-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Stellar’s explosive volume spikes and resistance breakthrough signal heightened volatility amid growing institutional interest.

By CD Analytics, Oliver Knight

Updated Sep 5, 2025, 3:40 p.m. Published Sep 5, 2025, 3:40 p.m.

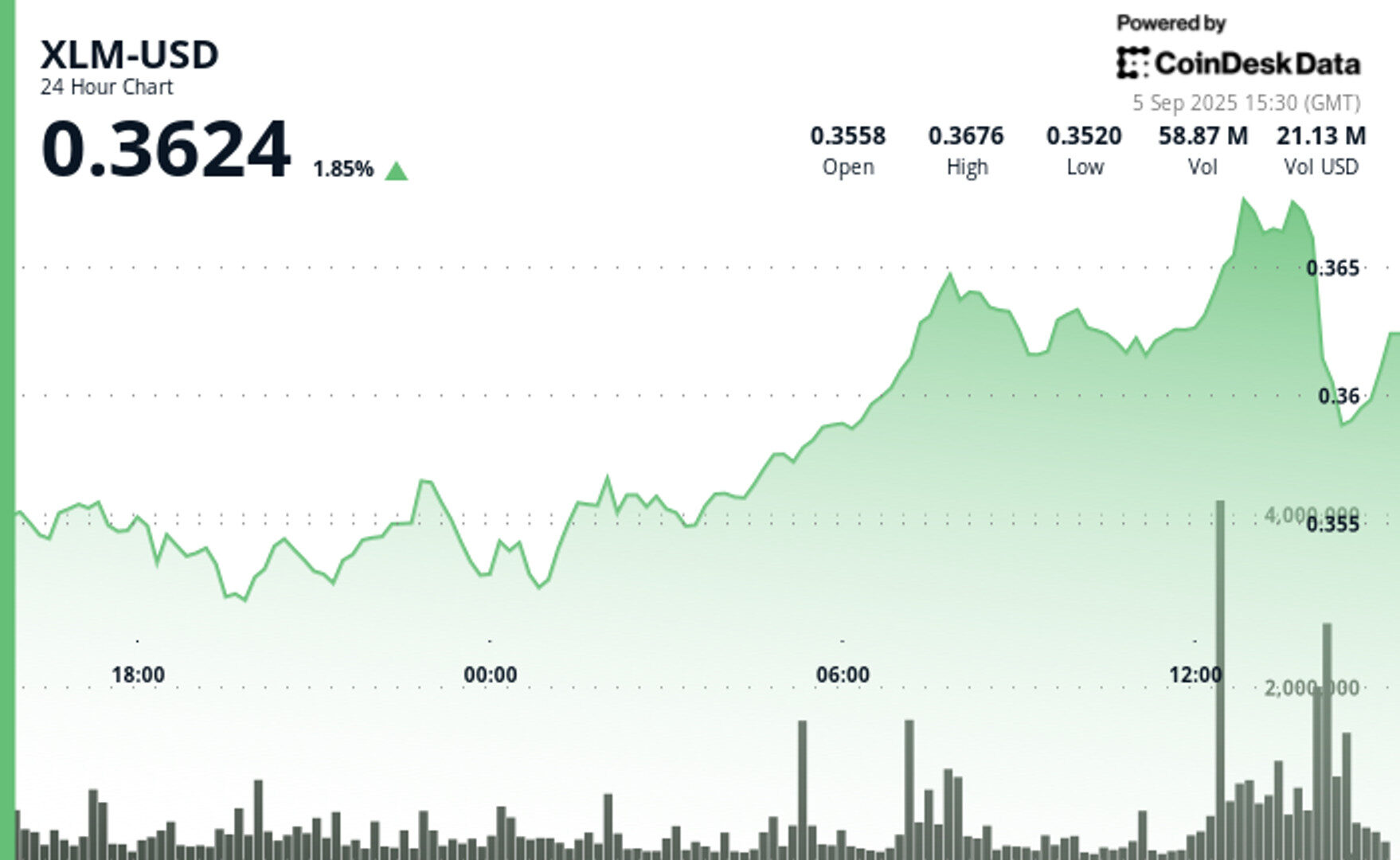

- XLM broke above $0.36 resistance on surging volumes, touching $0.37 before retreating to close at $0.36.

- Institutional appeal grows as Stellar’s 288% annual gains and Protocol 23 upgrades bolster its role in cross-border payments.

- Volatility underscores risks, with PayFi rivals intensifying competition even as elevated trading activity points to strong market engagement.

Stellar’s XLM token demonstrated impressive resilience over the past 24 hours, climbing from $0.36 to a session peak of $0.37 before retracing to end at $0.36. The move represented a 5% intraday range, underscored by heavy trading activity that pointed to heightened market participation. Notably, the asset found solid footing at $0.35 during the September 4 evening session, with buying momentum confirmed by volumes exceeding 16.9 million tokens.

The breakout above $0.36 resistance arrived on surging activity, with volumes spiking to 28.03 million at 07:00 and a staggering 82.75 million at midday on September 5. This influx of demand propelled XLM to its daily high of $0.37, marking a decisive test of bullish strength. However, a sharp reversal in the final trading hour wiped out those gains, as sellers drove the price back to the $0.36 level.

STORY CONTINUES BELOW

Despite the late-session pullback, XLM closed the period 1% above its opening value, maintaining a broadly bullish technical structure. The move fits into a broader trend: Stellar has posted a striking 288% gain over the past year, drawing institutional interest as Protocol 23 upgrades and cross-border payment solutions bolster its long-term fundamentals.

That said, the competitive landscape remains intense. With the rise of PayFi platforms challenging Stellar’s market position, XLM faces mounting external pressures even as volumes suggest strong trader engagement. For now, the combination of robust support levels and elevated demand provides a constructive backdrop, though volatility is likely to remain a defining feature of near-term price action.

- Solid support foundation confirmed at $0.35 with substantial volume backing during 4 September 20:00 period.

- Major upward breakout materialized during 5 September 07:00 and 12:00 intervals featuring exceptional volume expansion.

- Resistance penetration at $0.36 accelerated XLM toward session peak of $0.37.

- Severe final-hour reversal initiated intensive selling wave with exceptional volume participation.

- Fundamental bullish framework maintains integrity despite pronounced closing-session pullback.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By Shaurya Malwa|Edited by Oliver Knight

16 minutes ago

The investor, who originally acquired 1 million ETH during the 2014 ICO for $310,000, still holds 105,000 ETH valued at $451 million in two wallets.

What to know:

- An early Ethereum investor has made one of the largest recent staking deposits, moving 150,000 ETH worth $646 million into a staking address.

- The investor, who originally acquired 1 million ETH during the 2014 ICO for $310,000, still holds 105,000 ETH valued at $451 million in two wallets.

- This movement is part of a trend of ICO whales resurfacing, with traders noting the impact of long-dormant supply entering circulation, although the funds were staked rather than sold.