Share this article

Futures open interest collapsed 50% to $4.22B, signaling forced deleveraging as market makers cut risk exposure amid ongoing macro and regulatory uncertainty.

Updated Oct 16, 2025, 4:01 a.m. Published Oct 16, 2025, 4:01 a.m.

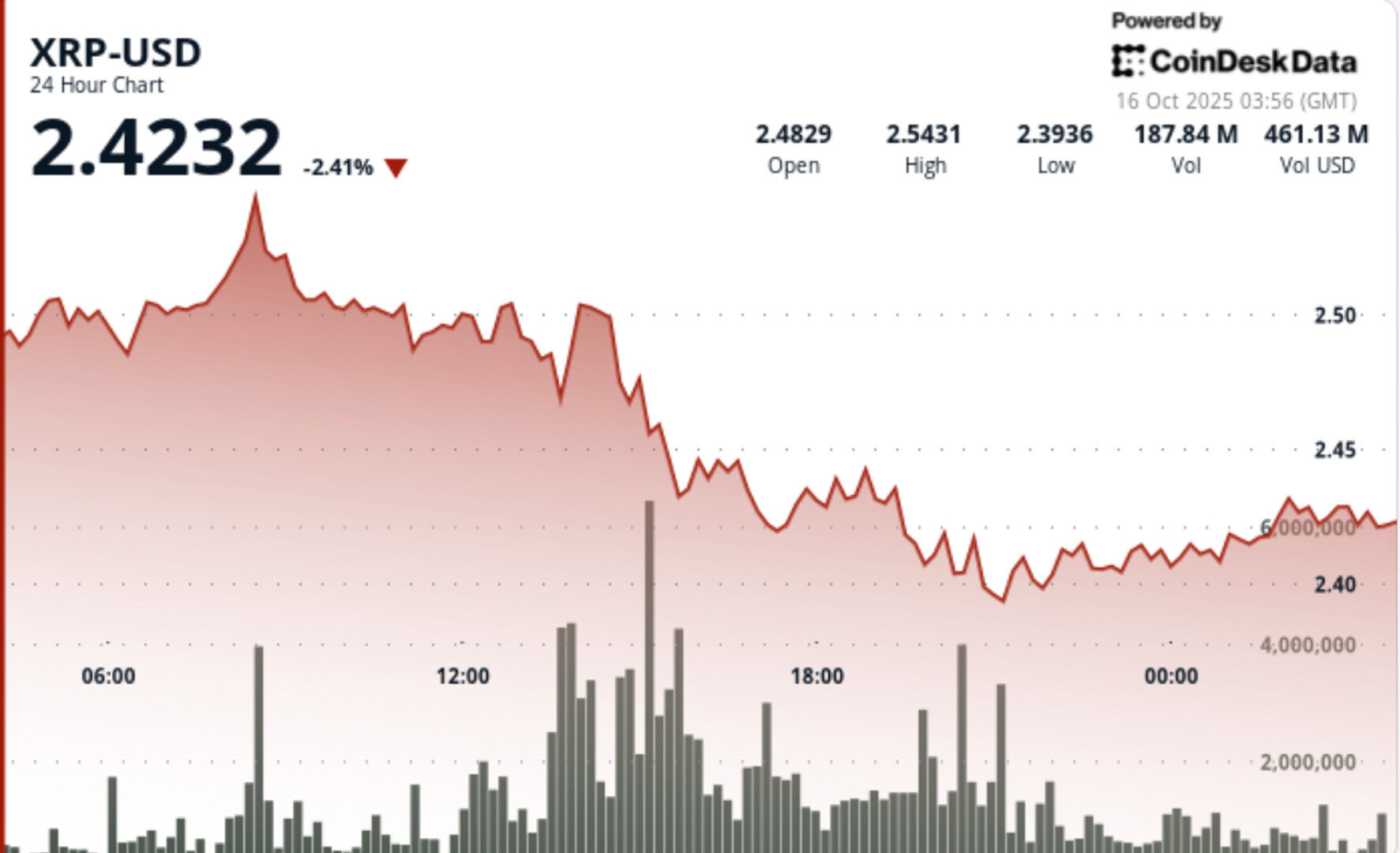

- XRP’s market value dropped by $10 billion due to heavy institutional selling and leverage unwinding.

