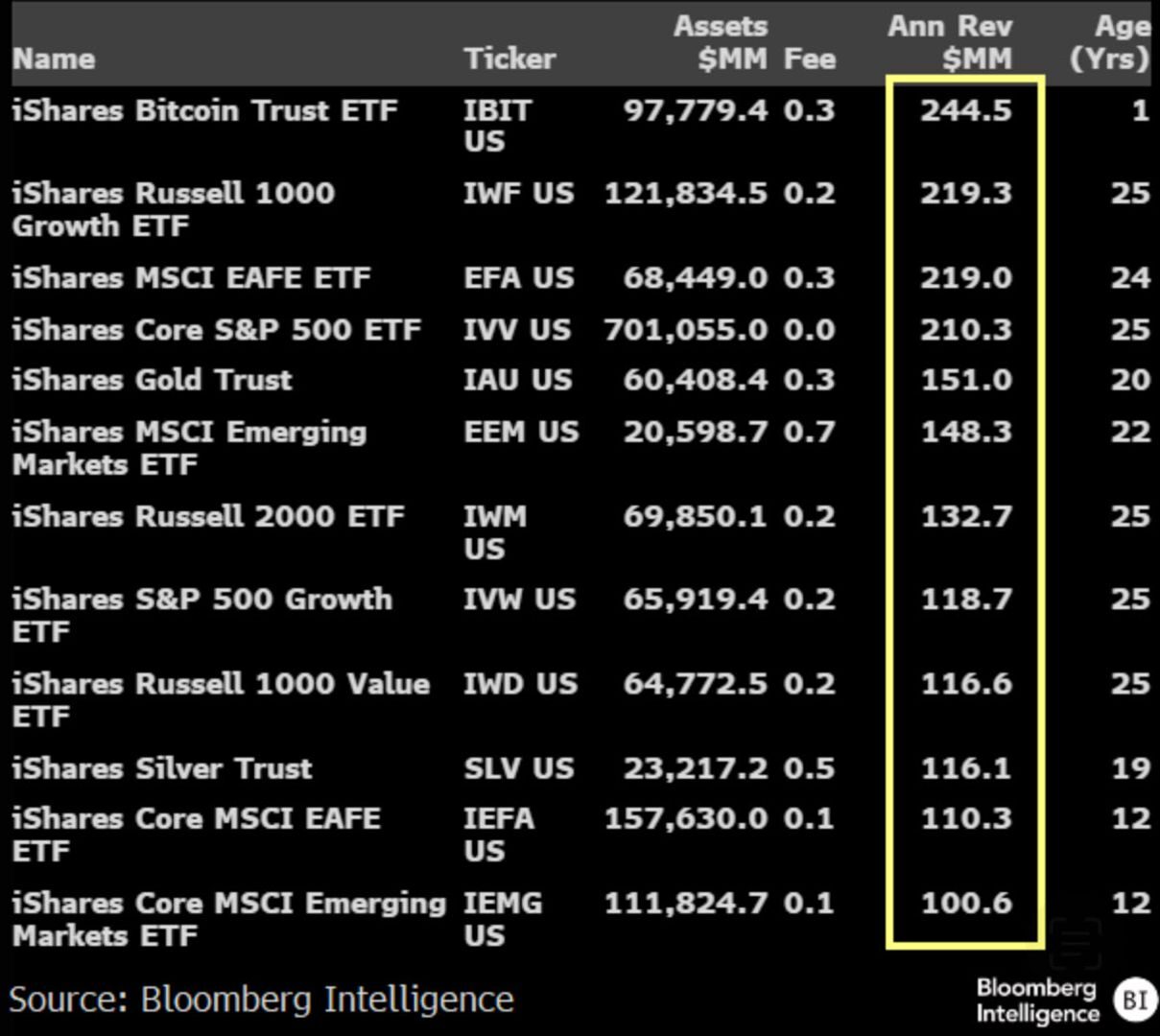

BlackRock’s iShares Bitcoin Trust (IBIT) is now its most profitable ETF for BlackRock, generating an estimated $244.5 million in annual revenue with nearly $100 billion in assets.

By James Van Straten|Edited by Oliver Knight

Updated Oct 7, 2025, 9:06 a.m. Published Oct 7, 2025, 9:06 a.m.

- U.S. spot bitcoin ETFs recorded $1.2 billion in net inflows on Monday, led by IBIT with $970 million.

- Historically, similar $1 billion inflow surges have aligned with short-term bitcoin price peaks.

- IBIT has grown to almost $100 billion in assets under management, generating roughly $244.5 million in annual revenue for BlackRock.

The U.S. bitcoin exchange-traded funds (ETFs) recorded a $1.2 billion net inflow on Monday, marking the seventh occasion that inflows have exceeded $1 billion, according to Farside data. The majority of these inflows came from BlackRock’s iShares Bitcoin Trust (IBIT), which attracted $970 million.

Historically, when inflows reach around $1 billion, it has often coincided with a short-term top in bitcoin’s price.

STORY CONTINUES BELOW

The first instance occurred on March 12, 2024, when bitcoin peaked at around $74,000 two days later on March 14. The next two instances were in November 2024, when bitcoin surged above $100,000, with large inflows appearing just before the rally concluded in December. On Jan. 17, another $1 billion inflow preceded a local top near $109,000 on Jan. 20. Similarly, on July 10 and 11, consecutive $1 billion inflows were followed by a short-term peak of $123,000 on July 14.

On Monday, bitcoin climbed above $126,000, so it remains to be seen whether a new high will form in the coming days, with bitcoin around $124,000.

Meanwhile, Senior Bloomberg ETF Analyst Eric Balchunas noted that IBIT is now BlackRock’s most profitable ETF, with assets under management just shy of $100 billion, generating an estimated $244.5 million in annual revenue. The next closest fund by revenue is the iShares Russell 1000 Growth ETF. Balchunas also highlighted that IBIT is approaching $100 billion in AUM in just 435 days, whereas the next-fastest ETF to reach that milestone, the Vanguard S&P 500 ETF (VOO), took 2,011 days.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Francisco Rodrigues|Edited by Oliver Knight

21 minutes ago

The BNB Chain reported a record 58 million monthly active addresses, overtaking Solana, with growth driven by the decentralized exchange Aster.

What to know:

- BNB surged over 5% to a new all-time high above $1,280, driven by signs of increased institutional demand and surging activity on the BNB Chain.

- The BNB Chain reported a record 58 million monthly active addresses, overtaking Solana, with growth driven by the decentralized exchange Aster, which saw its total value locked jump over 500% to $2.4 billion.

- The price move coincides with a partnership between BNB Chain and Chainlink to bring official US economic data on-chain, and builds on broader optimism across crypto markets, with BNB outperforming the wider market.