SUI Slides 3.4% as $2.60 Support Snaps on 180% Volume Surge

By CD Analytics, Helene Braun|Edited by Nikhilesh De

Oct 28, 2025, 8:53 p.m.

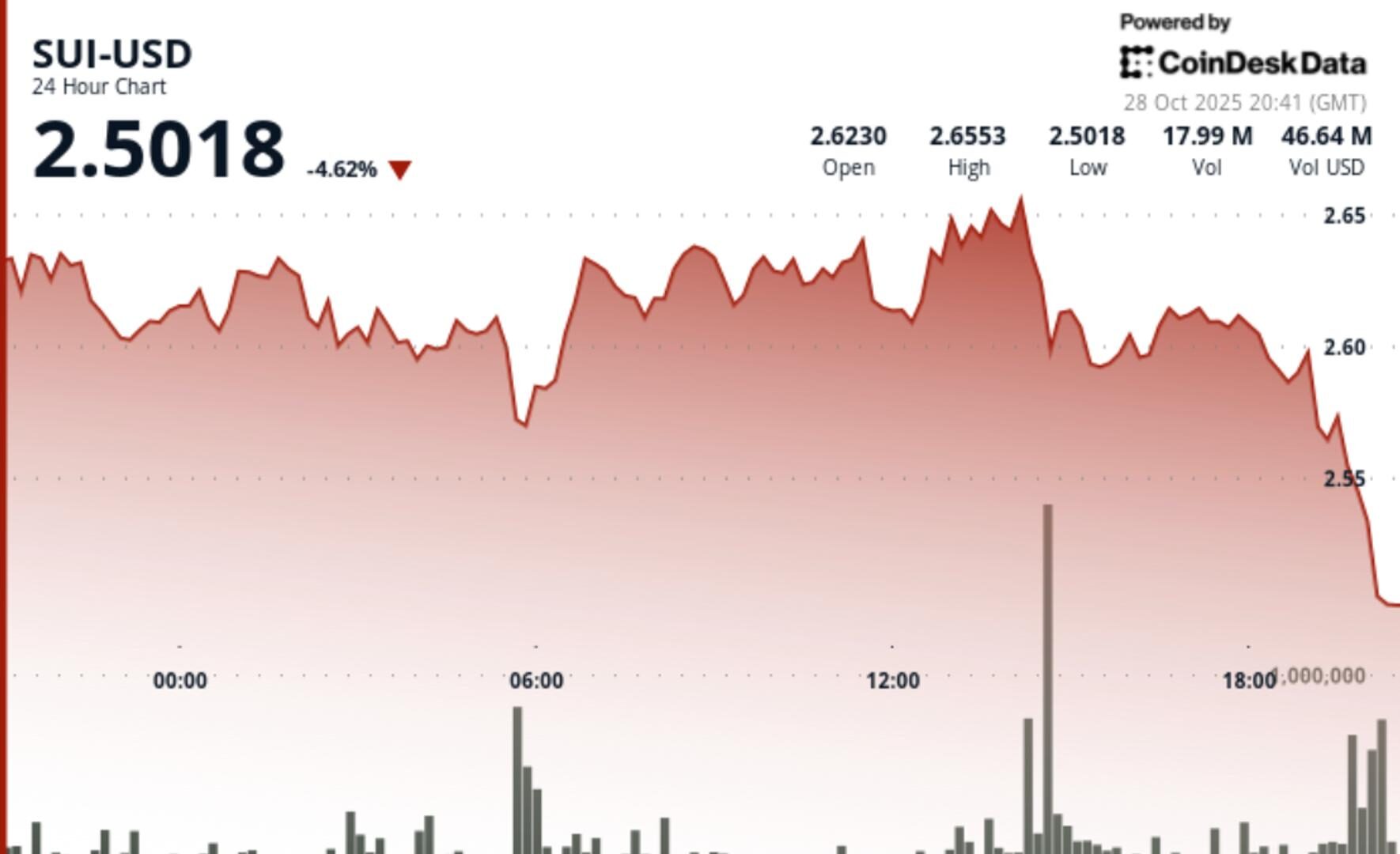

- SUI dropped 3.4% Tuesday, breaking below key $2.60 support as volume surged on likely institutional selling.

- Price fell sharply after 14:00 ET, with nearly 2.7M tokens traded in one minute during a late-day selloff.

- The CoinDesk CD5 Index slid 1.67%, closing under $2,000 as broader crypto markets lost earlier momentum.

SUI slipped 3.4% over the past 24 hours, dropping from $2.62 to $2.53 after a late-day breakdown accelerated on sharp volume spikes, signaling likely institutional selling.

The drop shattered the $2.60 support level, a key threshold traders had been watching throughout the session, CoinDesk Analytics found.

STORY CONTINUES BELOW

The breakdown kicked off when volume surged past 25.4 million, well over 180% of the 24-hour average. Price action turned increasingly bearish into the evening, with a second wave of selling intensifying.

A sharp rejection at $2.577 was followed by a steep drop to $2.527 within minutes, as nearly 2.7 million tokens changed hands in a single minute, likely triggered by algorithmic sell programs and stop-loss orders.

Charts showed a clear pattern of lower highs and lower lows throughout the day. Multiple attempts to reclaim ground above $2.60 failed, with resistance holding firm at $2.66. Sellers repeatedly stepped in, reinforcing the upper boundary.

No major news or fundamental catalyst appeared to drive the move, suggesting that price discovery was led by technical breakdowns. The volume profile and timing of the selloff pointed to systematic selling, not retail panic.

Traders are now eyeing support near the $2.50 zone, while resistance remains clearly defined at $2.577 and $2.66.

The broader market also showed strain. The CoinDesk CD5 Index fell 1.67% to $1,978.58, dropping below the psychologically important $2,000 level, despite earlier gains that briefly pushed it near $2,040.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Krisztian Sandor|Edited by Stephen Alpher

43 minutes ago

Tether’s gold-backed token swelled above $2 billion market cap, driven by record prices and surging retail demand, CEO Paolo Ardoino said in an interview.

What to know:

- Tether’s tokenized gold XAUT was backed by 375,000 ounces of physical bars held in Switzerland as of the end of September, the company said.

- The market cap of Tether Gold soared to $2.1 billion as of October, driven by rising gold prices and demand from retail investors in emerging markets.

- Tokenized gold allows investors to hold a blockchain-based representation of gold without the complexities of physical storage.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language