-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Jesse Hamilton|Edited by Cheyenne Ligon

Aug 22, 2025, 2:27 p.m.

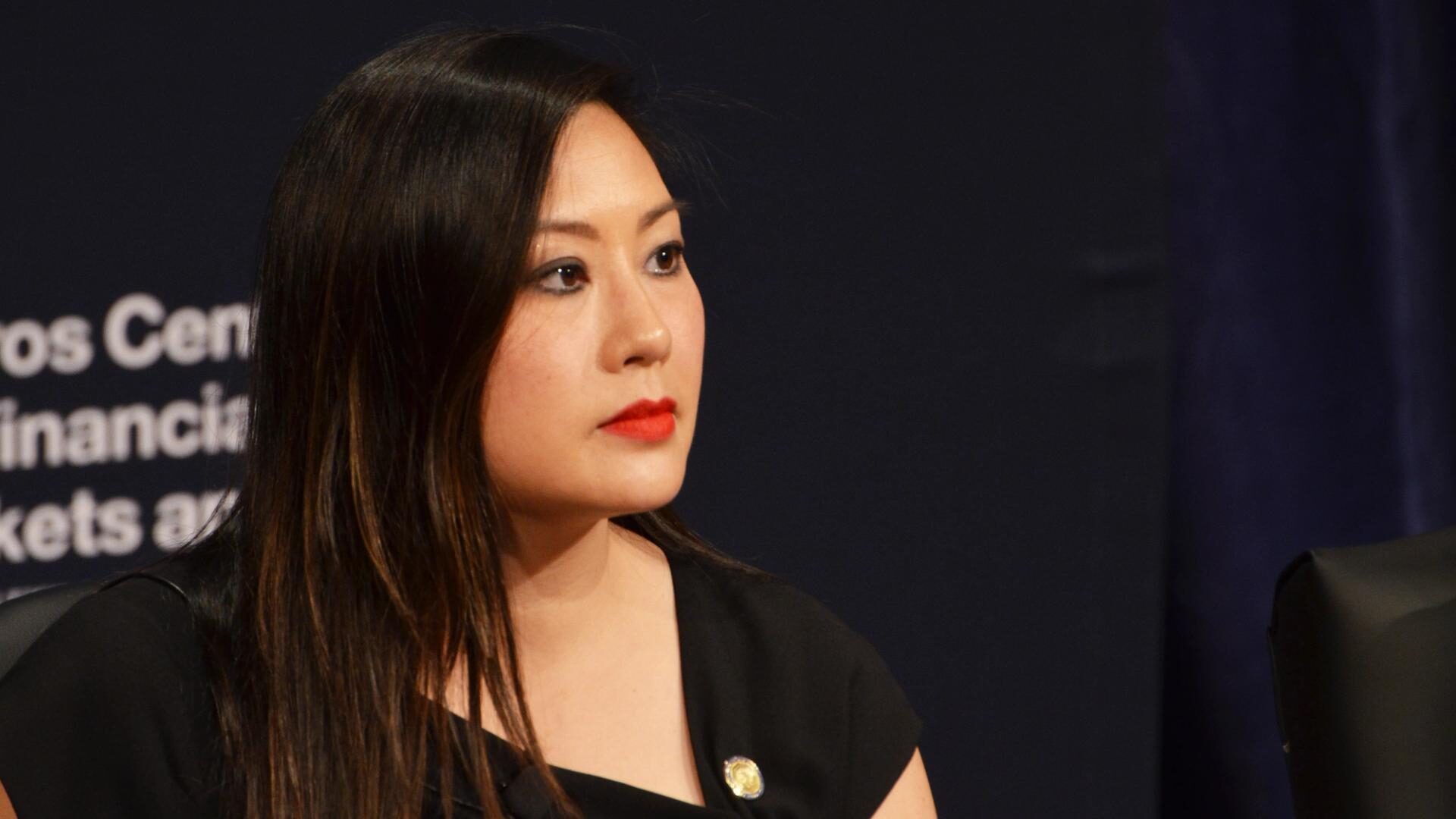

- As the Commodity Futures Trading Commission continues into an uncertain future over its leadership vacuum, Acting Chair Caroline Pham is pushing forward with a comment period to meet the Trump administration’s crypto recommendations.

