BTC

$106,390.30

+

2.03%

ETH

$2,636.88

+

4.04%

USDT

$1.0005

+

0.03%

XRP

$2.2384

+

3.75%

BNB

$666.86

+

1.65%

SOL

$161.81

+

5.58%

USDC

$0.9997

+

0.01%

DOGE

$0.1969

+

2.68%

TRX

$0.2706

+

1.28%

ADA

$0.6945

+

3.12%

HYPE

$37.94

+

14.19%

SUI

$3.3154

+

0.96%

LINK

$14.31

+

4.25%

AVAX

$21.43

+

4.35%

XLM

$0.2741

+

3.03%

LEO

$8.7525

+

4.66%

BCH

$405.42

+

1.26%

TON

$3.2020

+

0.95%

SHIB

$0.0₄1328

+

3.17%

HBAR

$0.1747

+

3.51%

By Helene Braun, AI Boost|Edited by Stephen Alpher

Jun 3, 2025, 2:11 p.m.

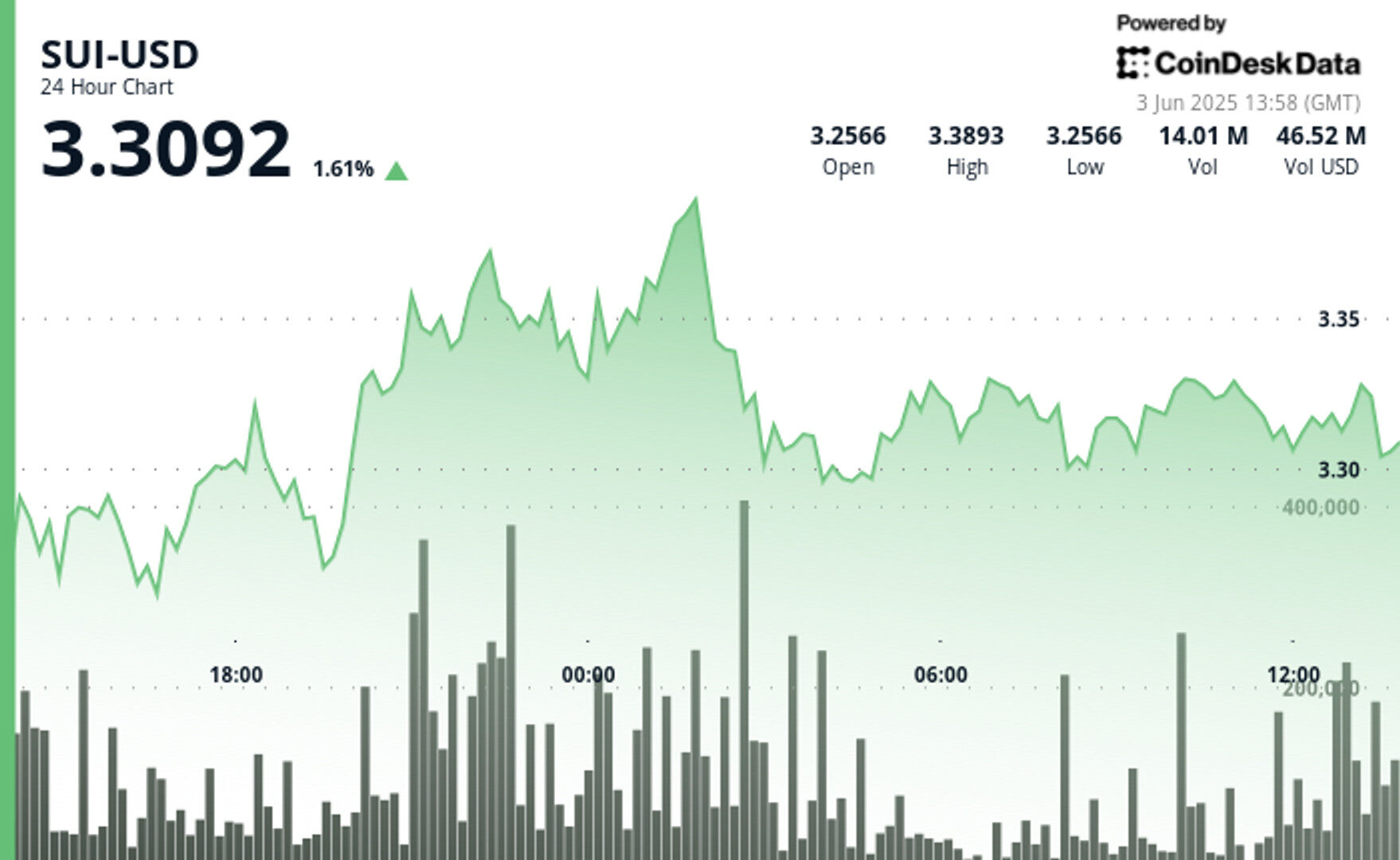

- SUI exhibited strong bullish momentum, climbing from $3.27 to a peak of $3.39 during early June 3 trading, before later dropping to around $3.30.

- Global trade disputes and economic policy shifts created market uncertainty, with SUI’s price action reflecting broader crypto sentiment.

- Recent price consolidation near $3.31 suggests completion of the accumulation phase, with higher lows forming a bullish structure despite minor pullbacks.

SUI

, the native token of the layer-1 blockchain, broke out from consolidation, climbing from $3.27 to $3.39, showing 5.2% volatility range amid increased trading volume earlier on Tuesday.

STORY CONTINUES BELOW

Geopolitical tensions and ongoing trade disputes between major economies are creating market uncertainty, with SUI’s price action reflecting broader market sentiment.

Recent price consolidation near $3.31 suggests accumulation phase completion, with higher lows forming a bullish structure despite minor pullbacks.

Global trade disputes and economic policy shifts are creating ripples across cryptocurrency markets, with SUI experiencing notable price action as investors navigate uncertain waters. The token’s recent breakout from a consolidation phase demonstrates resilience amid broader market volatility, with support levels forming at $3.29-$3.30 after previously acting as resistance. Meanwhile, Sui Network’s technological advancements continue to attract attention, with its focus on scalability and Web3 integration positioning it uniquely within the blockchain ecosystem.

Technical Analysis

- SUI exhibited a notable 5.2% volatility range ($0.17) over the 24-hour period.

- Key resistance established at $3.37-$3.39 backed by above-average volume of 14.6 million.

- Support levels formed at $3.29-$3.30, which previously acted as resistance before being breached.

- Price action suggests accumulation phase completion with higher lows forming a bullish structure.

- The token erased some of its gains during U.S. morning hours, trading at $3.30 at press time.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Helene is a New York-based markets reporter at CoinDesk, covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. She is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.