This Pattern Has Emerged Three Times Since Late 2023, Triggering BTC Price Corrections

Key moving averages remain crucial support levels as long-term investors trim holdings, adding pressure to the ongoing bull market.

By James Van Straten|Edited by Sheldon Reback

Nov 5, 2025, 10:33 a.m.

- Bitcoin briefly fell to $98,951, testing both the 365-day simple moving average of $102,055 and 365-day exponential moving average ($99,924) that have defined support this cycle.

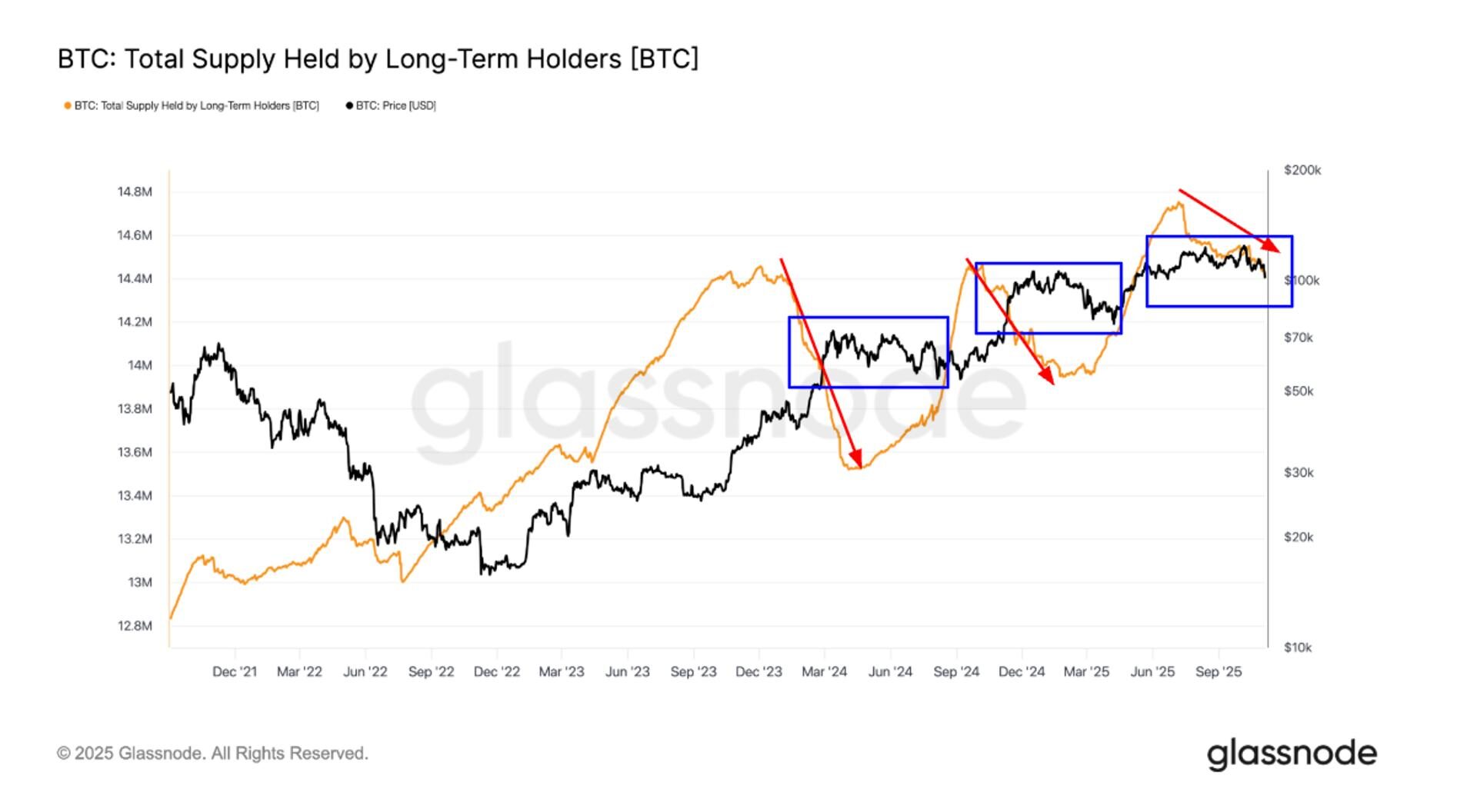

- Long-term holders have reduced their supply from 14.7 million BTC in July to 14.4 million BTC, the third major profit-taking phase since late 2023.

Bitcoin BTC$101,515.32 briefly fell below $100,000 for the first time since June on Tuesday, reaching lows of around $98,951. The drop took the largest cryptocurrency below two key support levels needed to sustain the current bull market, fueling concerns the decline may gather steam.

The two levels, the 365-day simple moving average (SMA) and the 365-day exponential moving average (EMA), are currently $102,055 and $99,924, respectively. Both have already been tested during this bull cycle.

STORY CONTINUES BELOW

In August 2024, bitcoin used the 365-day SMA, the average closing price over that period giving equal weight to each, as a key support level around $48,963, while briefly dipping below the EMA price, which gives more weight to recent readings. Then, during April’s “tariff tantrum,” bitcoin dropped as low as $76,500, breaking below both moving averages before reclaiming them shortly after.

The selling pressure continues to come from long-term holders, defined as investors who have held their bitcoin for at least 155 days. The supply held by this cohort is now about 14.4 million BTC, down from more than 14.7 million BTC at the peak in July.

This marks the third notable wave of selling by this group since late 2023. Each time has added downward pressure that leads to price consolidation or even corrections — drops of 10% or more — after a period of rallying prices. The previous instance occurred during the November 2024 rally following President Trump’s election victory.

More For You

Nov 3, 2025

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

What to know:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

By James Van Straten, AI Boost|Edited by Jamie Crawley

1 hour ago

Funding round backed by Fulgur Ventures, Nakamoto, and TOBAM positions FUTURE as an institutional bridge between Bitcoin and global capital.

What to know:

- FUTURE (Future Holdings AG) raised $35 million (28 million Swiss francs) to expand its balance-sheet-driven bitcoin treasury model under leadership of Richard Byworth, Sebastien Hess and Adam Back.

- The firm’s strategy spans BTC treasury operations, analytics, secure infrastructure, and advisory, with plans to host the Future Bitcoin Forum 2026 in Switzerland.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language