-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Jamie Crawley, AI Boost|Edited by Stephen Alpher

Updated Aug 14, 2025, 1:37 p.m. Published Aug 14, 2025, 1:00 p.m.

- Led by Framework Ventures with participation from Dragonfly, Arbitrum and others.

- USD.AI targets smaller AI companies shut out of traditional financing channels.

- With $50 million already in deposits during private beta, USD.AI plans a public launch featuring an ICO and a game-based allocation model.

Stablecoin protocol USD.AI, which provides credit to artificial intelligence (AI) companies, has raised $13 million in Series A funding led by Framework Ventures.

USD.AI, developed by Permian Labs, issues loans to emerging AI firms using graphics processing unit (GPU) hardware as collateral, cutting approval times by more than 90% compared with traditional lenders. The on-chain system includes USDai, a dollar-pegged token, and sUSDai, a yield-bearing version backed by income-generating compute assets.

STORY CONTINUES BELOW

GPUs are fundamental hardware to AI processes through performing the many calculations at once required to make the process of training and using AI models much faster.

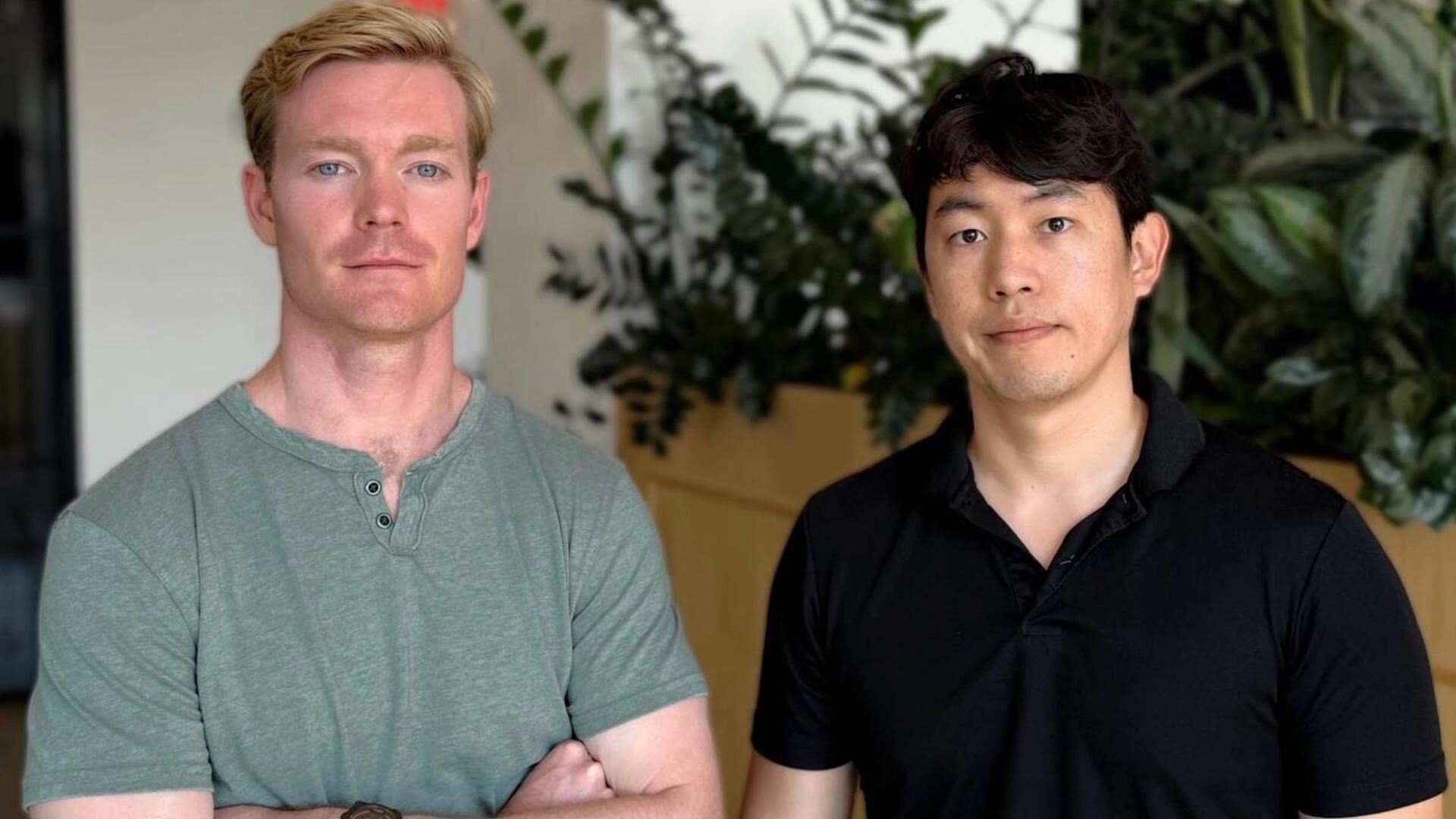

CEO David Choi said USD.AI’s model “treats GPUs like commodities,” enabling fast, programmatic loan approvals without conventional gatekeeping, in an announcement shared with CoinDesk on Thursday.

Framework’s Vance Spencer likened AI’s capital demands to the “oil boom” and said USD.AI could democratize access to funding while offering investors yield tied to AI sector growth.

With $50 million already in deposits during private beta, USD.AI plans a public launch featuring an ICO and a game-based allocation model.

USD.AI may represent the potential of a convergence between stablecoins, which have been at the forefront of the regulatory advancements in digital assets, and AI which has rapidly ascended to mainstream adoption in recent years.

Together, the two could create a more intelligent and efficient financial system. This synergy allows AI agents to transact autonomously and reliably using a stable currency, enhancing financial automation, security, and risk management across various applications from payments to decentralized finance.

CORRECTION (Aug. 14, 13:20 UTC): Removes Bullish from list of participants in What to Know section.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Jamie has been part of CoinDesk’s news team since February 2021, focusing on breaking news, Bitcoin tech and protocols and crypto VC. He holds BTC, ETH and DOGE.

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

More For You

By Will Canny, AI Boost|Edited by Aoyon Ashraf

48 minutes ago

Gemini users can now access Web3 and DeFi ecosystems with social recovery, gas sponsorship, and integrated trading support.

What to know:

- Crypto exchange Gemini has launched a self-custody smart wallet.

- The wallet eliminates common user hurdles by removing the need for seed phrases or app downloads, offering gas-free transactions and free ENS subdomains.

- Exchange integration is on the roadmap, allowing users to trade directly from their Gemini accounts without moving funds manually.