-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 21, 2025, 5:45 a.m. Published Aug 21, 2025, 5:45 a.m.

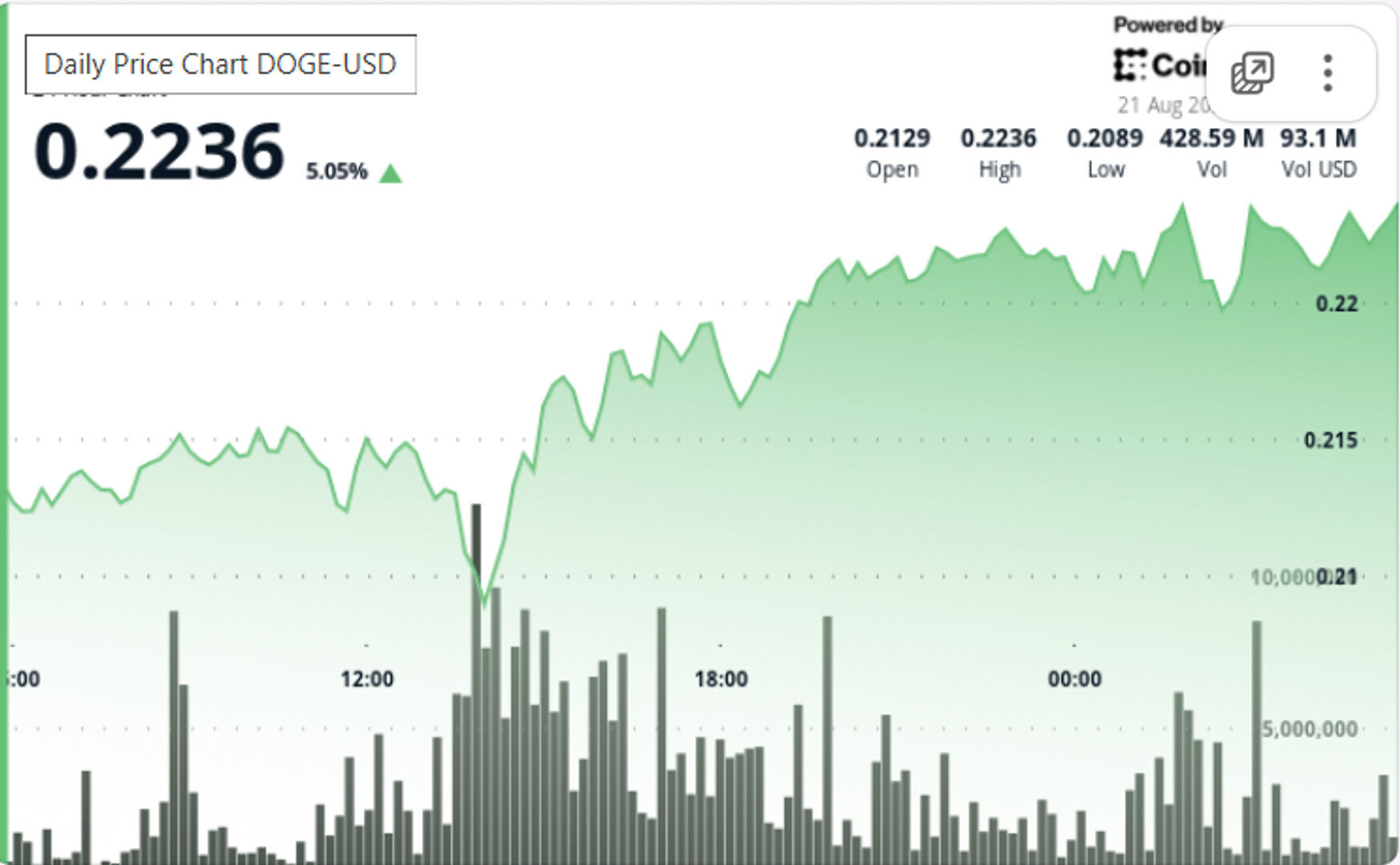

- Dogecoin rebounded to $0.22 after a late-session surge in volume, despite ongoing security concerns from Qubic’s attack threat.

- Whale investors accumulated over 680 million DOGE in August, countering retail selling pressures.

- Traders are watching if $0.22 can become support, potentially leading to further gains.

Dogecoin rebounded sharply from $0.21 lows, closing at $0.22 after a late-session surge in volume and aggressive whale accumulation, even as security risks from Qubic’s attack threat linger.

- DOGE has faced pressure this month after reports tied to Qubic’s potential 51% attack spooked retail traders and drove selling.

- Despite those risks, on-chain data shows whale cohorts accumulated more than 680 million DOGE in August, offsetting retail outflows.

- Broader market sentiment has been mixed, with Bitcoin and Ethereum consolidating near highs, leaving memecoins trading with outsized volatility.

- DOGE advanced 5% in the 24 hours ending Aug. 21, 04:00, recovering from an intraday bottom of $0.21 to close at $0.22.

- The token hit its session low around 13:00 UTC on Aug. 20 before reversing course in a V-shaped recovery.

- Trading volume spiked to 9.29 million in the final hour, adding 0.45% in the last stretch and confirming institutional-sized flows.

- Whales accumulated 680 million DOGE through August, positioning despite ongoing concerns around Qubic’s potential 51% attack.

- Key support held at $0.21, tested at mid-session before high-volume reversal.

- Resistance emerged at $0.22, setting a $0.01 trading range for the session.

- A breakout was triggered at 04:31 UTC with the 9.29 million volume spike marking the session pivot.

- Sustained turnover at 6.8 million per minute during the final hour points to larger buyers driving momentum.

- Whether $0.22 can flip from resistance into support, opening path toward $0.23–$0.24.

- Continued whale positioning trends against the backdrop of Qubic security concerns.

- Strength of follow-through buying after the late-session volume burst, which will confirm if the V-shaped recovery has legs.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By CD Analytics, Omkar Godbole

10 minutes ago

SHIB’s price range saw a 5% spread, with trading volume surging past 1 trillion tokens.

What to know:

- Shiba Inu (SHIB) rose over 2% in the last 24 hours, maintaining key support levels amid strong trading volumes.

- The cryptocurrency faced early declines due to market de-risking but rebounded above critical levels, including the 61.8% Fibonacci retracement.

- SHIB’s price range saw a 5% spread, with trading volume surging past 1 trillion tokens.