Critical support breakdown at $0.38 triggers institutional selling amid broader crypto market stress.

By CD Analytics, Oliver Knight

Updated Oct 9, 2025, 4:30 p.m. Published Oct 9, 2025, 4:30 p.m.

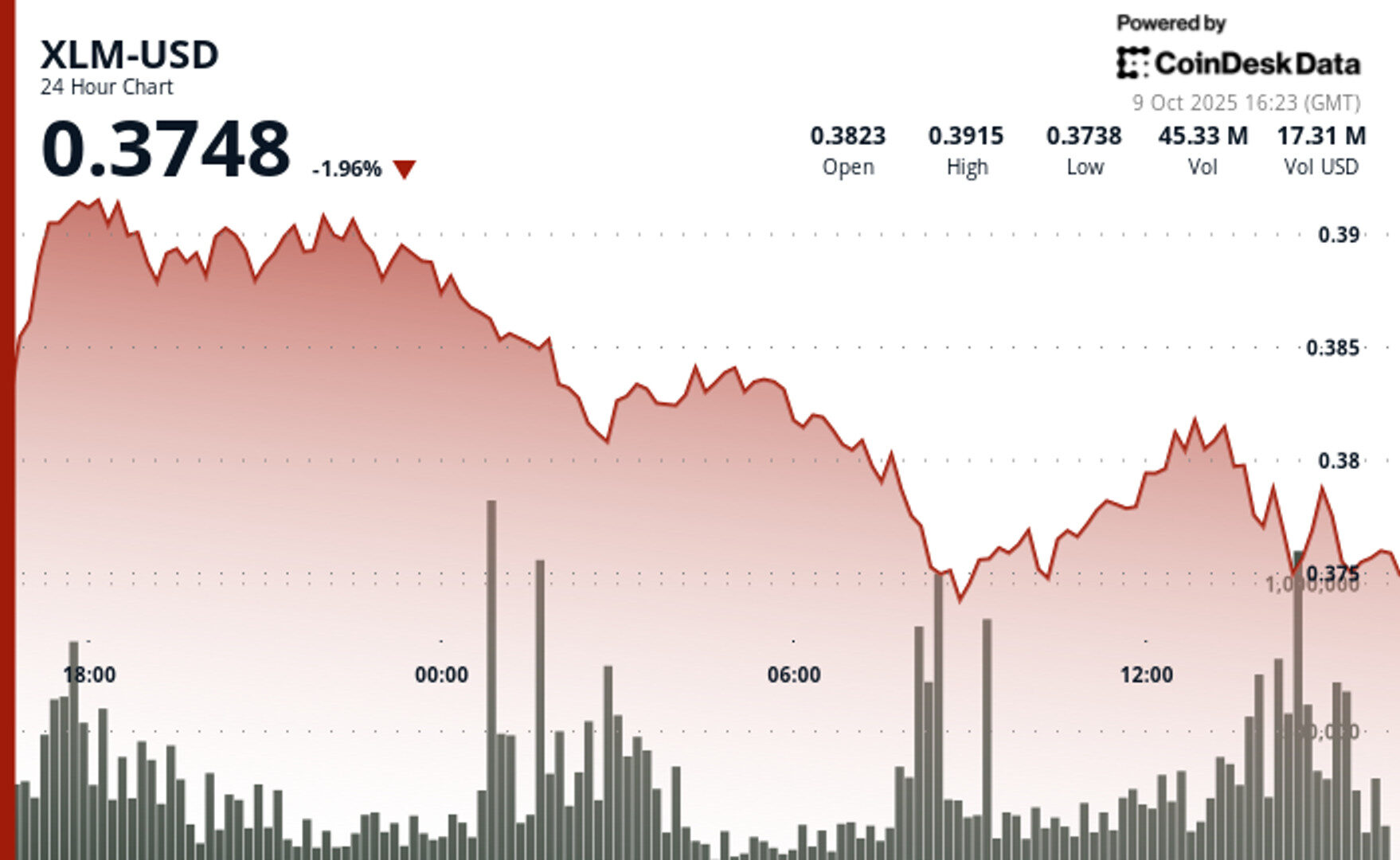

- XLM dropped 5% from $0.39 to $0.38 between October 8–9 as institutional selling accelerated.

- Support at $0.38 collapsed, with 35.51 million tokens traded — well above the daily average.

- Late-session volume spikes near 14:00 UTC pointed to coordinated institutional liquidation within a descending channel pattern.

Stellar’s XLM token extended its downturn over the past day, sliding 5% from $0.39 to $0.38 between October 8 at 15:00 and October 9 at 14:00. The selloff came amid heavy institutional activity, with volumes reaching 35.51 million — well above average levels — confirming strong distribution pressure.

The breakdown below the key $0.38 support level marked a clear shift in sentiment as trading intensified within a narrow $0.019 range. Market structure analysis showed a descending channel pattern forming, with repeated rejections near $0.38 suggesting sustained bearish control.

STORY CONTINUES BELOW

During the final hour of trading, from 13:13 to 14:12 on October 9, XLM shed another 1%, with significant volume spikes at 13:52 and 14:01 signaling coordinated institutional selling. Analysts said the move reflected continued liquidation across professional trading desks rather than short-term retail action.

- Critical support failure at $0.38 accompanied by institutional-grade volume of 35.51 million exceeding standard trading metrics

- Established downtrend pattern with successive lower highs indicating systematic institutional distribution

- Resistance zone established at $0.39 where institutional selling consistently emerged during recovery attempts

- Above-average volume participation during price reversals confirming coordinated institutional distribution strategies

- Technical chart pattern shows descending channel formation with lower highs at key resistance levels

- Failed recovery attempts near $0.38 consistently met with institutional supply indicating strong overhead resistance

- Volume concentration during decline phases with 1.34 million at 13:52 and 1.43 million at 14:01 confirming institutional participation

- Technical momentum indicators suggest continued downside pressure toward the $0.38 psychological support threshold

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Oliver Knight

1 hour ago

Institutional investors retreat amid regulatory gridlock, with trading volumes surging past 100 million as market participants reassess digital asset exposure.

What to know:

- HBAR drops nearly 5% between Oct. 8–9, falling from $0.22 to $0.21 amid heightened institutional caution and 5.4% volatility

- Heavy selling pressure hit during early Oct. 9, with volumes exceeding 100 million units and resistance at $0.22 versus support at $0.21

- Regulatory delays deepen uncertainty as the U.S. government shutdown stalls SEC ETF approvals, leaving corporate treasuries defensive