-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 21, 2025, 6:01 a.m. Published Aug 21, 2025, 6:00 a.m.

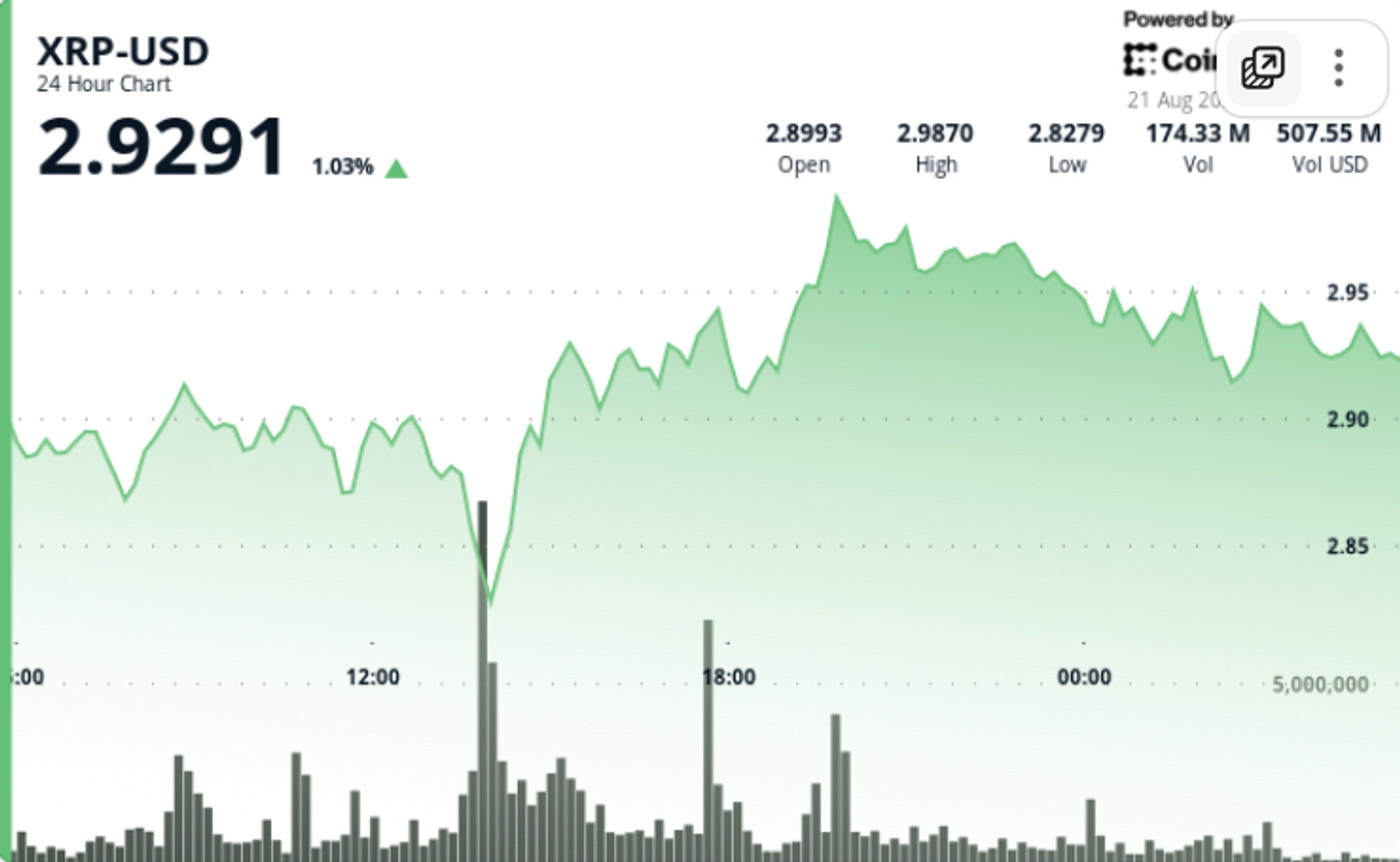

- XRP rebounded 6% to $2.93 after a volatile session marked by heavy trading volume and strategic support buying.

- The cryptocurrency faced selling pressure due to a blockchain security downgrade and broader market liquidations.

- Traders are watching if XRP can break and hold above $2.99, with $3.17 as the next potential breakout target.

XRP swung nearly 6% in a volatile 24-hour session, rebounding from steep losses at $2.82 to settle at $2.93. The move was fueled by a surge in volume and aggressive support buying, even as whales offloaded and broader markets absorbed $360 million in liquidations.

- XRP has faced selling pressure amid a blockchain security downgrade that raised concerns about potential vulnerabilities.

- Whale cohorts have been active on both sides — some accelerating sales into rallies while others defended critical support levels.

- Broader crypto markets saw $360 million in liquidations as institutions rotated out of risk assets, weighing on sentiment across majors and memecoins.

- Technical analysts continue to point to $3.17 as the breakout zone that could unlock a sharp rally toward $5.00+, though bearish camps warn of a slide to $2.65 if supports break.

- XRP swung 5.69% between Aug. 20–21, carving a $0.17 range from $2.82 to $2.99.

- The token collapsed to session lows during the 13:00–15:00 UTC window before staging a sharp counterattack back to $2.93.

- Volume spiked to 155 million during the 14:00 recovery hour — nearly triple the 63 million daily average.

- Bears defended $2.99 resistance aggressively, but bulls anchored bids at $2.82, forcing a late-session rally.

- XRP closed the session at $2.93, momentum tilted toward bulls on strong volume confirmation.

- Support Zone: Buyers defended $2.82 with high conviction, validating the floor on elevated flows.

- Resistance Wall: Sellers capped moves at $2.99, setting a clear ceiling.

- Volume Surge: 155 million turnover during recovery — 2.5x daily average — marks institutional-sized buying.

- Intraday Pattern: V-shaped reversal from $2.82 to $2.93, signaling accumulation interest.

- Morning Session: XRP extended gains by 0.34%, climbing to $2.94 with hourly volumes of 580,000 vs a 470,000 norm.

- Momentum Outlook: Sustained bid flows at $2.92–$2.93 suggest breakout pressure is building.

- Whether XRP can crack and hold above $2.99, unlocking $3.17 as the next breakout target.

- Continued whale positioning trends — especially signs of distribution vs. accumulation around $3.00.

- Broader market spillover, with liquidations and institutional risk appetite dictating near-term flows.

- If $2.82 holds on further tests, setting a durable floor ahead of possible upside extension.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By CD Analytics, Omkar Godbole

10 minutes ago

SHIB’s price range saw a 5% spread, with trading volume surging past 1 trillion tokens.

What to know:

- Shiba Inu (SHIB) rose over 2% in the last 24 hours, maintaining key support levels amid strong trading volumes.

- The cryptocurrency faced early declines due to market de-risking but rebounded above critical levels, including the 61.8% Fibonacci retracement.

- SHIB’s price range saw a 5% spread, with trading volume surging past 1 trillion tokens.