- The cryptocurrency experienced a 6% decline in price, falling from $2.49 to $2.41 between October 14 and 15.

- Futures open interest halved, indicating forced deleveraging amid macroeconomic and regulatory uncertainties.

Heavy institutional selling wipes out $10B in market value as leverage unwinds across derivatives markets.

- XRP endured one of its sharpest single-day declines this month, plunging 6% from $2.49 to $2.41 between October 14 and 15. The drop followed sustained whale distribution, with 2.23B tokens — worth roughly $5.5B — moving to exchanges since October 10.

- Futures open interest collapsed 50% to $4.22B, signaling forced deleveraging as market makers cut risk exposure amid ongoing macro and regulatory uncertainty.

- XRP collapsed from $2.56 to $2.41 during the 24-hour window ending Oct. 15 20:00, marking 6% downside and a $0.15 trading range (6.3% intraday volatility).

- Intense sell pressure hit from 13:00–15:00 as volumes spiked from 119M to 154M.

- Support failed at $2.48–$2.50, triggering cascade liquidations that drove price to $2.40.

- A brief recovery attempt to $2.44 around 19:27 was rejected; price closed near lows at $2.41.

- Final hour volumes peaked near 4.5M, confirming capitulation before activity faded.

- The breakdown below $2.48 confirms short-term trend reversal. Support now rests at $2.40–$2.42, with interim resistance at $2.55–$2.56 and broader overhead supply at $2.65.

- Volume-weighted metrics point to institutional exodus rather than retail panic. If $2.40 holds, expect range-bound chop until leverage normalizes; a clean reclaim above $2.55 would hint at re-accumulation.

- Momentum oscillators remain oversold, but buyers have yet to step up in size. Funding rates across major derivatives platforms turned negative, reinforcing bearish bias through midweek.

- Can $2.40 support withstand further selling from whales or funds?

- Whether open interest rebuilds after a 50% drop — signal of stabilization or fresh shorts.

- Spot inflows vs. exchange outflows to gauge if accumulation resumes.

- Reaction near $2.65 resistance for any credible bounce confirmation.

More For You

Oct 10, 2025

Combined spot and derivatives volumes fell 17.5% in September, continuing a four-year seasonal trend

What to know:

- Trading activity falls 17.5% in September slowdown: Combined spot and derivatives volumes dropped to $8.12 trillion, marking the first decline after three months of growth. September has now seen reduced trading volume for the fourth consecutive year.

- Open interest reaches record high despite derivatives market share decline: Total open interest surged 3.2% to $204 billion and peaked at an all-time high of $230 billion during the month.

- Altcoins on CME outperform as Bitcoin and Ether futures decline: While CME’s total derivatives volume stayed flat at $287 billion (-0.08%), SOL futures jumped 57.1% to $13.5 billion and XRP futures rose 7.19% to $7.84 billion. BTC and ETH futures fell 4.05% and 17.9% respectively.

More For You

By Shaurya Malwa, CD Analytics

32 minutes ago

DOGE followed the broader market liquidation triggered by renewed U.S.–China tariff rhetoric, sliding 5% from $0.21 highs to settle at $0.20. President Trump’s proposed 100% tariff plan erased roughly $19B in crypto market value, sparking forced liquidations across majors.

What to know:

- DOGE fell 5% amid heavy selling in the digital asset market, influenced by U.S.–China tariff tensions.

- Institutional interest is noted near the $0.20 level, despite broader market liquidations.

- The House of Doge’s Nasdaq debut supports long-term institutional interest, though short-term sentiment remains cautious.