-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 28, 2025, 5:47 a.m. Published Aug 28, 2025, 5:47 a.m.

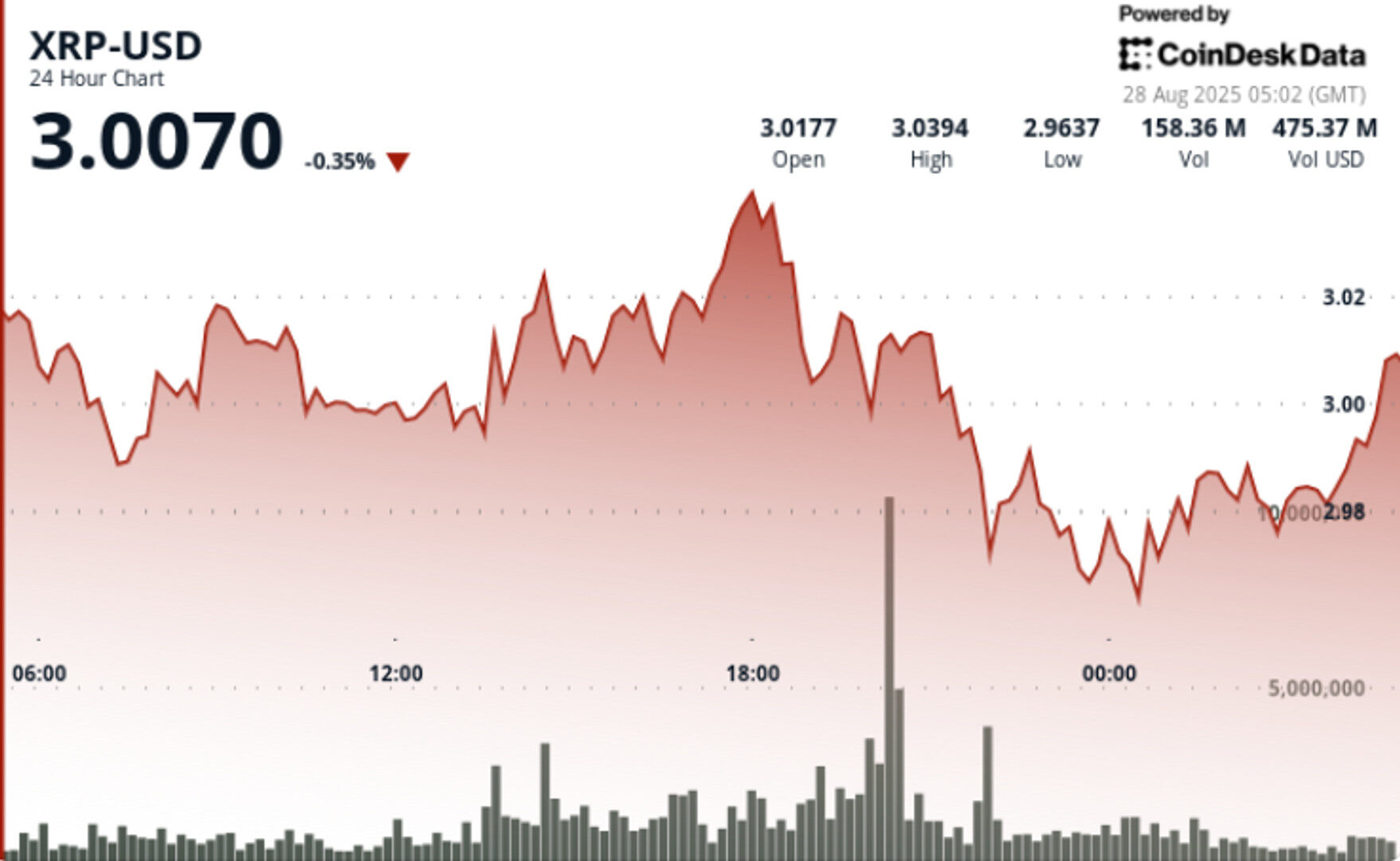

- XRP rose nearly 9% for the week, trading around the $3.00 level.

- Gemini’s new XRP-rewards Mastercard boosted its app ranking above Coinbase.

- Institutional flows into XRP products are estimated at $25 million daily, adding market depth.

- XRP extended its late-August advance, climbing nearly 9% on the week while trading tightly around the $3.00 psychological level.

- Gemini launched an XRP-rewards Mastercard with WebBank, offering up to 4% cashback in XRP. The release pushed Gemini ahead of Coinbase in U.S. iOS app rankings.

- Institutional flows into XRP-linked products reached an estimated $25 million daily, adding depth to the market backdrop.

- Analysts continue to monitor breakout setups, with longer-term technical targets cited near $27 if the current compression phase resolves upward.

- Across the 24-hour session ending August 27 at 04:00 GMT, XRP traded in a $0.09 band between $2.95 and $3.05, closing at $2.98 for a 1.3% intraday decline.

- The heaviest activity came at 20:00 GMT, when volumes surged to 273.15 million — more than 4x the 62.47 million daily average — as XRP briefly touched $3.05 before sellers capped the move.

- In the final hour (03:04–04:03 GMT), XRP consolidated within a $0.11 range from $2.97–$3.08, with repeated tests of $2.975 support holding firm.

- Volume spikes of 1.31M at 03:59 and 1.19M at 03:07 GMT coincided with short-lived rallies toward $2.99 resistance.

- Support: $2.975–$2.98 remains the key psychological floor after multiple successful defenses.

- Resistance: $3.02–$3.04 continues to cap upside attempts amid heavy sell pressure.

- Momentum: RSI steady in mid-50s reflects neutral bias; MACD histogram converging toward potential bullish crossover.

- Volume: 273M peak turnover underscores institutional presence but also highlights strong profit-taking at resistance.

- Patterns: Ongoing consolidation near $3.00 suggests a base-building phase, with potential continuation if resistance at $3.04 breaks.

- Bulls target $3.20 if the $3.02–$3.04 resistance band is cleared.

- Bears highlight $2.96 as the first downside trigger, with $2.94 as the next level below.

- Market desks are watching whether Gemini’s Mastercard launch drives incremental retail flows into XRP.

- Institutional inflows above $25M daily remain critical for sustaining momentum.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Shaurya Malwa, CD Analytics

1 hour ago

Token holds narrow range near $0.22 as large holders liquidate and corporate desks absorb flows.

What to know:

- A whale transferred 900 million DOGE to Binance, causing fears of a sell-off and a brief price drop.

- Despite the transfer, whales accumulated 680 million DOGE in August, indicating a balance between selling and buying.

- DOGE’s price remains in a tight range, with strong support at $0.219 and resistance at $0.225.