Stellar faces brutal selling pressure while institutional buyers emerge at oversold levels amid broader crypto market turmoil.

By CD Analytics, Oliver Knight

Updated Oct 14, 2025, 4:10 p.m. Published Oct 14, 2025, 4:10 p.m.

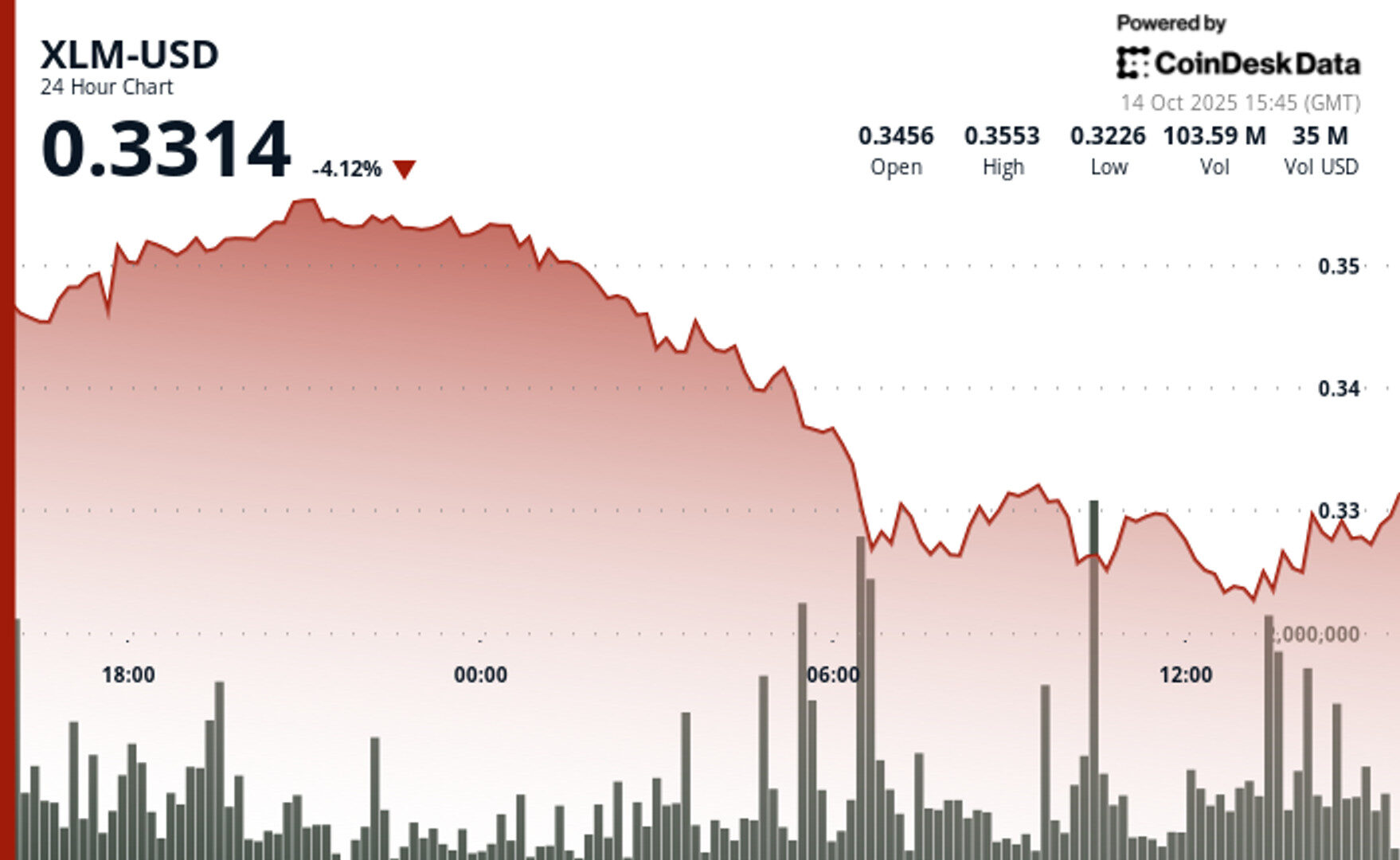

- XLM plunges 8% in a 23-hour selloff from Oct. 13–14, breaking key $0.34 support and hitting a new low of $0.32 on surging 63.1 million token volume.

- Capitulation selling and sharp volatility point to oversold conditions, with brief institutional buying lifting prices back to $0.33 before trading froze at 14:05.

- Analysts eye recovery potential, citing Elliott Wave patterns that could drive a longer-term rally toward $1.44 by end-2025 despite near-term bearish pressure.

Stellar’s XLM plunged 8% between Oct. 13 and Oct. 14, sliding from $0.36 to $0.33 amid a surge in trading volume to 63.1 million tokens — well above the 24-hour average of 36.85 million. The selloff intensified after the token broke key support at $0.34 during early Oct. 14 trading, triggering heavy liquidation and pushing prices to a new local low of $0.32.

The sharp decline showed clear capitulation signs, with high-volume selling hinting at potential oversold conditions. XLM briefly rebounded in the final hour of trading, rising 0.4% from $0.32 to $0.33 as institutional buyers appeared to accumulate at discounted levels.

STORY CONTINUES BELOW

Trading activity froze after 14:05, suggesting market consolidation near the $0.33 resistance zone. The volatility underscores broader crypto market uncertainty, with Bitcoin dominance steady near 58%. Despite the turmoil, some analysts remain bullish long term, forecasting a potential rally toward $1.44 by the end of 2025 based on Elliott Wave patterns.

- XLM breaks critical $0.34 support during Oct 14 04:00 session with 48.03 million volume exceeding 24-hour average.

- Capitulation selling emerges at $0.32 low as volume surges to 63.10 million tokens during Oct 14 13:00 session.

- Exceptional volatility posts 2% intraday range with sharp reversal patterns signaling potential oversold conditions.

- Institutional accumulation signals flash during 13:46-13:47 sessions with extraordinary 2.67-3.68 million token volume.

- Trading activity ceases completely from 14:05 onwards with zero volume indicating market consolidation phase.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Siamak Masnavi, CD Analytics|Edited by Aoyon Ashraf

56 minutes ago

Ark Invest has reportedly taken a 11.5% Solmate (SLMT) stake while the company said it bought $50 million discounted SOL from Solana Foundation.

What to know:

- Solmate (SLMT) says a Schedule 13G filing shows ARK Invest owns approximately 11.5% of the shares as of Sept. 30, 2025.

- The company also says it bought $50 million worth of SOL from the Solana Foundation at a 15% discount.