Bitcoiners aren’t usually the forgiving type – especially toward perceived apostates who ape into other cryptocurrencies. That’s why Republican U.S. presidential nominee Donald Trump’s visit last week to a beloved Bitcoin bar in New York appeared so well timed – to repair any lost credibility after he and his family started promoting a decentralized-finance project that appears rooted in other blockchain ecosystems.

Democratic U.S. presidential candidate Kamala Harris’s policy is “N/A.”

Telegram’s turnabout.

EXCLUSIVE: Huddle01, a video-conferencing blockchain project taking on Zoom, aims to sell as much as $37 million of “media nodes.”

Top picks from the past week’s Protocol Village column:

$110 million of blockchain project fundraisings.

This article is featured in the latest issue of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday.

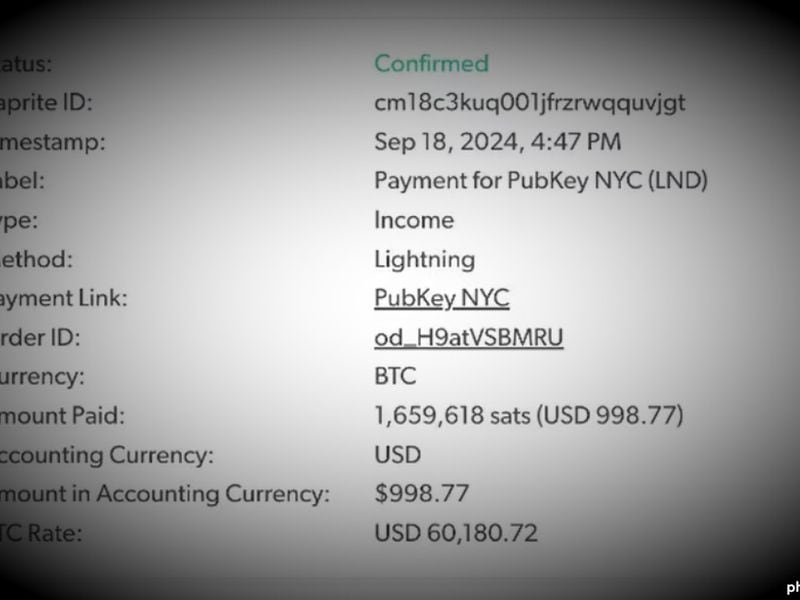

Screenshot of the Zaprite invoice used by Republican U.S. presidential nominee Donald Trump to buy burgers and Diet Cokes at the bar PubKey in New York (PubKey/X)

LESSER EVILISM – It goes without saying that many Bitcoin purists do not like to mingle their business, politics or even company with users of other blockchains or cryptocurrencies. Which is partly why the Republican U.S. presidential nominee Donald Trump garnered so much scorn from Bitcoiners last week for promoting a very-much-NOT-Bitcoin decentralized-finance project, World Liberty Financial – complete with its own token, and a pre-mined allocation to insiders. “Trump launching a sh*tcoin may have been the final straw to lose my vote,” tweeted Bitcoin-friendly author Mitchell Askew. Responses on the thread ranged from total agreement to what one might call lesser evilism – the rhetorical contrast of one bad option with an even worse option: “True but it’s that or WW3 with commie Kamala,” wrote @FrictionlessBTC.

The DeFi dalliance threatened to undo much of the goodwill Trump built up at the Bitcoin Nashville conference in July, when he tossed out a series of red-meat pledges, including commuting the rest of Silk Road creator Ross Ulbrecht’s life sentence and creating a “strategic national bitcoin stockpile.” Multiple standing ovations ensued.

So it was fortuitous timing for Trump that his campaign scheduled a stop, later in the week, at the Bitcoin-friendly New York City bar, PubKey. According to the bar’s official X account, Trump bought 50 smash burgers and Diet Cokes for people in attendance, at a total cost of $998.77 including tax and tip, and then paid for it all in bitcoin. Fox News posted a video of the entire scene, leading a sharp-eyed reporter from CryptoSlate to quickly point out that Trump’s role mainly consisted of standing by at the counter while handlers actually performed the transaction, passing smartphones back and forth between them. Whatever. The bar crowd cheered. “Crypto burgers!” Trump said as he handed them out. A voice from behind the camera corrected him, “Bitcoin burgers!”

