Holder behavior, not external factors, emerges as the primary source of selling pressure as older coins move and profits are realized.

By James Van Straten|Edited by Oliver Knight

Updated Oct 20, 2025, 11:33 a.m. Published Oct 20, 2025, 11:04 a.m.

- Revived supply and rising average coin age signal that long-term holders are selling, with $1.7 billion in daily realized profits.

- Nearly half of selling pressure comes from coins held for six months to one year, indicating profit-taking from 2025 buyers.

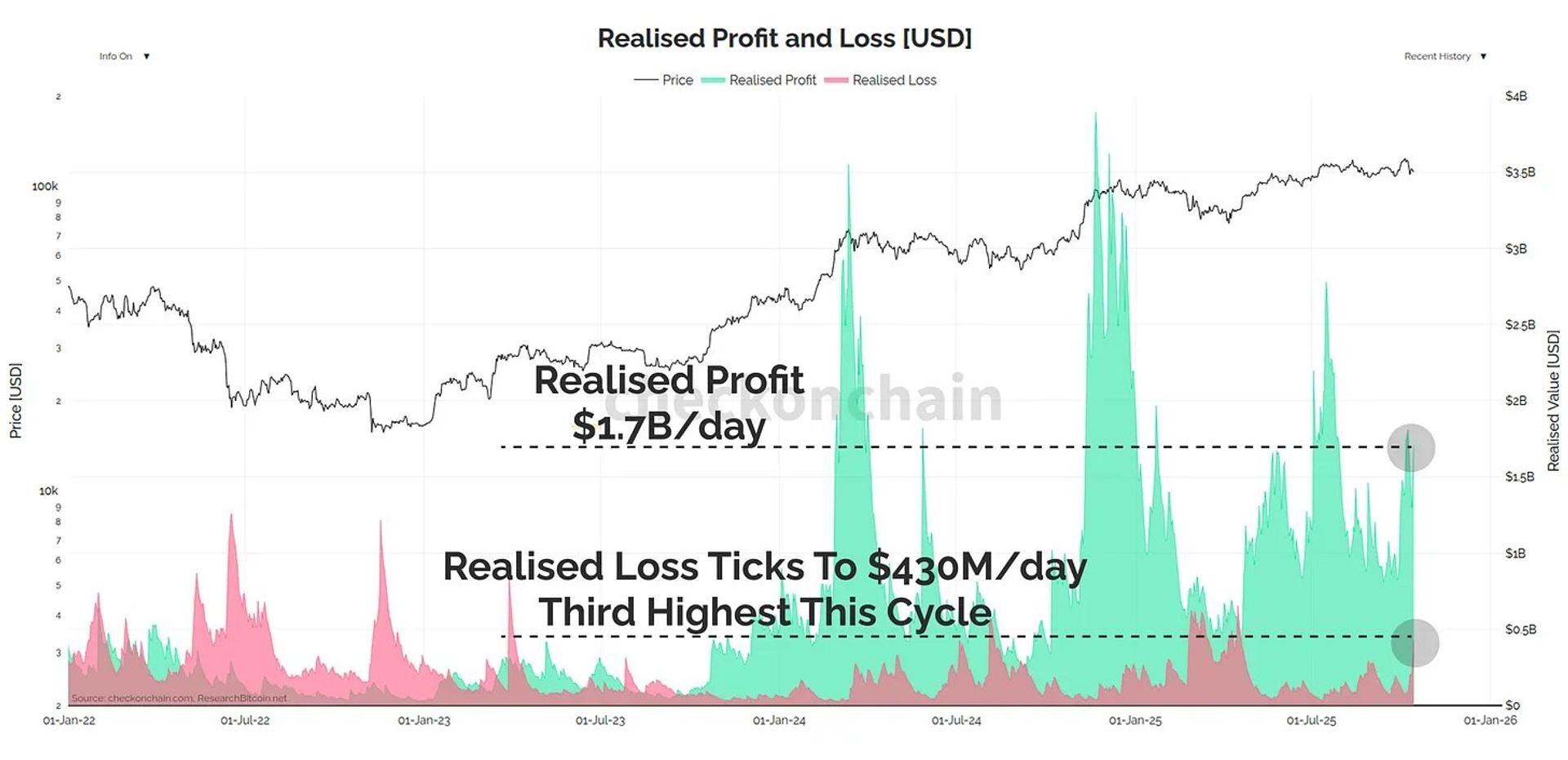

- Realized profits have surged to about $1.7 billion per day, one of the highest levels seen this cycle.

Bitcoin BTC$110,951.27 bottomed out at around $103,500 on Friday, marking an 18% correction from its all-time high of $126,200 reached on Oct. 6. This aligns with a standard bull market correction, where bitcoin typically retraces around 20% a pattern that has defined the current cycle since it began in 2023.

STORY CONTINUES BELOW

The main source of sell-side pressure in the market is existing bitcoin holders, according to analyst Checkmate.

“The sheer volume of sell-side pressure from existing bitcoin holders is still not widely appreciated, but it has been the source of resistance. Not manipulation, not paper bitcoin, not suppression. Just good old fashioned sellers”, Checkmate noted.

The first chart illustrates revived supply, which refers to the total amount of coins returning to circulation after being dormant for a certain amount of time. Revived supply has recently reached its second-highest level of the cycle at $2.9 billion per day.

Notably, 47% of selling pressure is coming from coins held for six months to one year, suggesting that many investors who bought bitcoin at the end of 2024 and particularly during its drop to around $76,000 in April following tariff-related market reactions are now taking profits.

The second chart highlights a similar trend through the average age of spent coins, which has continued to rise throughout this cycle. At the start of the cycle in 2023, the average age of spent coins was 26 days, relatively young age, but it has now increased to 100 days. This indicates that older coins are increasingly being spent as holders choose to realize gains.

Supporting this profit-taking narrative, Checkmate also shows that realized profits have surged to about $1.7 billion per day, one of the highest levels seen this cycle. Meanwhile, realized losses have also climbed to $430 million per day, the third-highest level of the cycle, a high level of capitulation.

Overall, the data suggests that profit-taking remains the dominant market behavior, and this continued selling pressure is weighing on bitcoin’s price.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Will Canny, AI Boost|Edited by Sheldon Reback

2 minutes ago

Stablecoins are growing alongside crypto, lifting Ethereum while new networks loom and the dollar stays dominant.

What to know:

- Stablecoins are still largely used as an entry point to crypto, with little effect on overall bank deposits but potential pressure on funding costs, the report said.

- Ethereum benefits from the boom, but Citi warned new networks could erode the blockchain’s dominance as dollar-backed coins continue to lead.