BTC

$105,948.70

–

2.63%

ETH

$2,624.00

–

3.39%

USDT

$1.0003

+

0.01%

XRP

$2.2123

–

3.95%

BNB

$671.44

–

2.09%

SOL

$163.93

–

5.14%

USDC

$0.9999

+

0.03%

DOGE

$0.2054

–

8.62%

TRX

$0.2721

–

1.91%

ADA

$0.7101

–

6.05%

SUI

$3.4893

–

5.99%

HYPE

$33.01

–

3.25%

LINK

$14.56

–

8.19%

AVAX

$21.84

–

6.74%

XLM

$0.2748

–

4.58%

LEO

$9.2279

+

2.17%

TON

$3.3206

–

0.90%

BCH

$408.95

–

2.49%

SHIB

$0.0₄1336

–

7.62%

HBAR

$0.1767

–

5.59%

By AI Boost, Omkar Godbole|Edited by Omkar Godbole

May 30, 2025, 10:54 a.m.

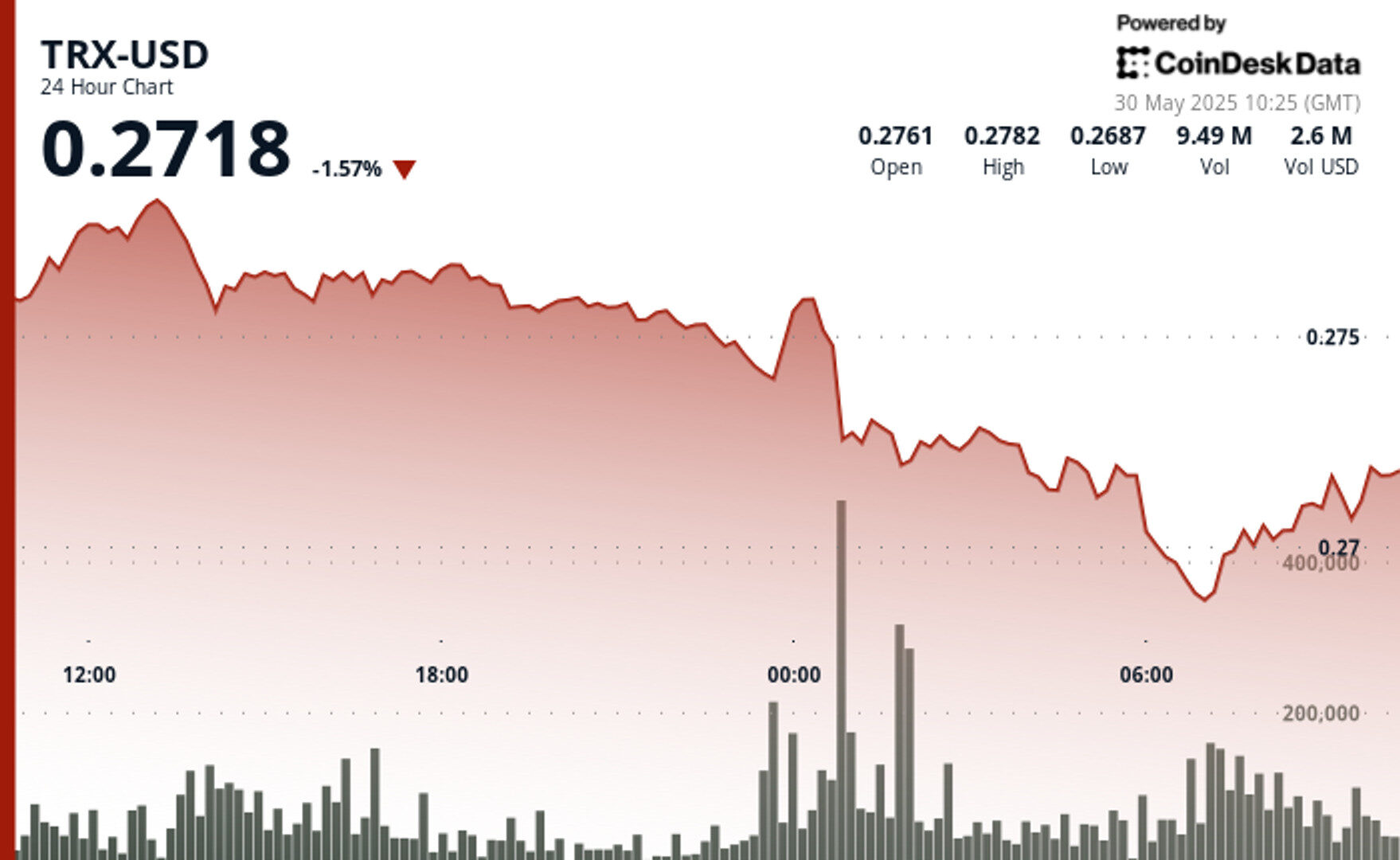

- TRX fell from $0.277 to $0.270 in 24 hours, suggesting significant market volatility.

- Geopolitical tensions and trade policies affect overall market sentiment.

- High trading volume points to potential further downward pressure on TRX prices.

Tron’s native token, TRX, faced intense selling pressure in the past 24 hours, marking a price from 27.7 cents to 27 cents.

The high-volume decline happened alongside turbulence in the broader market influenced by geopolitical tensions and evolving investor sentiment.

STORY CONTINUES BELOW

These macroeconomic factors compound the challenges already presented by high trading volumes. However, the final hour of analysis revealed some market resilience, where TRX slightly recovered from a dip below 27 cents.

- The 24-hour price drop from $0.277 to $0.270, with a closing price of $0.269, was accompanied by significant volume spikes, reaching 156.716 million, indicating selling pressure.

- Price volatility between a high of $0.278 and a low of $0.268 was observed.

- High trading volume points to potential further downward pressure on TRX prices.

- The quick rebound from under $0.27, coupled with a continued trading interest, suggests a critical support level that may prevent further declines.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.