Institutional activity declined significantly, and the market remains pressured by Bitcoin’s weak structure and ETF outflows.

By Shaurya Malwa, CD Analytics

Updated Nov 20, 2025, 4:12 p.m. Published Nov 20, 2025, 4:12 p.m.

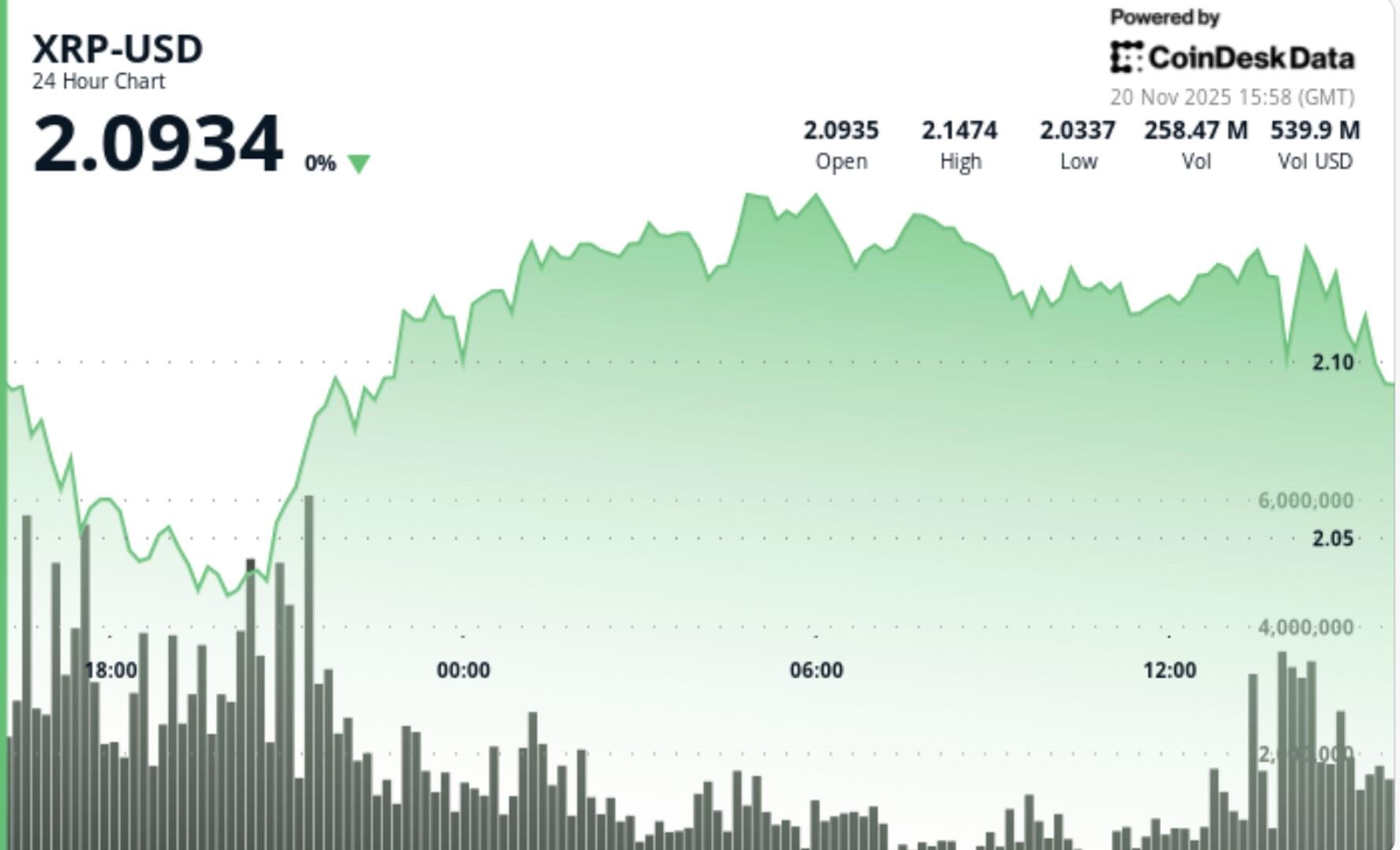

- XRP fell below the critical $2.10 support level as traders exited positions amid fears of a deeper correction.