As much as it was a second chance for Trump to prove his Bitcoin bona fides, the choreographed transaction served as a sort of benchmark for the blockchain’s evolution as a viable payments option for a retail-facing business in the U.S. Will Cole, head of product at the Bitcoin payments app Zaprite (who happens to be Bitcoin-friendly U.S. Senator Cynthia Lummis’s son-in-law), described what he called the “Trump stack:” PubKey, running a node on Bitcoin’s Lightning Network on Voltage Cloud, used Zaprite to provide an invoice for the purchase, and Trump paid using a Strike wallet. (Official spokespeople for the Trump campaign didn’t respond to CoinDesk’s email asking where the bitcoin originated from.)

Asked whether the episode might have helped erase any lingering disgust among Bitcoiners over the World Liberty Financial rollout, PubKey founder Thomas Pacchia didn’t exactly dispute the premise of the question: “The other stuff that the family has going on is sort of outside our purview and scope,” he said in an interview. “Everybody is on a journey toward understanding the difference between Bitcoin and crypto. I like to meet people where they are.”

ELSEWHERE:

Caroline Ellison exits a Manhattan courthouse after being sentenced to two years in prison on Sept. 24, 2024. (Victor Chen/CoinDesk)

Former Alameda Research CEO Caroline Ellison was sentenced to two years in prison by a federal judge on Tuesday. The judge said Ellison, 29, who will also have to forfeit about $11 billion, could serve the sentence at a minimum-security facility near Boston, where her family lives. Ellison was a key witness in the government’s trial against her former boyfriend, FTX founder Sam Bankman-Fried, who was convicted on seven counts of fraud and conspiracy before being sentenced earlier this year to 25 years in prison.

Vice President and Democratic nominee Kamala Harris made her first remarks on crypto on Sunday before donors in New York City. (Her specific choice of term was “digital assets.”) A person with knowledge of the talks between her campaign and crypto insiders told CoinDesk that the discussions about digital-asset policy remain high-level and aren’t likely to produce a detailed stance before the election in early November. Stand With Crypto, an advocacy group whose industry partners include exchanges Coinbase and Gemini as well as Filecoin developer Protocol Labs, issued a rating of “N/A” on Harris’s crypto policies, for “not enough information.”

Telegram, the instant-messaging app popular with crypto-industry pros, made significant changes to its terms of service, chief executive officer Pavel Durov said in a post on the app on Monday. The app’s privacy conditions now state that Telegram will now share a user’s IP address and phone number with judicial authorities in cases where criminal conduct is being investigated.

Crypto exchange BingX has been hacked for a “minor” amount of assets and the exchange plans to compensate users for any loss, the firm’s chief product officer (CPO) said in a message on X. On-chain data suggests nearly $43 million was stolen from the exchange in multiple tranches, with $13.25 million ether, $2.3 million BNB, $4.4 million USDT, among other being drained.

Former Grammy-nominated artist and entrepreneur Iggy Azalea will release Motherland, a new online casino that uses her MOTHER token, in November. Azalea unveiled the project alongside business partner Joe McCann, founder of crypto investment firm Asymmetric, and manager Reece Pearson at her Motherland Rodeo event, at Breakpoint in Singapore last Friday.

Huddle01, a blockchain project to provide decentralized audio and video conferencing – aiming to provide lower latency virtual meetings than Zoom and Google Meet – plans to raise as much as $37 million in a sale of network nodes.

The 49,600 “media nodes” being sold offer operators a way to contribute excess internet bandwidth the communication network, in exchange for token rewards. According to a litepaper, some 21% of the project’s HUDL tokens will be distributed to media nodes.

“These nodes will power a network that already outperforms the incumbent Web2 competitors on latency where there is a large cluster of nodes, and is capable of improving lags across the globe,” Huddle01 CEO Ayush Ranjan said in the release, shared exclusively with CoinDesk.

The project is built using technology borrowed from the Ethereum layer-2 network Arbitrum. A test network will launch two weeks after the sale completes, according to the press release.

Huddle01 becomes the latest in a growing trend of blockchain projects conducting node sales as a way to raise funds while simultaneously decentralizing their networks.

