-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

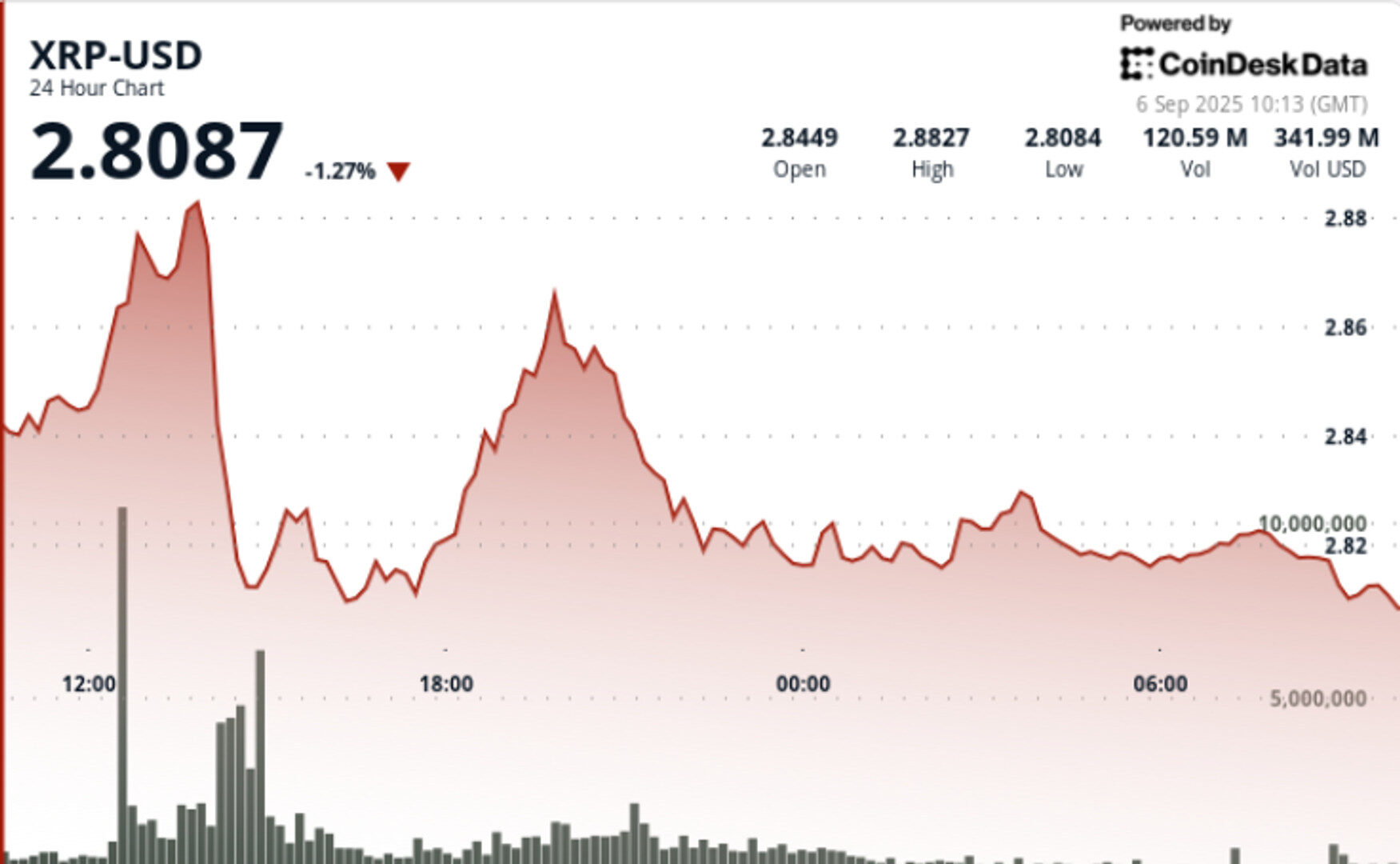

The move keeps XRP locked in a 47-day consolidation under $3.00, with traders now eyeing the $2.77 support pivot and October’s SEC ETF decisions as the next catalysts.

By Shaurya Malwa, CD Analytics

Sep 6, 2025, 1:30 p.m.

- XRP failed to maintain momentum above $2.88, leading to a 4% decline as institutional selling increased.

- Traders are closely watching the $2.77 support level and upcoming SEC decisions on XRP ETFs in October.

- Whale accumulation continues despite volatility, with exchange balances remaining high, indicating potential supply pressure.

XRP failed to sustain momentum above $2.88–$2.89, triggering a 4% decline as institutional selling capped the advance. Heavy volume confirmed resistance at those levels, while buyers reappeared in the $2.81–$2.83 range to stabilize price action.

The move keeps XRP locked in a 47-day consolidation under $3.00, with traders now eyeing the $2.77 support pivot and October’s SEC ETF decisions as the next catalysts.

- Six institutional asset managers have filed spot XRP ETF applications, with SEC decisions expected in October.

- Whale accumulation continues, with roughly 340 million tokens purchased in recent weeks despite persistent volatility.

- Exchange balances remain elevated above 3.5 billion XRP, raising questions of potential supply pressure if selling resumes.

- Federal Reserve policy shifts and inflation prints are shaping broader liquidity conditions across risk assets.

- Previous attempts to break higher saw 227.7 million tokens trade near $2.88–$2.89, confirming that zone as firm resistance.

- XRP traded within a $0.08 range from $2.81 to $2.89, representing 3% volatility.

- The sharpest decline came at 14:00 on Sept 5, dropping from $2.88 to $2.81 on nearly 280 million tokens traded.

- Stabilization followed, with consolidation between $2.82 and $2.83 on lighter volume.

- Closing price near $2.82 kept XRP just above the $2.77 support pivot, viewed as the next key downside guardrail.

- Support: Strong bid zone identified at $2.77–$2.81 following repeated defenses.

- Resistance: Immediate ceiling at $2.88–$2.89, with $3.00 psychological level and $3.30 breakout threshold above.

- Indicators: RSI sits mid-50s, reflecting neutral-to-bullish bias.

- MACD histogram converges toward bullish crossover, signaling possible momentum shift if volume returns.

- Structure: Ongoing 47-day consolidation under $3.00, with a close above $3.30 opening potential path to $4.00+.

- Whether $2.77 holds as the decisive support level if selling resumes.

- Price behavior on retests of $2.88–$2.89 resistance, particularly if volume surpasses daily averages.

- How whale accumulation offsets elevated exchange balances, which suggest latent supply risk.

- October SEC decisions on spot XRP ETFs, viewed as a key institutional adoption catalyst.

- Macro drivers from Fed policy and inflation data releases that may influence flows across digital assets.

More For You

By Sam Reynolds|Edited by Shaurya Malwa

6 hours ago

Onchain data shows WLFI’s sharp drop was driven by shorting and dumping across exchanges – not Justin Sun’s token movements – while the project says wallet freezes targeted phishing-related compromises, not market participants.

What to know:

- World Liberty Financial froze hundreds of wallets, including Justin Sun’s, to protect users from phishing attacks.

- Onchain data shows Justin Sun’s transfers occurred after WLFI’s token decline, not causing it.

- Market participants attribute WLFI’s crash to widespread shorting and dumping, not individual actions.