-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

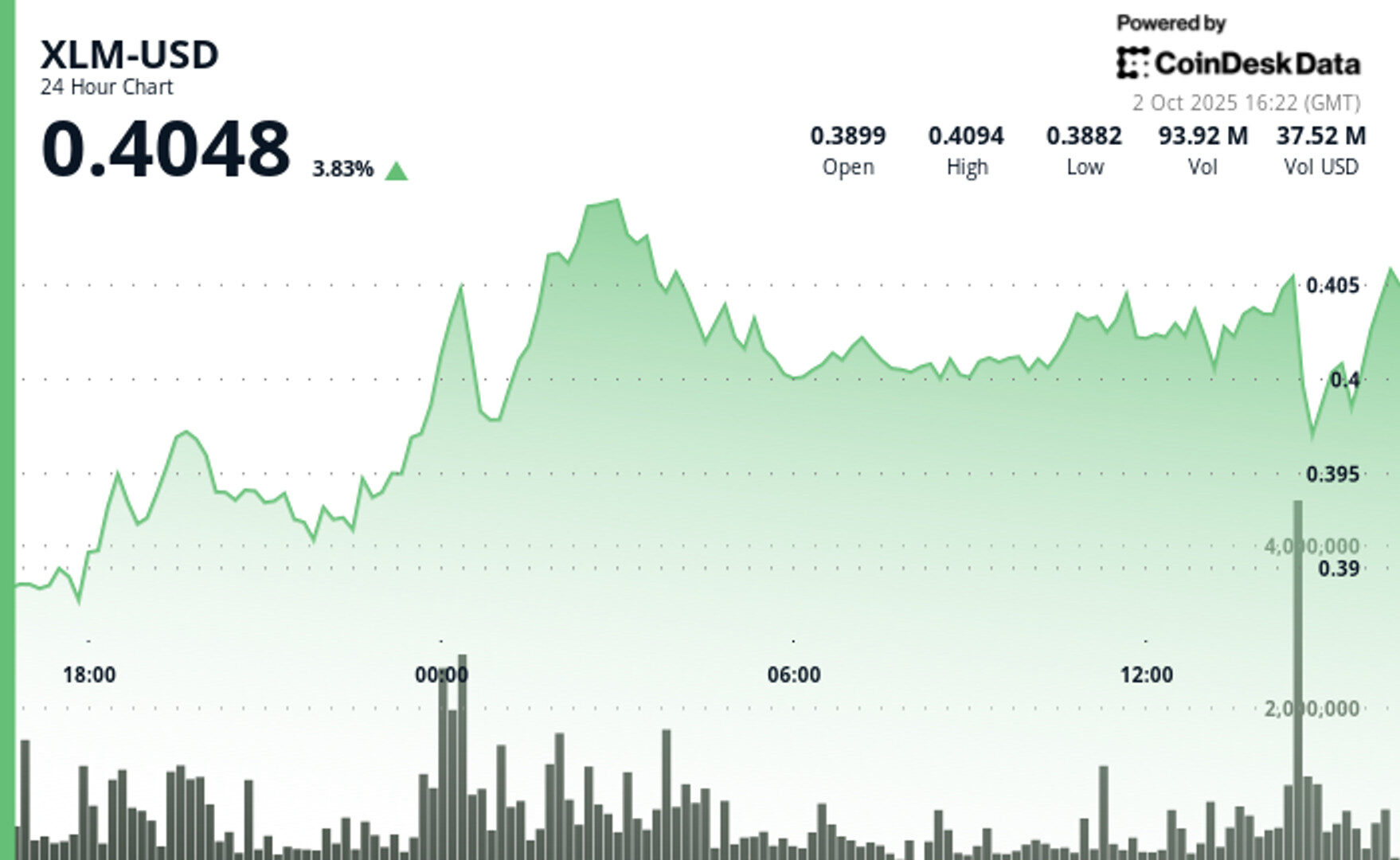

XLM rallied past $0.40 with a brief move above $0.41, boosted by Bitcoin.com Wallet integration and institutional demand, as volumes soared to more than twice the daily average.

By CD Analytics, Oliver Knight

Updated Oct 2, 2025, 4:40 p.m. Published Oct 2, 2025, 4:40 p.m.

- Strong Rally: XLM climbed 4% in 24 hours, establishing support at $0.40 and resistance at $0.41.

- Catalyst: Bitcoin.com Wallet added Stellar, expanding access to millions of global users.

- Market Activity: Trading volumes surged well above average, signaling growing institutional and retail interest.

Stellar’s XLM rose 4% in the past 24 hours, climbing from $0.39 to $0.40 with a brief push above $0.41. Trading volumes surged to more than double the daily average, establishing support at $0.40 and resistance near $0.41, signaling potential consolidation before the next move.

The rally followed Bitcoin.com Wallet’s integration of Stellar, giving millions of users access to its low-cost, fast payment network and DeFi tools. The news coincided with heightened volatility as XLM repeatedly tested the $0.41 level while holding key support.

STORY CONTINUES BELOW

Institutional demand is also fueling momentum, with traditional finance showing growing interest in blockchain-based payments. Strong volume during the breakout highlights rising market engagement as XLM pushes through psychological resistance zones.

Short-term action reinforced this trend: between 13:11 and 14:10 UTC on October 2, XLM briefly spiked to $0.41 on trading volumes nearly double the hourly average, underscoring robust bullish sentiment despite near-term resistance.

- Rally developed through two separate phases featuring initial advancement to $0.40 followed by decisive breakout exceeding $0.41 during overnight sessions.

- Outstanding trading volumes of 90.15 million and 61.23 million documented, substantially above 24-hour benchmark of 36.85 million.

- Essential support formed at $0.40 with substantial volume backing while resistance materialized around $0.41.

- Volume surges surpassed 1.4 million during 13:45 and 13:51 periods, exceeding hourly benchmark of 750,000.

- Repeated resistance challenges near $0.41 with support stabilization around $0.40 threshold.

- Robust upward trajectory preserved with balanced profit-taking patterns above essential $0.40 psychological barrier.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By CD Analytics, Oliver Knight

34 minutes ago

Hedera’s token posted sharp gains on heavy volume before late-session volatility cut into momentum.

What to know:

- Resistance at $0.23: Heavy trading early Oct. 2 lifted HBAR to $0.23, where strong selling pressure continues to cap gains.

- Institutional Signals: Hedera joined SWIFT, Citigroup and Germany’s Bundesbank in digital currency discussions, while Wyoming’s stablecoin pilot highlights adoption.

- ETF Watch: The SEC is reviewing a potential spot HBAR ETF this month, which analysts say could fuel October upside despite short-term weakness.