- The token experienced a sharp rebound from $2.03 with a 28% volume surge, but failed to sustain momentum above $2.14.

- Institutional activity declined significantly, and the market remains pressured by Bitcoin’s weak structure and ETF outflows.

The token pierced the critical $2.10 floor during late-session selling as traders dumped positions ahead of a potential deeper correction.

• XRP traded within a volatile $2.03–$2.15 range as broader crypto markets weakened under macro pressure

• The token’s sharp bounce from $2.03 occurred amid a 28% volume surge, signaling active dip-buying before momentum faded

• Multiple failed attempts to reclaim the $2.14–$2.15 zone capped upside throughout the session

• Market sentiment remains fragile as Bitcoin’s death-cross and heavy ETF outflows weigh on altcoins

• Institutional activity slowed sharply in final trading hour as XRP cracked the widely-watched $2.10 support level

STORY CONTINUES BELOW

XRP slid 1.0% from $2.13 to $2.11 over the latest 24-hour session, navigating a choppy $2.03–$2.15 range. The token initially showed resilience against broader market weakness, but bullish momentum deteriorated steadily.

The most significant move came at 21:00 UTC when a 177.9M volume spike—28% above the 24-hour average—helped XRP rebound sharply from $2.03. However, the recovery stalled repeatedly at the $2.14–$2.15 resistance band. A pattern of lower highs developed as sellers absorbed each attempted breakout.

The session ended with a decisive breakdown: XRP plunged from $2.124 to $2.103 as heavy sell volume hit the tape. The drop punched cleanly through the critical $2.10 support, a level that had held for several sessions.

Late-session liquidity collapsed, signaling institutional traders stepped to the sidelines ahead of potential continuation selling.

XRP’s chart structure shifted firmly bearish as breakdown signals stacked across intraday timeframes.

The loss of $2.10 turned prior support into immediate resistance. Meanwhile, the market now orients around the cycle low at $2.03, which formed during the heavy-volume rejection earlier in the session. The inability to reclaim $2.14–$2.15 keeps the near-term ceiling well-defined and the risk skewed to the downside.

The 177.9M surge during the $2.03 rebound confirmed strong participation, but the lack of follow-through volume during recovery attempts signaled exhaustion. The final-hour breakdown occurred on 4.4M units in a single interval—enough to trigger algorithmic momentum selling.

XRP now prints a clear sequence of lower highs and lower lows, consistent with early-stage continuation structures that often precede retests of major swing supports. The broader trend remains pressured by an unresolved medium-term downslope that began after repeated failures above $2.48.

Short-term oscillators approach oversold readings, suggesting potential stabilization if $2.03 holds. But without reclaiming $2.15, any bounce risks becoming reactive rather than structural.

XRP sits at an unstable inflection point:

• $2.03 must hold to prevent a deeper breakdown toward $1.91–$1.73 next-tier support

• A reclaim of $2.15 is required to neutralize the bearish continuation structure

• Liquidity conditions suggest institutions paused activity after the $2.10 failure—renewed volume will dictate the next impulse

• Bitcoin’s weak structure and death-cross dynamic continue to pressure altcoins disproportionately

• Watch for volatility clusters around derivatives liquidation points—XRP saw ~$28M liquidated in prior sessions, and fresh forced selling could accelerate moves

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Olivier Acuna|Edited by Sheldon Reback

41 minutes ago

Spot SOL exchange-traded funds extended an inflow streak since they began trading on Oct. 28 while bitcoin and ether ETFs bled hundreds of millions of dollars.

What to know:

- U.S. spot solana ETFs have experienced inflows for the 17 consecutive days since their debut last month.

- The ETFs have amassed a total net inflow of $476 million, with a notable single-day inflow of $48.5 million on Wednesday.

- Unlike solana, spot bitcoin and ether ETFs have faced significant outflows, highlighting a shift in investor interest.