BTC

$109,159.64

+

0.93%

ETH

$2,575.43

+

2.12%

USDT

$1.0001

–

0.02%

XRP

$2.2685

+

1.61%

BNB

$661.98

+

0.99%

SOL

$151.58

+

2.34%

USDC

$0.9999

–

0.00%

TRX

$0.2877

+

1.52%

DOGE

$0.1741

+

6.27%

ADA

$0.5866

+

1.94%

HYPE

$39.97

+

2.71%

SUI

$2.9229

+

0.92%

BCH

$497.07

+

2.24%

WBT

$44.80

–

0.62%

LINK

$13.60

+

2.92%

LEO

$9.0336

+

0.42%

XLM

$0.2525

+

6.24%

AVAX

$18.27

+

2.03%

TON

$2.8413

+

3.77%

SHIB

$0.0₄1180

+

2.93%

By Shaurya Malwa, CD Analytics

Updated Jul 7, 2025, 5:50 a.m. Published Jul 7, 2025, 5:50 a.m.

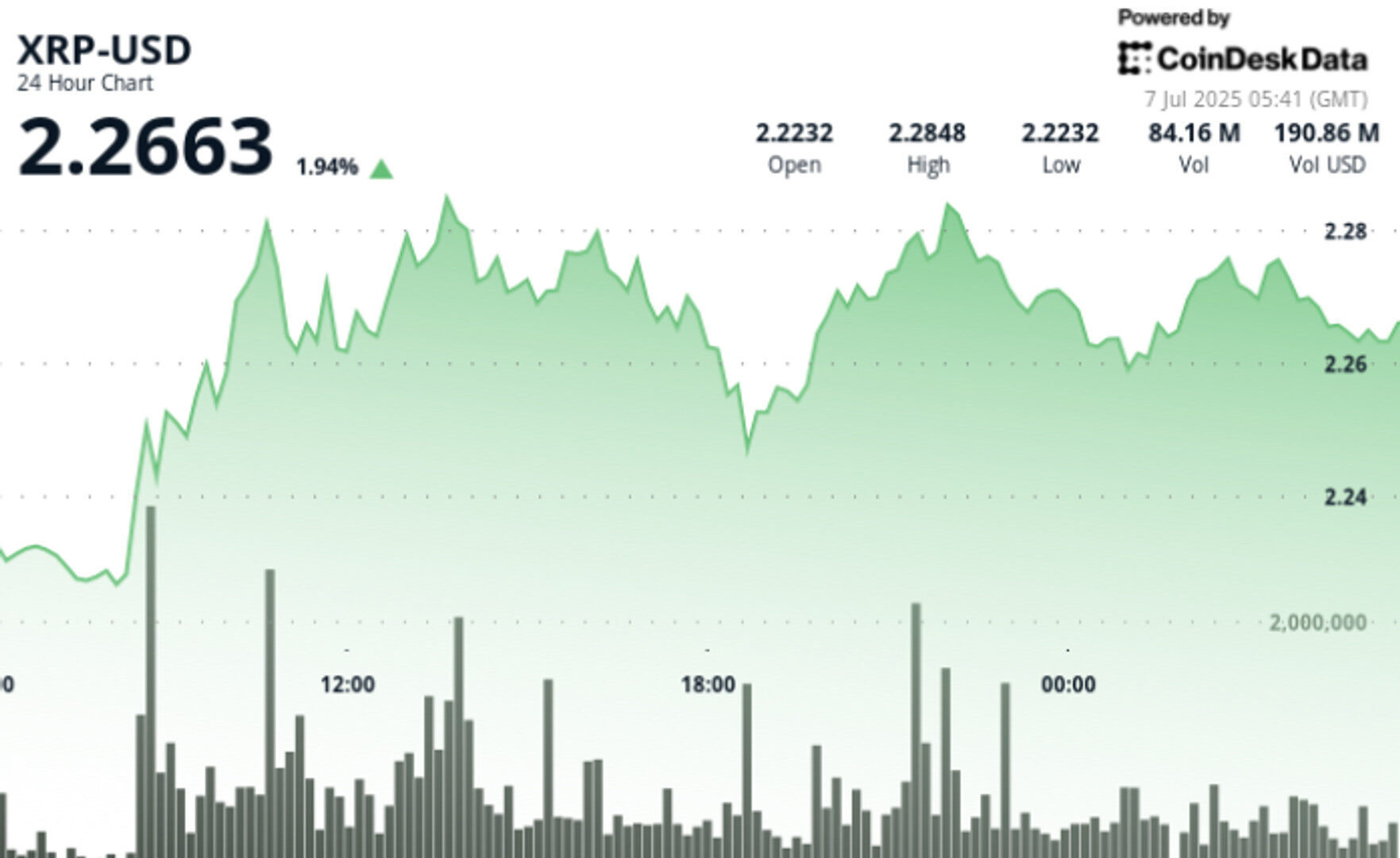

- XRP has broken above the $2.28 resistance zone with a 2.36% gain, supported by surging trading volume.

- Ripple’s application for a national bank charter has boosted investor confidence, potentially accelerating institutional adoption.

- Key resistance for XRP is now at $2.29–$2.30, with potential upside targets if momentum continues.

XRP is showing signs of accumulation, breaking above the critical $2.28 resistance zone on surging volume. From 6 July 03:00 to 7 July 02:00, the token gained 2.36%, moving from $2.21 to $2.26 with peak hourly trading volume exceeding 67 million.

Ripple’s bank charter news is reinforcing a bullish technical setup, as buyers consistently defend the $2.24–$2.25 support range.

STORY CONTINUES BELOW

News Background

- Ripple Labs’ July 2 application for a national bank charter with the U.S. Office of the Comptroller of the Currency (OCC) has reignited investor confidence in XRP.

- If approved, the license would allow Ripple to operate as a federally regulated trust bank — marking a major leap toward deeper integration between crypto and the traditional banking system.

- Analysts say this could accelerate institutional adoption of XRP, particularly for global payments and stablecoin issuance.

- The move comes amid growing anticipation for a U.S.-based XRP spot ETF and Ripple’s potential Fed master account access, positioning the token for longer-term upside.

- XRP gained 2.36% over the 24-hour period, rising from $2.21 to $2.26 with a trading range of $0.08 (3.62%).

- The most aggressive breakout occurred at 10:00, when volume exceeded 67M and price surged through the $2.28 level.

- Support is firmly established at $2.24–$2.25, where buyers absorbed selling pressure during multiple dips, particularly at 18:00.

- In the final hour (7 July 01:05–02:04), XRP climbed another 2.29%, breaking $2.26 resistance and closing at $2.27.

- The uptrend accelerated at 01:30 and 02:01, with volume spikes confirming strong buyer interest; a local high was set at $2.27.

- Key resistance now lies at $2.29–$2.30, with upside targets between $2.60 and $3.40 if momentum sustains through the $2.38 breakout zone.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.