-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

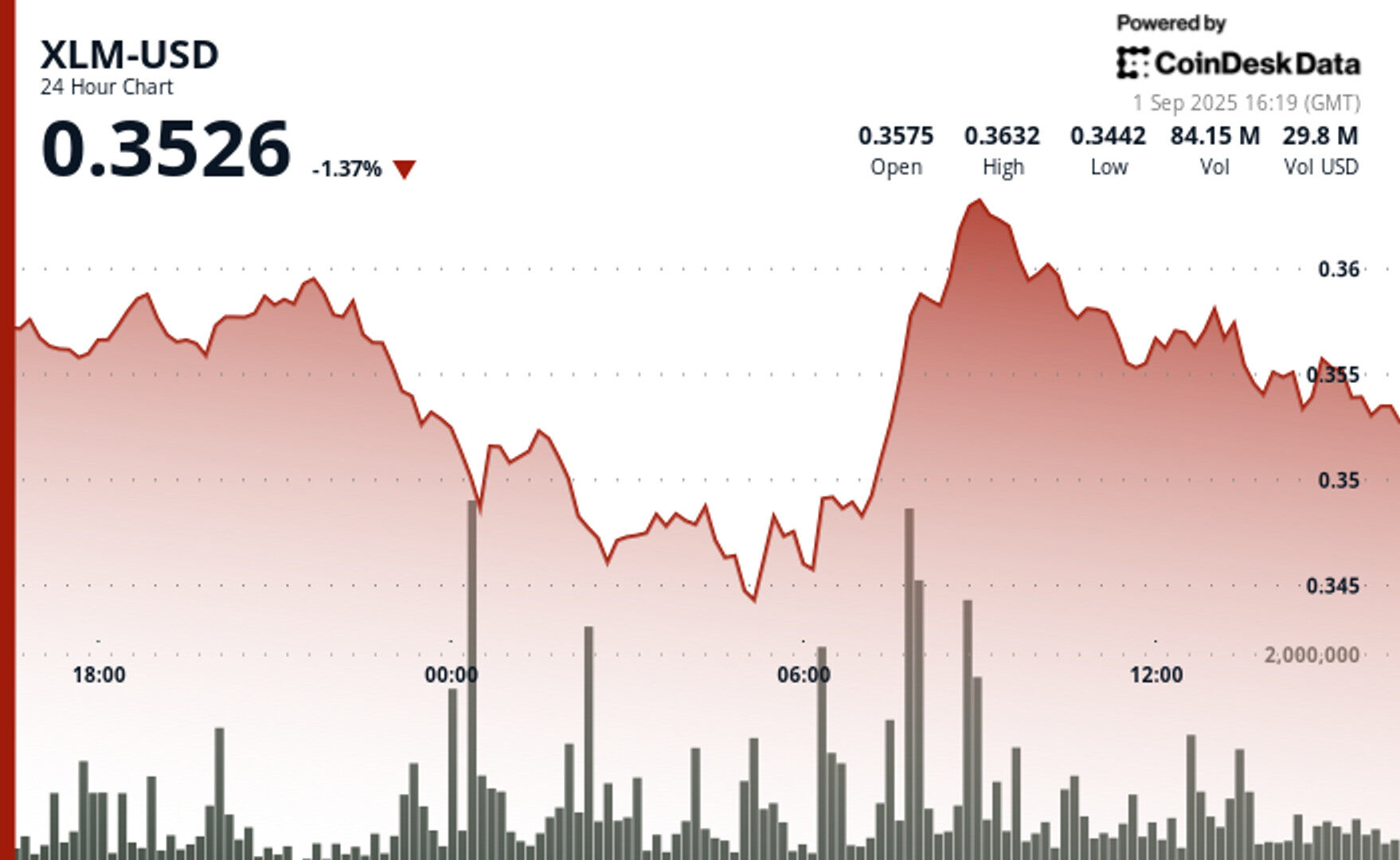

Network upgrades trigger exchange halts while African expansion fuels institutional buying amid volatile price action.

By CD Analytics, Oliver Knight

Updated Sep 1, 2025, 4:27 p.m. Published Sep 1, 2025, 4:27 p.m.

- XLM faced sharp volatility, trading between $0.34 and $0.36 in a 24-hour window, with heavy selloffs and volume spikes exceeding 70 million units.

- Bithumb will suspend deposits Sept. 3 as Stellar undergoes critical network upgrades, even as Ripple’s bank pilots boost sector confidence.

- Stellar is expanding in Africa, pushing mobile money integrations in Nigeria, Kenya and Ghana, with analysts still eyeing long-term targets of $0.62–$0.95 despite recent declines.

Stellar’s native token XLM endured heavy selling pressure over the past 24 hours, trading in a tight but punishing 5% range between $0.34 and $0.36. The session began with relative stability before a late-evening selloff knocked the token from its $0.36 peak to $0.34.

Trading volume surged past 57 million units at midnight as the market tested support around the $0.34–$0.35 zone. Buyers stepped back in early the next morning, briefly lifting XLM back to $0.36 on the back of what appeared to be institutional accumulation, with volumes swelling to 70 million units.

STORY CONTINUES BELOW

Despite the recovery, price action stalled around $0.36, creating a range-bound structure that technical traders say often precedes a directional breakout. The final hour of trading on Sept. 1 showed bearish momentum regaining control, with XLM slipping 1% as the consolidation pattern broke down.

Intraday data highlighted an acceleration of selling pressure between 13:45 and 13:46, when more than 1.28 million tokens changed hands at the day’s low. Attempts at recovery fizzled before the close, and a lack of activity in the final minute suggested trading had effectively ground to a halt.

The token’s fundamentals were also tested by exchange- and network-related developments. South Korea’s Bithumb announced it will suspend XLM deposits on Sept. 3 while Stellar implements network upgrades, a temporary disruption that underscores the blockchain’s transition into a critical upgrade phase this month.

At the same time, Ripple’s completion of pilot tests with banks has bolstered broader confidence in blockchain-based payment solutions, putting added pressure on Stellar to deliver competitive improvements.

- $0.02 trading range represents 5% spread between $0.34 support and $0.36 resistance during session.

- Midnight selloff generates 57 million volume spike indicating heavy institutional selling.

- Morning recovery surge hits $0.36 on 70 million volume suggesting accumulation phase.

- Resistance confirmed at $0.36 with support zone established around $0.34-$0.35.

- Final hour recovery attempts fail as bearish momentum accelerates.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Aoyon Ashraf

13 minutes ago

Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

What to know:

- BNB’s price saw sharp intraday swings, trading between $849.88 and $868.76, but ultimately failed to hold gains.

- Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

- The price action is ahead of key economic data from the US, including jobs data, which could influence the Federal Reserve’s interest rate decision, with a near 90% chance of a 25 bps cut currently priced in.