Share this article

XRP’s price action now faces resistance at the former support levels, with $1.90 as the immediate line of defense.

By Shaurya Malwa, CD Analytics

Updated Dec 17, 2025, 5:06 p.m. Published Dec 17, 2025, 5:06 p.m.

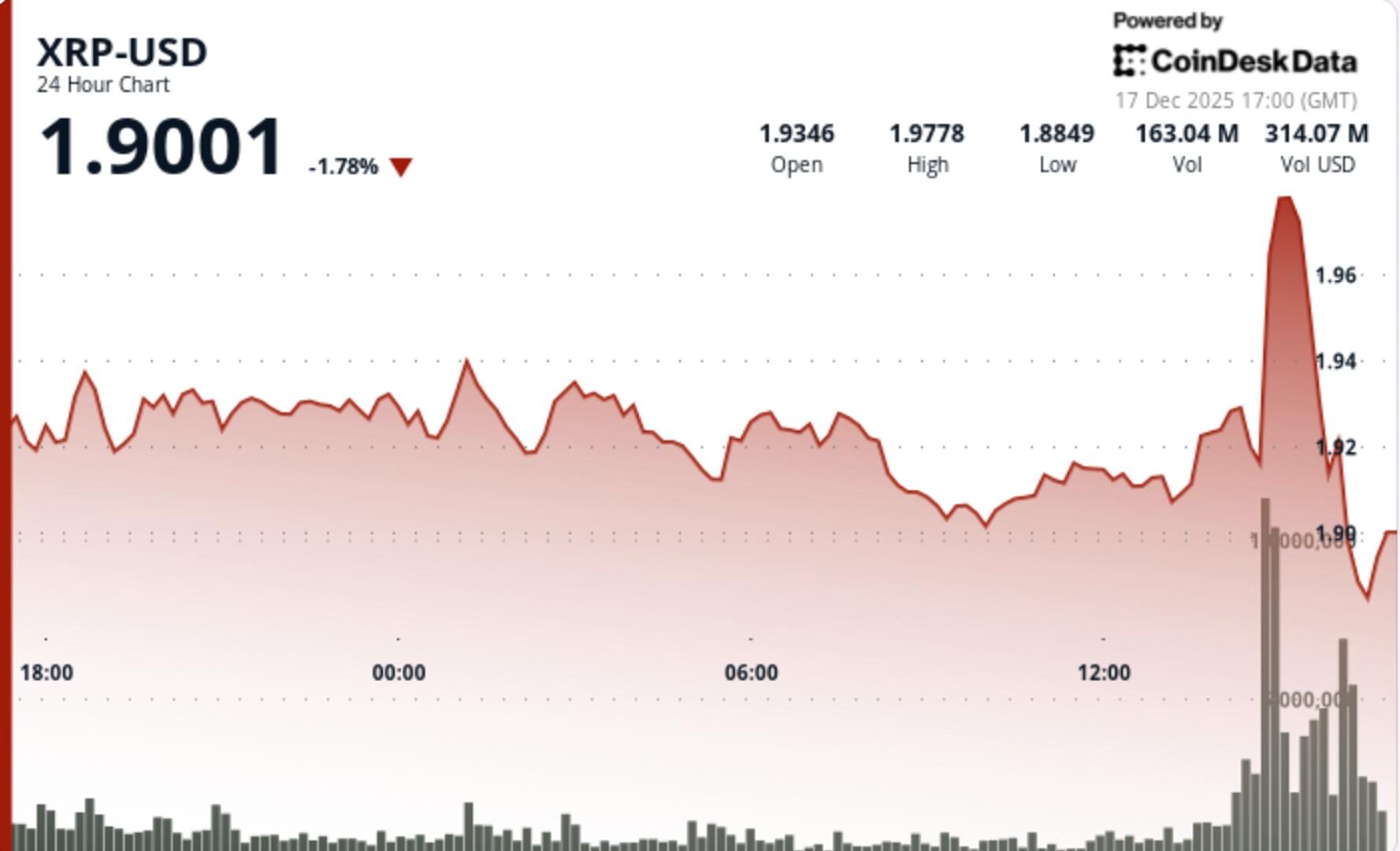

- XRP fell 5.04% as it broke below the $1.92 support zone amid heightened selling pressure and market volatility.

- The selloff was marked by high trading volume, indicating institutional repositioning rather than retail panic.

- XRP’s price action now faces resistance at the former support levels, with $1.90 as the immediate line of defense.

XRP slid sharply on Wednesday, breaking below the $1.92 support zone as elevated selling pressure collided with violent cross-asset volatility during U.S. trading hours.

The move came amid abrupt reversals in bitcoin, U.S. equities and AI-linked stocks, leaving altcoins exposed as liquidity thinned and derivatives positioning reset.

STORY CONTINUES BELOW

Don’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today.See all newslettersBy signing up, you will receive emails about CoinDesk products and you agree to ourterms of useandprivacy policy.

- Crypto markets saw violent whipsaw action in early U.S. trade, with bitcoin briefly ripping from $87,000 to above $90,000 before snapping back to the $87,000 area

- The reversal coincided with sharp losses in AI-linked equities, including Nvidia, Broadcom and Oracle falling 3%–6%, dragging the Nasdaq down more than 1%

- Sentiment weakened after reports that Blue Owl Capital pulled out of funding a $10 billion Oracle data-center project, pressuring risk assets tied to AI infrastructure.

- The sudden swings triggered over $190 million in crypto liquidations in four hours, with $72 million in longs and $121 million in shorts flushed out, according to CoinGlass.

- XRP underperformed the broader market slightly as derivatives-driven flows hit mid-beta altcoins harder during the volatility spike.

- Support:Immediate: $1.90, now the first line of defenseSecondary: $1.75–$1.64, deeper liquidity zone if $1.90 fails

- Resistance:Near-term: $1.94–$1.99, former support turned supplyPsychological: $2.00, now firmly rejected

- Volume Structure:Rejection near $1.9885 printed the session’s highest volumeElevated activity confirms distribution, not passive sellingNo evidence yet of seller exhaustion

- Trend Structure:Breakdown below key Fibonacci retracement shifts structure bearishLower highs formed before the rejection, signaling momentum decayConsolidation resolved to the downside

- Momentum Check: Failed squeeze above $2.00 acted as a bull trapPrice acceptance below $1.94 keeps downside bias intact.

- Whether $1.90 holds — a clean break exposes $1.75–$1.64 quickly.

- Reaction if price retests $1.94–$1.99 — rejection there confirms trend continuation.

- Whether macro volatility eases or continues to force cross-asset deleveraging.

- Derivatives positioning after $190 million in liquidations — direction depends on who reloads first.

- XRP’s relative performance vs BTC if bitcoin stabilizes near $87,000

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Francisco Rodrigues|Edited by Sheldon Reback

16 minutes ago

Crypto-linked stocks pulled back, with miners like MARA Holdings (MARA) down 4.8% and Core Scientific (CORZ) down 6%.

What to know:

- The crypto market rally reversed, with bitcoin (BTC) falling 3.9% to around $86,500 and ether (ETH) losing 5.3% and and XRP dropping 4.1%.

- Crypto-linked stocks also pulled back, with miners like MARA Holdings (MARA) down 4.8% and Core Scientific (CORZ) down 6%.

- Hut 8 (HUT) remains up 12.8% after signing a $7 billion lease agreement.