BTC

$103,715.58

–

0.26%

ETH

$2,483.91

–

0.09%

USDT

$1.0001

–

0.03%

XRP

$2.1264

–

1.40%

BNB

$644.12

+

0.85%

SOL

$142.48

–

0.45%

USDC

$0.9998

–

0.02%

TRX

$0.2731

–

0.10%

DOGE

$0.1634

–

2.85%

ADA

$0.5779

–

1.93%

HYPE

$34.23

–

4.89%

WBT

$49.00

–

0.33%

BCH

$486.62

+

0.87%

SUI

$2.7298

–

2.36%

LINK

$12.76

–

1.11%

LEO

$8.8950

–

0.48%

XLM

$0.2446

–

1.02%

AVAX

$17.49

–

0.75%

TON

$2.9760

+

1.86%

SHIB

$0.0₄1145

+

0.07%

By Shaurya Malwa, CD Analytics

Updated Jun 20, 2025, 4:28 p.m. Published Jun 20, 2025, 4:11 p.m.

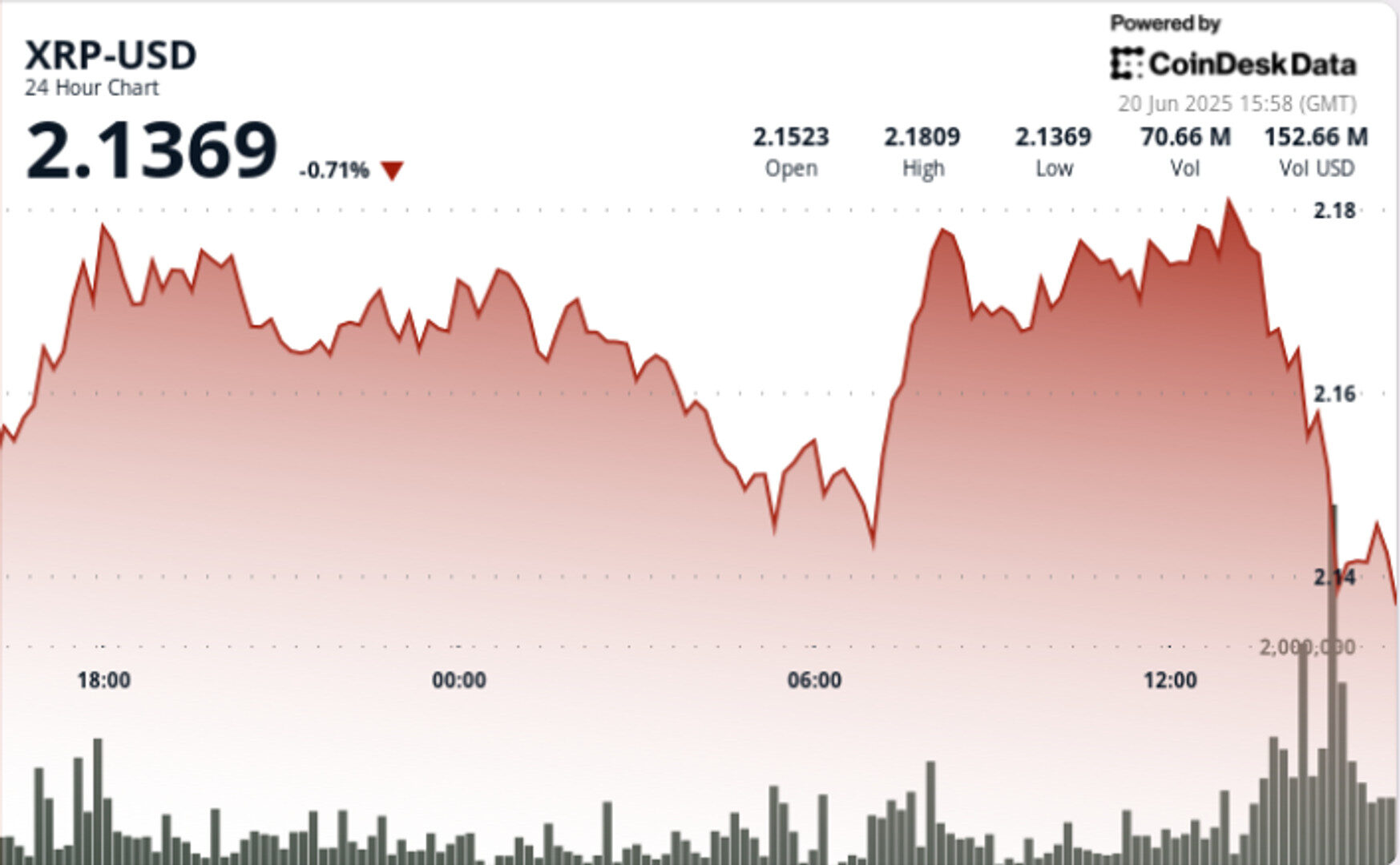

- XRP is stabilizing near the top of its recent range, showing signs of bullish pressure as volatility narrows.

- Despite market liquidations due to Middle East conflicts, XRP has held ground, forming higher lows within a $2.14–$2.18 trading band.

- Technical indicators suggest a potential breakout setup, with Bollinger Bands tightening and XRP maintaining an ascending channel.

XRP is stabilizing near the top of its recent range and showing signs of bullish pressure as volatility narrows.

With strong volume-backed support at $2.14–$2.15 and multiple resistance tests at $2.18, the asset appears to be coiling within an ascending channel, setting the stage for a possible breakout.

- Middle East conflicts triggered renewed risk-off sentiment across markets, sparking liquidations across crypto. While top assets like Cardano and Solana posted over 1% declines, XRP has managed to hold ground — forming higher lows and carving out a new trading band in the $2.14–$2.18 zone.

- This resilience comes as the Federal Reserve prepares to announce its next interest rate decision. With global economic policy increasingly fragmented, crypto traders are bracing for sharp moves across digital assets.

