BTC

$107,667.21

+

1.05%

ETH

$2,450.44

+

0.03%

USDT

$1.0002

–

0.02%

XRP

$2.1844

–

0.93%

BNB

$657.26

+

0.73%

SOL

$148.90

–

0.03%

USDC

$0.9999

–

0.02%

TRX

$0.2817

+

1.10%

DOGE

$0.1616

+

0.56%

ADA

$0.5619

+

0.28%

HYPE

$38.56

–

1.49%

BCH

$503.13

–

3.52%

SUI

$2.7532

+

1.41%

WBT

$43.54

–

1.87%

LINK

$13.14

+

0.00%

LEO

$8.9303

–

0.68%

AVAX

$17.62

+

0.88%

XLM

$0.2311

–

2.67%

TON

$2.8234

–

0.16%

SHIB

$0.0₄1138

+

1.06%

By Omkar Godbole|Edited by Sheldon Reback

Updated Jul 2, 2025, 9:54 a.m. Published Jul 2, 2025, 9:22 a.m.

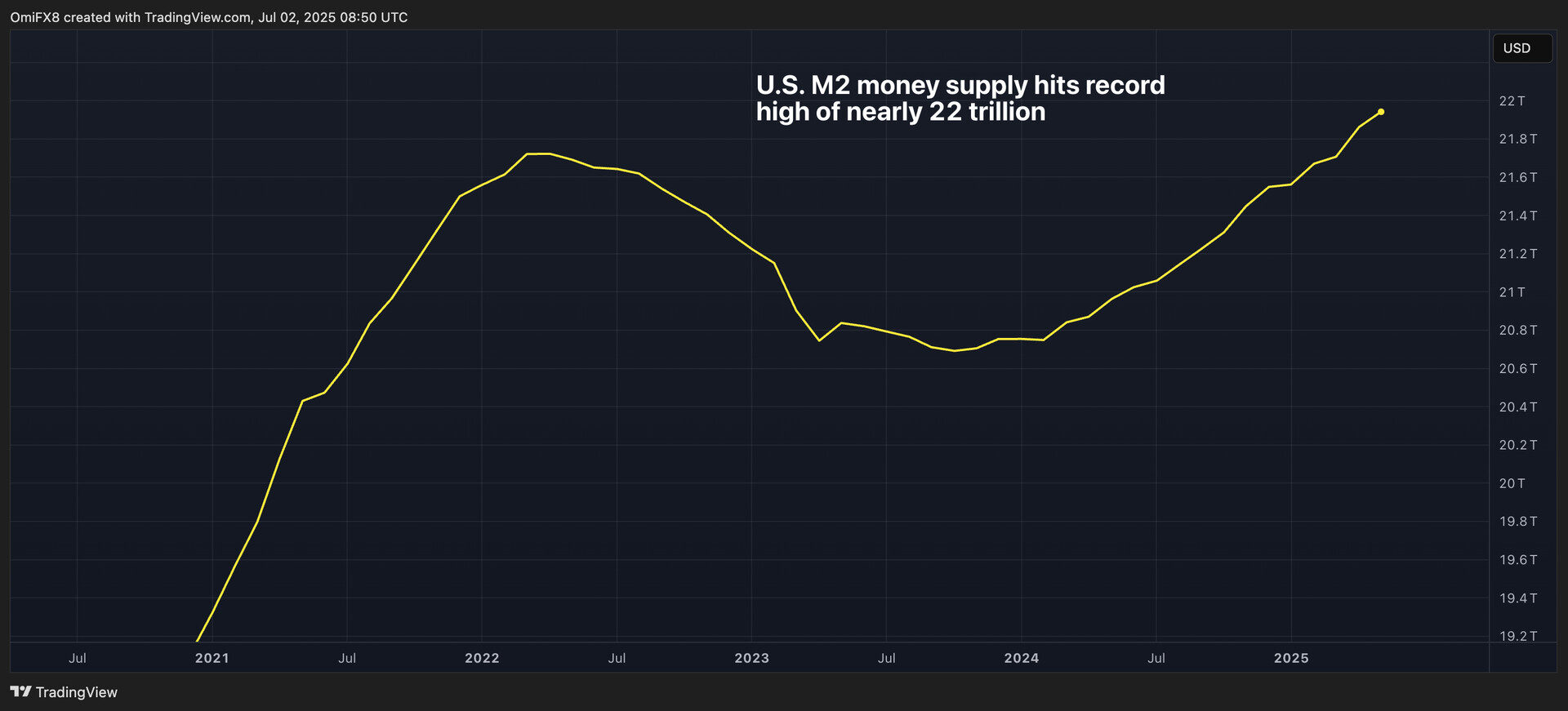

- The U.S. M2 money supply reached a record $21.94 trillion in May, surpassing the previous high from March 2022.

- The M2 growth rate year-on-year is at 4.5%, the highest in nearly three years.

- Rising M2 tends to have a lagged effect on inflation, according to St. Louis Federal Reserve.

A comprehensive measure of money circulation in the U.S. has risen to new highs, a signal of economic growth that posts contradictory messages for the path of bitcoin

.

The M2 money supply, which includes hard currency and bank and money market mutual fund deposits that are relatively liquid, rose to a record $21.94 trillion at the end of May, topping the previous peak of $21.72 trillion in March 2022, according to data source barchart.com. Year-on-year growth rate matched April’s 4.5%, which is also the highest in nearly three years, according to data source Yahoo Finance.

STORY CONTINUES BELOW

For cryptocurrencies, the message is muddled. Typically, a growing money supply is taken as a signal of looser financial conditions and a growing economy that promotes greater investor exposure to riskier assets.

On the other hand, money supply growth can lead to inflation if it outpaces the economy, according to Cyprus-based TIOmarkets. Inflation concerns could reduce investor risk-taking and pressure the Federal Reserve to raise interest rates.

In recent years, a rising M2 has had a lagged impact on the Fed’s preferred inflation measure, the personal consumption expenditures (PCE) inflation. The PCE began rising in February 2021, a year after M2 growth began soaring in February 2020 and followed the M2 growth lower in 2023, St. Louis Federal Reserve noted in a blog post.

If history is a guide, the ongoing uptick in the M2 growth rate could contribute to inflation in the coming months, making it more challenging for the Federal Reserve to cut rates to as low as 1%, as recently called for by President Donald Trump.

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team based in Mumbai, holds a masters degree in Finance and a Chartered Market Technician (CMT) member. Omkar previously worked at FXStreet, writing research on currency markets and as fundamental analyst at currency and commodities desk at Mumbai-based brokerage houses. Omkar holds small amounts of bitcoin, ether, BitTorrent, tron and dot.