BTC

$104,433.26

+

0.50%

ETH

$2,486.06

–

0.29%

USDT

$1.0003

–

0.00%

XRP

$2.1537

+

0.52%

BNB

$652.30

+

0.51%

SOL

$154.10

+

1.66%

USDC

$0.9998

+

0.00%

DOGE

$0.1903

+

0.95%

TRX

$0.2687

+

0.42%

ADA

$0.6675

+

0.95%

SUI

$3.2678

+

1.16%

HYPE

$32.64

+

2.87%

LINK

$13.71

–

0.39%

AVAX

$20.34

–

0.36%

XLM

$0.2646

+

0.30%

BCH

$403.30

+

1.27%

LEO

$8.4007

–

3.31%

TON

$3.1073

–

0.09%

SHIB

$0.0₄1271

–

0.06%

HBAR

$0.1679

+

1.39%

By AI Boost, Siamak Masnavi|Edited by Aoyon Ashraf

Jun 2, 2025, 10:14 a.m.

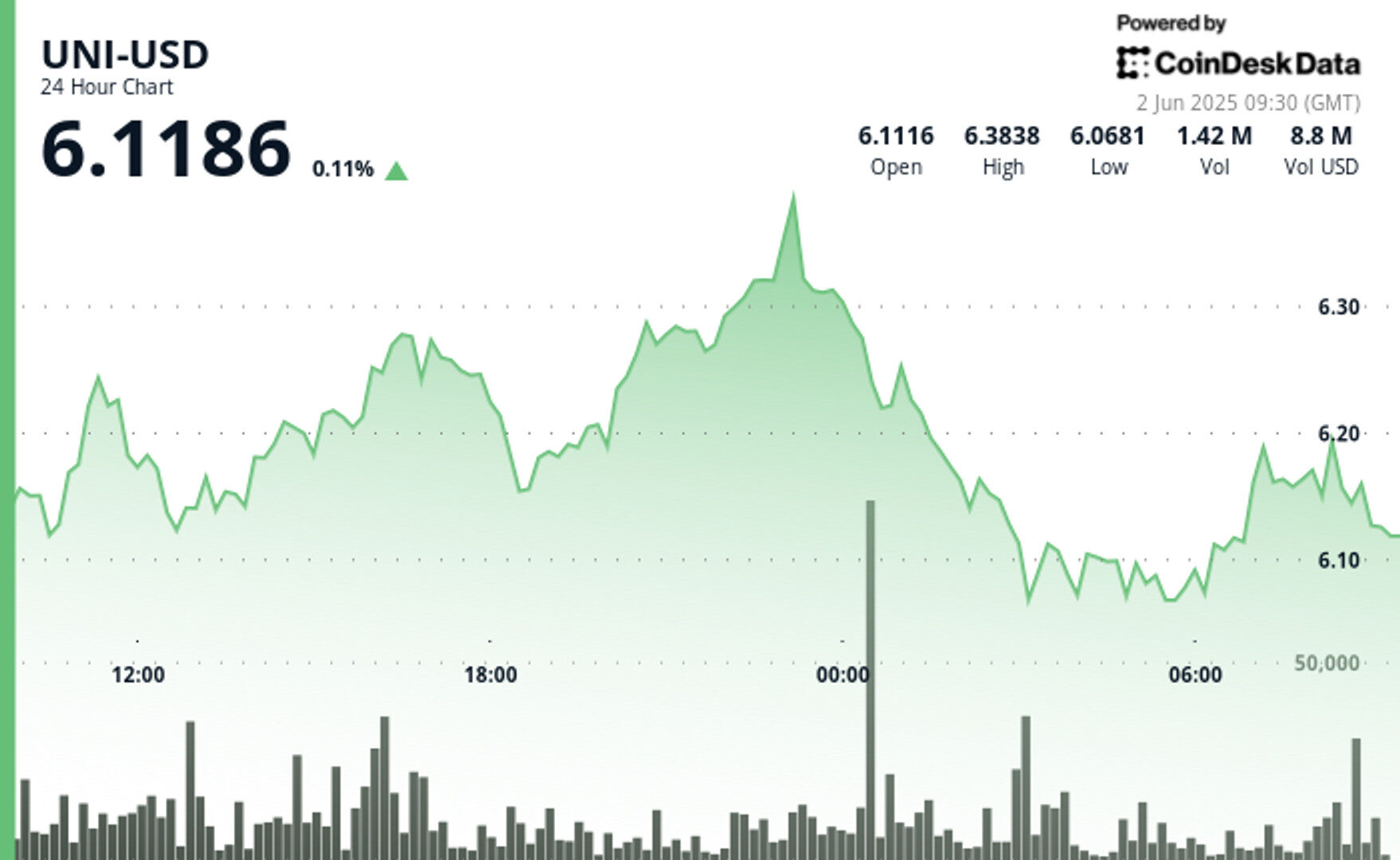

- UNI fell sharply to $6.045 before recovering to trade above $6.11 as risk sentiment stabilized.

- Sellers dominated near $6.38 resistance during peak volume hours.

- Broader macro headwinds still weigh on crypto markets despite the intraday rebound.

The cryptocurrency market continues to feel the effects of global economic tensions, with investor sentiment swaying under the weight of rising geopolitical risks and trade uncertainty.

Uniswap’s UNI token saw a sharp intraday swing between $6.045 and $6.385 before stabilizing above $6.11, signaling cautious buyer support, according to CoinDesk Research’s technical analysis data model.

STORY CONTINUES BELOW

Although UNI briefly rebounded after early losses, analysts warn that macroeconomic headwinds — including tariff escalations and delayed monetary easing — may cap near-term gains even as key technical levels hold for now.

Technical Analysis Highlights

- UNI experienced significant volatility over 24 hours, with prices peaking at $6.385 before declining sharply to a low of $6.045, representing a 5.33% range.

- A notable resistance zone formed around $6.30–6.38, with high-volume selling emerging at these levels, particularly during the 23:00 hour.

- Support was established at the $6.05–6.08 range, where buyers stepped in during early hours of June 2.

- A declining volume profile and failure to reclaim earlier highs suggest bearish momentum may continue in the short term.

- In the final hour of the analysis window, UNI showed a recovery pattern, climbing from $6.146 to $6.176 for a 0.48% gain.

- Strong support held at $6.148–6.152 during a brief sell-off at 07:35, reinforcing that zone as a key short-term floor.

- Volume analysis shows renewed buying interest during the 08:00 candle, where price surged to $6.176 on above-average volume.

- UNI is currently hovering near the $6.12–$6.18 resistance band; a clear breakout above this level remains key for confirming any potential bullish reversal.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.