- Despite broader caution, XRP’s recent behavior suggests underlying strength, with technical compression pointing to a potential breakout setup.

- XRP’s long-term structure remains in focus. After nearly 200 days of ranging between $1.90 and $2.90, the token is testing the upper end of a descending channel on the USDT pair, with macro resistance near $2.60.

- Analysts continue to debate whether this structure mirrors XRP’s 2017 price setup — a consolidation that preceded a 1,300% breakout.

- Meanwhile, investor behavior is shifting. Glassnode data shows rising profit-taking activity averaging $68.8 million daily, even as Bollinger Bands narrow — a classic sign of pending volatility.

XRP traded within a 3.81% range from $2.143 to $2.182 over 24 hours, with strong buying pressure defending support at $2.143 during the 07:00 hour, where volume spiked to nearly 50 million units. Resistance was tested repeatedly at $2.179–$2.182 throughout the day but held firm.

STORY CONTINUES BELOW

In the final trading hour, XRP fell from a local high of $2.181 to $2.167, a 0.7% drop that formed a new short-term descending channel. Volume surged to 1.7 million as support at $2.170 was breached, but price stabilized quickly and formed a higher low, preserving the broader uptrend structure.

- XRP posted a 3.81% 24-hour range, from $2.143 to $2.182.

- Support held at $2.143–$2.147 with heavy volume during early session lows.

- Resistance tested at $2.179–$2.182 multiple times, forming a clear upper boundary.

- Price action appears to form an ascending channel with higher lows intact.

- Late-session sell-off triggered by 1.7M volume spike at $2.170, but price recovered to $2.167.

- Descending micro-channel formed in the final hour; broader trend remains bullish if $2.14 support holds.

- Bollinger Bands tightening; RSI neutral at 52 suggests pending volatility.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.