Fundraisings

Screengrab from Daylight blog post with examples of personalized transaction recommendations (Daylight)

Daylight, a project with an API that powers personalized transaction recommendations for crypto wallets like Coinbase Wallet, MetaMask, Zerion and OKX Wallet, has raised $6 million in a seed round led by Union Square Ventures and co-led by 1kx. Examples of recommended transactions (see images, above) include token mints, claims and quests. According to a blog post: “It’s like the home tabs of Netflix or Spotify, but with things to do onchain instead of movies or music.”

Others (Details in Protocol Village column): Celestia Foundation ($100M, first on CoinDesk), WSPN ($30M), Drift ($25M), Darkbright ($6M).

Data and Tokens

*Regulatory and Policy

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

Praxis “Citizen Map” (Praxis)

Abra, a platform for digital asset services, has partnered with Praxis, described as “the first network state,” to collaborate on real world asset tokenization, as well as DeFi services to network states, including those created on the Praxis platform. According to the team: “Praxis and Abra intend to create an on-chain database of real estate, businesses, citizenship, contracts, marketplaces and other on-chain DeFi (decentralized financial) services that interact seamlessly with both online communities and physical cities.” Balaji Srinivasan, author of “The Network State,” is one of Praxis’s backers.

Bitcoin zero-knowledge rollup Citrea has deployed its BitVM-based bridge Clementine to the Bitcoin testnet. Citrea, which raised $2.7 million in seed funding led by Galaxy in February, aim is to use Bitcoin as a settlement layer to make it “the foundation for the world’s finance,” according to an emailed announcement on Tuesday.

Frankendancer, an early version of Jump Crypto’s highly anticipated Solana validator client software, Firedancer, is live and contributing to the performance of the Solana blockchain, Jump’s Chief Science Officer Kevin Bowers said Friday. Firedancer itself is running on testnet, Bowers said, indicating it has achieved minimum viability and is getting close.

Worldcoin, the blockchain identity network known for its iris-scanning orbs as well as its affiliation with OpenAI founder Sam Altman, introduced Face Auth, a new security measure for World ID. According to the team: “Face Auth is a private 1:1 face comparison that ensures only the person who verified their World ID at an orb can use it. It provides increased security for your World ID during actions like online purchases, financial transactions, secure sign-in applications and much more.”

Aethir, a project for decentralized GPU cloud computing, andFilecoin Foundation are establishing an alliance to provide clients with enterprise-grade solutions to support their businesses with decentralized infrastructure, according to a blog post: “As part of our collaboration with the Filecoin Foundation, Aethir will explore GPU leasing to Filecoin’s storage providers, thus providing Filecoin’s infrastructure network with a reliable and secure source of GPU cloud computing supplies.

Sept. 25-26: European Blockchain Convention, Barcelona

Sept. 30-Oct. 2: Messari Mainnet, New York.

Oct. 1-2: CV Summit, Zug, Switzerland.

Oct. 9-11: Permissionless, Salt Lake City.

Oct. 9-10: Bitcoin Amsterdam.

Oct. 10-12: Bitcoin++ mints ecash: Berlin.

Oct. 15-17: Meridian, London.

Oct. 18-19: Pacific Bitcoin Festival, Los Angeles.

Oct. 21-22: Cosmoverse, Dubai.

Oct. 23-24: Cardano Summit, Dubai.

Oct. 25-26: Plan B Forum, Lugano.

Oct. 30-31: Chainlink SmartCon, Hong Kong.

Nov. 9-11: NEAR Protocol’s [REDACTED], Bangkok.

Nov. 10: OP_NEXT Bitcoin scaling conference, Boston.

Nov. 11-14: Websummit, Lisbon.

Nov 12-14: Devcon 7, Bangkok.

Nov. 15-16: Adopting Bitcoin, San Salvador, El Salvador.

Nov. 20-21: North American Blockchain Summit, Dallas.

Dec. 5-6: Emergence, Prague

Jan. 21-25: WAGMI conference, Miami.

Jan. 30-31: PLAN B Forum, San Salvador, El Salvador.

Feb. 19-20, 2025: ConsensusHK, Hong Kong.

May 14-16: Consensus, Toronto.

May 27-29: Bitcoin 2025, Las Vegas.