BTC

$105,315.59

+

0.63%

ETH

$2,615.74

+

5.27%

USDT

$1.0004

+

0.01%

XRP

$2.2011

+

1.91%

BNB

$667.86

+

2.13%

SOL

$159.90

+

3.97%

USDC

$0.9997

+

0.00%

DOGE

$0.1951

+

2.64%

TRX

$0.2704

+

0.49%

ADA

$0.6961

+

3.92%

HYPE

$36.75

+

12.26%

SUI

$3.3172

+

1.34%

LINK

$14.10

+

2.62%

AVAX

$21.29

+

4.40%

XLM

$0.2717

+

2.68%

BCH

$402.75

–

0.21%

TON

$3.2249

+

3.29%

LEO

$8.5956

+

1.73%

SHIB

$0.0₄1319

+

3.81%

HBAR

$0.1727

+

2.15%

Par AI Boost, Siamak Masnavi|Édité par Aoyon Ashraf

3 juin 2025, 9:40 a.m. Traduit par IA

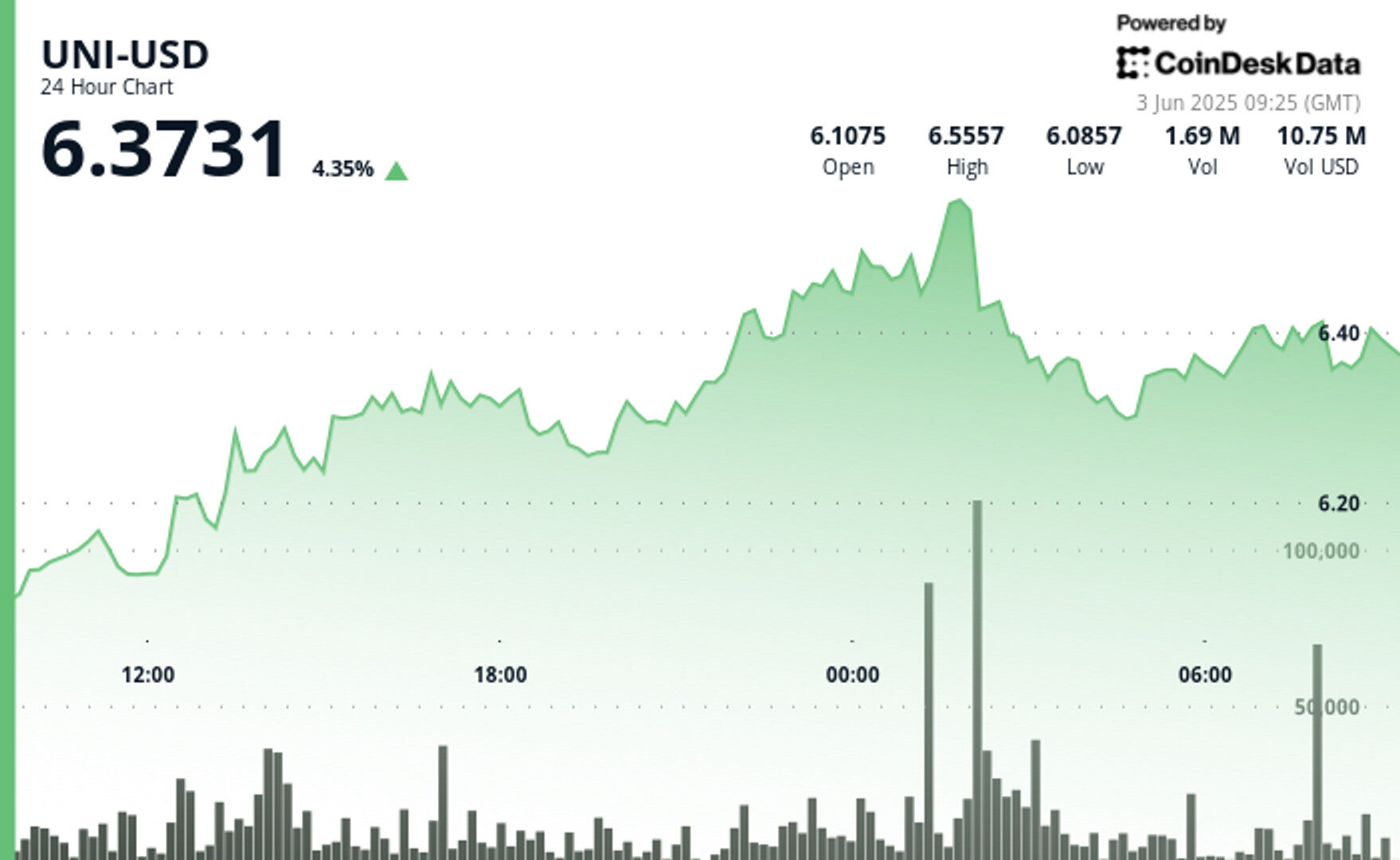

- UNI surged 5.09% in 24 hours, breaking above $6.37 while forming key support around $6.30 amid global macroeconomic headwinds, according to CoinDesk Research’s technical analysis data model.

- Price action was driven by bullish momentum, peaking at $6.5557 before a sharp pullback.

- Heavy volume at key levels confirms buyer conviction, while repeated tests near $6.41 suggest consolidation above critical resistance.

Uniswap’s native token UNI extended its recent recovery rally, brushing off macroeconomic pressure as investors looked past heightened global trade tensions.

The token climbed steadily from $6.09 to $6.40, establishing key support above the $6.30 level.

La storia continua sotto

Market volatility remains elevated, fueled by geopolitical risk and speculation surrounding rate cuts in Europe and the U.S.

Still, UNI appears to be benefiting from risk rotation as traders seek upside in altcoins, with price holding firm despite choppy conditions.

A sharp spike in volume during the early hours of the session, particularly at $6.5557, marked a potential short-term top.

However, subsequent pullbacks were met with aggressive buying, reinforcing a bullish bias and keeping UNI on track for further gains — provided it can sustain price action above the $6.30-$6.33 zone.

Technical Price Highlights

- UNI exhibited strong bullish momentum over 24 hours, climbing from 6.09 to 6.40, representing a 5.09% gain despite significant price swings.

- The token established a clear uptrend with higher lows until encountering resistance at 6.57, followed by a sharp rejection with abnormally high volume (3.89M) at 02:00, creating a high-volume resistance zone.

- Support has formed around the 6.30-6.33 range where buyers consistently stepped in, while the overall range of 0.49 (8.07% of starting price) demonstrates substantial volatility.

- In the last hour, UNI experienced significant volatility with a notable recovery pattern, dropping to 6.36 before establishing higher lows and highs.

- Volume spiked dramatically to 56,320 at 07:59, confirming buyer conviction at these levels.

- Price action formed a clear support zone around 6.38-6.39, while resistance near 6.41 was tested multiple times.

- Consolidation above 6.40 suggests potential continuation of the broader bullish momentum.

Disclaimer: alcune parti di questo articolo sono state generate con l’ausilio di strumenti di IA e sono state riviste dal nostro team editoriale per garantire l’accuratezza e l’aderenza ai ostri standard. Per ulteriori informazioni, vedere La politica completa sull’intelligenza artificiale di CoinDesk.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

Siamak Masnavi is a researcher specializing in blockchain technology, cryptocurrency regulations, and macroeconomic trends shaping the crypto market. He holds a PhD in computer science from the University of London and began his career in software development, including four years in the banking industry in the City of London and Zurich. In April 2018, Siamak transitioned to writing about cryptocurrency news, focusing on journalism until January 2025, when he shifted exclusively to research on the aforementioned topics.