- The White House has delayed the confirmation of Trump’s nominee, Brian Quintenz, to take the agency’s chairmanship, though most of the crypto industry has urged the president to hurry his approval.

With the chairmanship still an open question for the Commodity Futures Trading Commission — likely to be a leading U.S. watchdog for crypto — its interim leader, Caroline Pham, is getting started on recommendations from the recent crypto report of the President’s Working Group.

STORY CONTINUES BELOW

The CFTC, which regulates U.S. derivatives trading and would assume oversight of the bulk of U.S. crypto trading under Congress’ market structure legislation, was at the center of key recommendations in the Trump administration report. So Pham, who President Donald Trump named acting chairman earlier this year, directed the agency to start taking industry input on meeting what’s become “a top priority” of the White House.

“I am beginning stakeholder engagement on all other report recommendations for the CFTC with the full support of the President’s Working Group on Digital Asset Markets to operationalize President Trump’s promise to win on crypto,” Pham said in a statement. The agency is formally requesting public comments on fulfilling the report’s recommendations, opening a two-month window for input.

The CFTC is facing potential leadership drama, with Pham having said she’s on her way out and the confirmation process to make former Commissioner Brian Quintenz the chairman deliberately delayed by the White House. Quintenz drew open criticism from Tyler Winklevoss, CEO of Gemini, who is among Trump’s inner circle of favored crypto executives, but the bulk of the industry’s lobbyists are asking the president to press for a quick approval of his nomination. For reasons it never detailed, the White House delayed what would have been a final committee vote to send Quintenz’s confirmation to the Senate floor, it’s reportedly still backing him.

After that stitch in his confirmation, the Senate went on its August break, further forestalling the resolution of the CFTC chairmanship, with Pham poised to leave and the only other sitting commissioner — Democrat Kristin Johnson — also planning to go. Even if Quintenz is quickly confirmed after the Senate’s summer recess, he may take over an otherwise empty five-member commission.

Meanwhile, Pham said the CFTC’s renewed crypto effort is meant to operate alongside “Project Crypto” recently announced by Paul Atkins, the Trump-appointed chairman of the Securities and Exchange Commission. This is a followup to the “crypto sprint” that Pham most recently promised on Aug. 1.

Read More: U.S. CFTC Considers Allowing Spot Crypto Trading on Registered Futures Exchanges

Jesse Hamilton is CoinDesk’s deputy managing editor on the Global Policy and Regulation team, based in Washington, D.C. Before joining CoinDesk in 2022, he worked for more than a decade covering Wall Street regulation at Bloomberg News and Businessweek, writing about the early whisperings among federal agencies trying to decide what to do about crypto. He’s won several national honors in his reporting career, including from his time as a war correspondent in Iraq and as a police reporter for newspapers. Jesse is a graduate of Western Washington University, where he studied journalism and history. He has no crypto holdings.

More For You

By Margaux Nijkerk, AI Boost|Edited by Sheldon Reback

4 hours ago

The GENIUS Act’s passage caught many in Europe off guard and sparked concerns dollar-backed stablecoins could tighten America’s grip on cross-border payments.

What to know:

- European policymakers are ramping up efforts to launch a digital euro, according to a report from the Financial Times, as the US’ new stablecoin law intensifies pressure on the bloc to keep up the pace in the fast-moving world of digital money.

- The move caught many in Europe off guard, according to people familiar with the talks, and has sparked concerns that dollar-backed stablecoins could tighten America’s grip on cross-border payments if the EU doesn’t accelerate its own plans.