactical equity issuance even below the 2.5x mNAV threshold, Strategy effectively restored flexibility, the analyst said. Rather than a capricious move, the change freed the company to keep buying bitcoin during periods of weakness, maintaining its accumulation flywheel.

This approach is consistent with its history of adapting its balance sheet, Palmer argued, whether paying down restrictive debt, refinancing with convertible bonds, or innovating with perpetual preferred stock designed to supply permanent capital without refinancing risk.

That financial innovation has been one of Strategy’s most overlooked strengths., according to Palmer. Its preferred stock program has created new bitcoin-linked instruments attractive to hedge funds and volatility traders, validating the firm’s strategy and expanding the investor base. Each successful placement underscores the appetite for bitcoin-tied fixed income and cements the company’s reputation as a credible issuer experimenting at the intersection of crypto and traditional markets.

The company may soon face another milestone: potential inclusion in the S&P 500 index. If admitted, the stock could see billions in passive inflows and would join Coinbase (COIN) and Block (XYZ) in embedding crypto exposure directly into the portfolios of mainstream equity investors, the broker said.

Palmer reiterated its buy rating and $705 price target, calling Strategy the most liquid and direct vehicle for exposure to bitcoin’s upside without mining risk. That would be more than a double from the current share price of $332.

Read more: Strategy Added Another 4,408 Bitcoin for $450M Last Week

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

20 minutes ago

The rebound from support was fueled by above-average activity and a clean break above nearby resistance could shift sentiment.

What to know:

- BNB’s price was little changed at $850 after dropping to around $840 and then rallying to $855.

- Buying interest emerged at the $840-$845 support zone.

- The rebound from support was fueled by above-average activity and a clean break above nearby resistance could shift sentiment.

- The token is now consolidating, with resistance near $855-$857, and a hold above current levels could set the stage for a test of higher levels.