Toncoin Falls, Extending Slide as Broader Crypto Market Drops

The token’s trading range was volatile with above-average volume indicating trader repositioning and uncertainty.

By CD Analytics, Francisco Rodrigues|Edited by Sheldon Reback

Dec 15, 2025, 3:24 p.m.

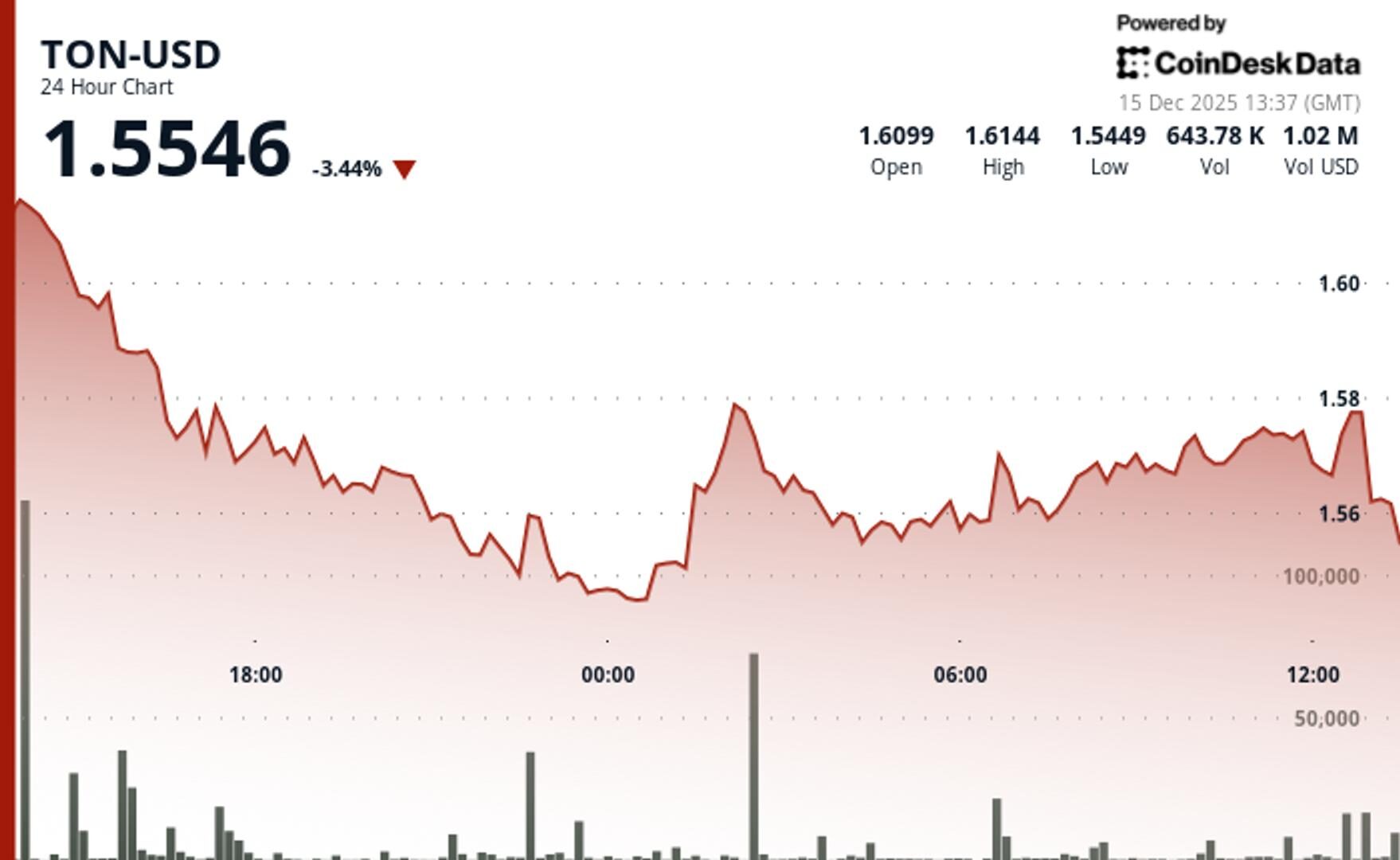

- TON’s price fell 3.4% to $1.5567, underperforming the broader crypto market which lost 1.8%.

- The token’s trading range was volatile with above-average volume indicating trader repositioning and uncertainty.

- Technical signs are mixed, with TON finding support near $1.5449 but struggling to sustain recoveries, leaving traders watching for signs of stabilization or further rotation away from the asset.

TON’s price slipped 3.4% over the past 24 hours, falling to $1.5567 and widening its performance gap with broader crypto markets.

The broader market, as measured via the CoinDesk 20 (CD20) index, fell 1.8% in the same period. TON’s retreat points to continued selling pressure specific to the token.

STORY CONTINUES BELOW

The token staged a few brief recoveries, but ultimately extended its sequence of lower highs. This consistent downward movement suggests sellers are staying active even as market conditions improve elsewhere.

The trading range spanned from a high of $1.6144 to a low of $1.5449, a nearly 4.3% swing, highlighting the volatility behind the decline according to CoinDesk Research’s technical analysis data model.

Volume topped 640,000 tokens, with spikes during both sell-offs and rebounds running above the daily average. This activity level indicates traders are repositioning, though not necessarily committing in one direction. It’s a sign of uncertainty, with market participants active but cautious.

Technical signs remain mixed. The token found some support near $1.5449 and bounced toward $1.58 before slipping again, suggesting buyers stepped in briefly before the selling resumed. These patterns hint at possible interest from major market participants, but without sustained follow-through, TON continues to lag.

The drop adds to a broader pattern of underperformance. For now, traders are watching for signs of stabilization or deeper rotation away from the asset.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Francisco Rodrigues, AI Boost|Edited by Nikhilesh De

16 minutes ago

These are CME’s smallest crypto contracts to date, aimed at active participants who prefer to trade in spot market terms without managing contract expiries or rollovers.

What to know:

- CME Group has launched Spot-Quoted futures for XRP (XRP) and Solana (SOL), allowing for trading closer to real-time market prices.

- These are CME’s smallest crypto contracts to date, aimed at active participants who prefer to trade in spot market terms without managing contract expiries or rollovers.

- The launch also includes Trading at Settlement (TAS) for XRP, SOL and Micro futures, enabling traders to manage risk around crypto ETFs with added flexibility.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language