-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Updated Aug 13, 2025, 3:32 a.m. Published Aug 13, 2025, 3:31 a.m.

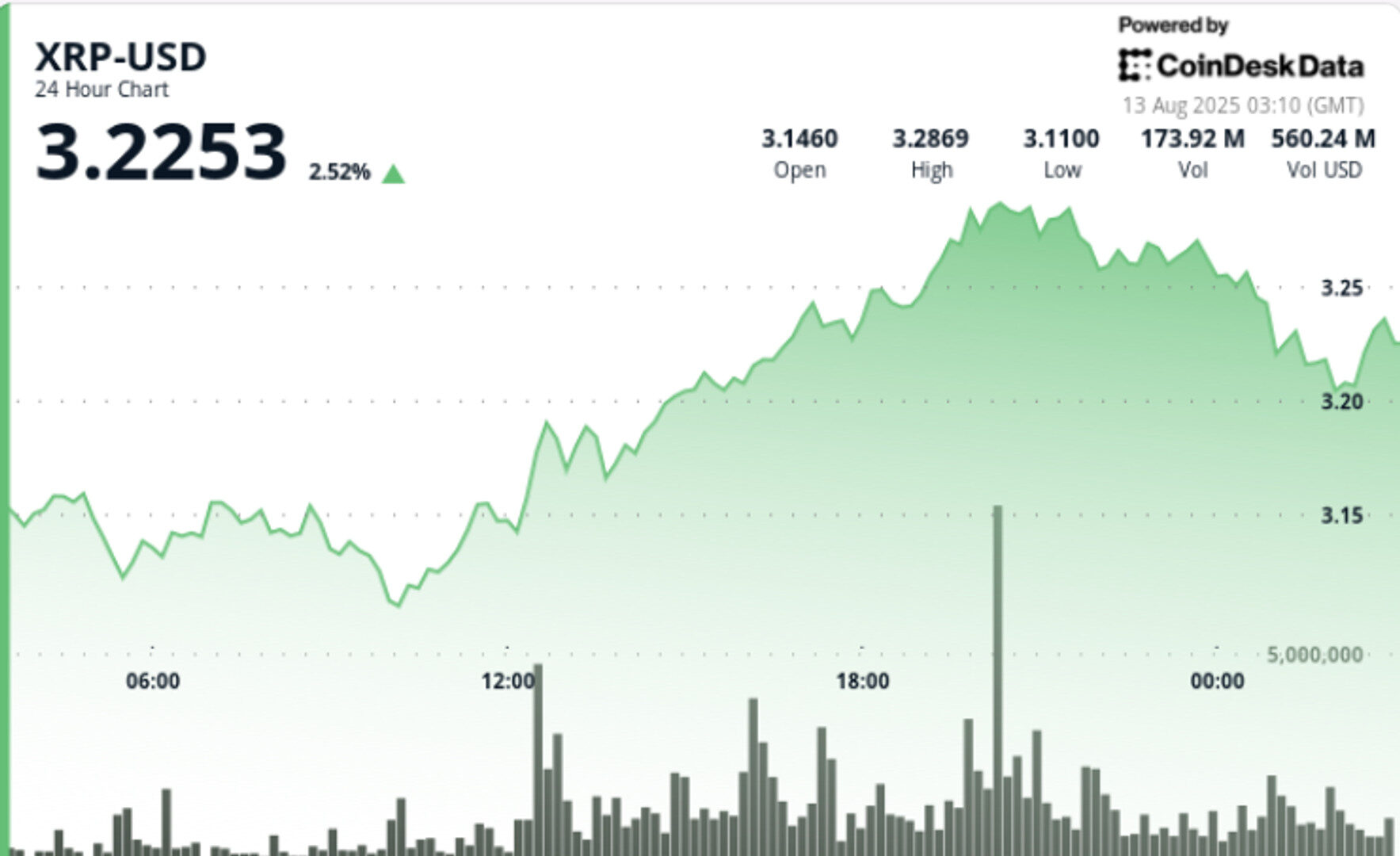

- XRP rose 4% as it moved from $3.15 to $3.25, with a significant mid-session rally pushing volumes over 140 million tokens.

- Ripple Labs and the SEC have dismissed their appeals, ending litigation and boosting institutional inflows, with daily volumes increasing by 208%.

- Resistance was confirmed at $3.30, while support held at $3.25-$3.26, despite late-session profit-taking.

Token extends post-settlement rally on strong mid-session momentum, with volumes topping 140 million tokens as buyers test $3.30 resistance.

XRP rises 4% in the 24-hour period ending August 13, climbing from $3.15 to $3.25 within a $0.20 range (6% volatility).

The bulk of gains occur between 12:00 and 20:00, when price moves from $3.15 to $3.30 on volume exceeding 140M units. Resistance forms at $3.30 as buying momentum slows, while support consolidates at $3.25-$3.26, showing orderly profit-taking without breaking bullish structure.

STORY CONTINUES BELOW

The final trading hour sees a 1% retreat from $3.27 to $3.25 as late-session profit-taking emerges.

Volume spikes above 5.9M during 00:32-00:33 point to controlled distribution by institutional desks while keeping price above key support.

Ripple Labs and the Securities and Exchange Commission have formally dismissed their appeals, concluding years of litigation over XRP. The legal clarity has triggered fresh institutional inflows, with daily volumes up 208% to $12.4B since the announcement.

Enterprise adoption headlines added to sentiment, including Blue Origin’s integration of XRP payments and SEC approval of Ripple’s enhanced Regulation D exemption — removing capital-raising constraints for certain investor classes.

• XRP gains 4% from $3.15 to $3.25 during August 12 01:00–August 13 00:00

• Mid-session rally from $3.15 to $3.30 sees volume surpass 140M units

• Resistance confirmed at $3.30; support holds at $3.25-$3.26

• Final-hour profit-taking trims price to $3.25 without breaking structure

• Support: $3.25-$3.26 (volume-backed consolidation)

• Resistance: $3.30 (multiple rejections)

• Intraday range: $0.20 (6% volatility)

• Largest volume concentration: 12:00-20:00 rally window

• Late-session volume spikes >5.9M linked to profit-taking

• Breakout attempts above $3.30 toward $3.35-$3.50

• Sustained large-holder inflows post-settlement

• Impact of enterprise adoption news flow on spot demand

• Macro spillover effects from trade and rate policy shifts

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

More For You

By Sam Reynolds, AI Boost|Edited by Aoyon Ashraf

1 hour ago

But ETH’s rally is hiding the fact that more and more liquidity is leaving for TRON, which could put a damper on growth.

What to know:

- Ethereum is trading above $4600, with traders anticipating a potential rise to $5000 by the end of August.

- A significant amount of Ethereum is being converted to TRON’s USDT, which may impact Ethereum’s liquidity and growth.

- Bitcoin maintains bullish momentum, holding at $119,943, while the S&P 500 and Nasdaq reach record highs amid rate cut expectations.