BTC

$105,373.89

+

3.31%

ETH

$2,406.72

+

6.36%

USDT

$1.0007

–

0.01%

XRP

$2.1921

+

8.11%

BNB

$640.20

+

2.53%

SOL

$145.15

+

7.84%

USDC

$0.9999

–

0.04%

TRX

$0.2716

+

1.41%

DOGE

$0.1645

+

6.86%

ADA

$0.5877

+

7.09%

HYPE

$37.32

+

3.97%

WBT

$47.93

–

0.65%

SUI

$2.8246

+

12.17%

BCH

$457.64

+

0.66%

LINK

$13.10

+

10.35%

LEO

$9.1016

+

1.60%

AVAX

$18.25

+

8.37%

XLM

$0.2466

+

7.01%

TON

$2.9108

+

5.97%

SHIB

$0.0₄1179

+

9.46%

By Shaurya Malwa, CD Analytics

Jun 24, 2025, 5:15 a.m.

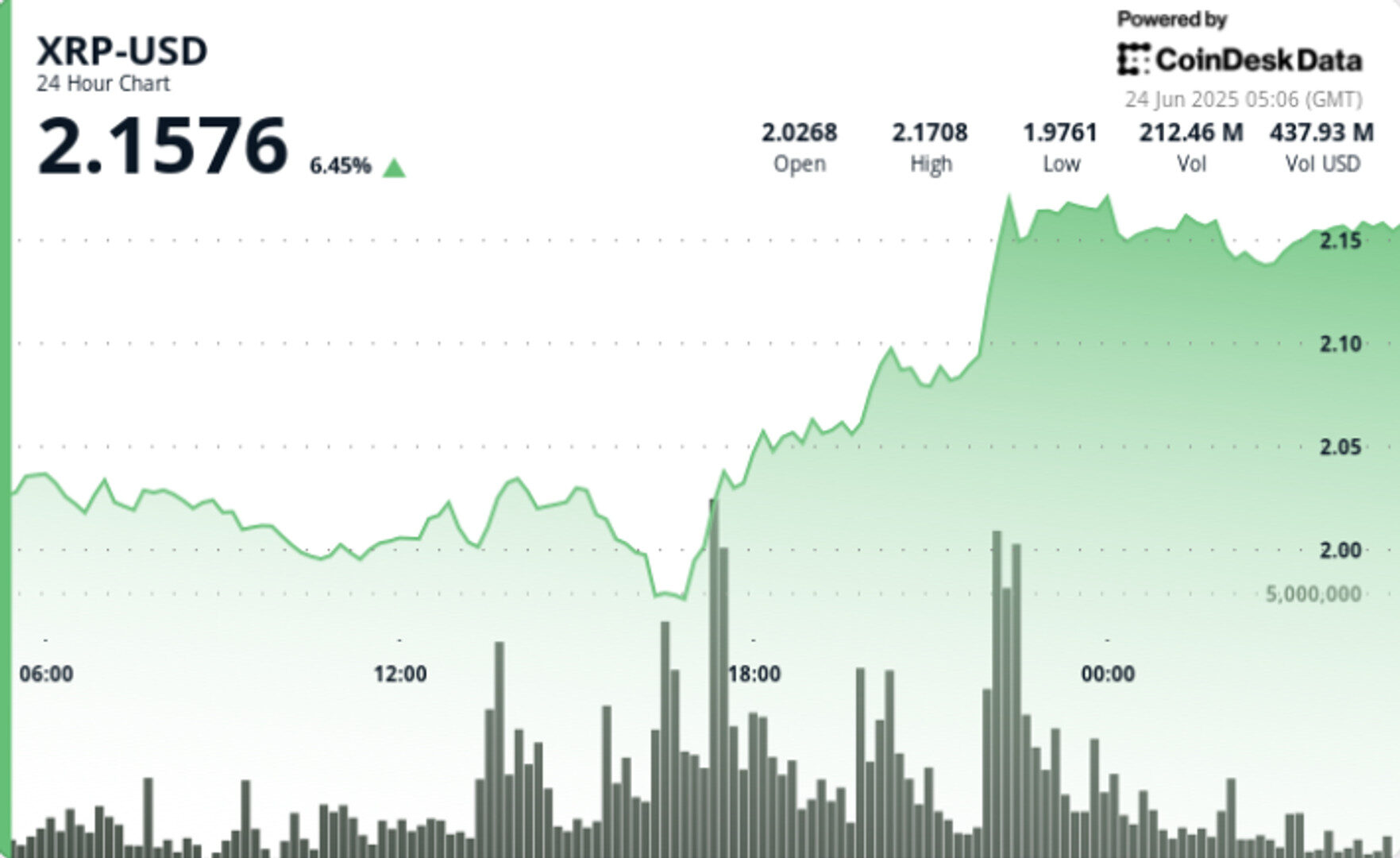

- XRP surged 11% in 24 hours, surpassing the $2 mark amid global geopolitical tensions.

- The cryptocurrency tested new resistance levels, with strong support at $1.97 and $2.154.

- Analysts are divided on XRP’s future, with predictions ranging from a rise to $6 to a potential 25% correction.

XRP is pushing higher despite escalating global turmoil, surging 11% over the past 24 hours to reclaim the $2 mark.

STORY CONTINUES BELOW

The rally comes after a turbulent weekend driven by U.S. and Israeli military activity in the Middle East, which briefly pushed the token below key psychological support.

Now back above $2.17, XRP is testing fresh resistance levels with high-volume support holding at $1.97.

News Background

- Geopolitical tensions have gripped global markets, with crypto especially reactive to headlines involving Iran, Israel, and the U.S. XRP’s recent climb comes amid this volatility, showing relative strength despite the uncertain macro backdrop.

- Trading volumes surged as buyers stepped in at the $1.97 level, setting off a high-momentum breakout that topped out at $2.173.

- Some analysts now forecast a potential run toward $6 by the end of the month — though others warn a 25% correction to $1.55 remains possible.

- While sentiment is split, market data shows institutional players are still active.

- Futures open interest and volume are elevated, and on-chain flows suggest accumulation over distribution.

- The $2.13–$2.15 zone is now acting as immediate support, and the broader structure appears bullish if it holds.

Price Action

XRP climbed from $1.967 to $2.173 over the past day, posting a 10.5% range with bullish momentum concentrated in the late session.

The decisive breakout came during the 22:00 hour with 217M volume — nearly 3x the average — establishing $2.06 as strong resistance.

Buyers first stepped in at $1.97 around 17:00 with 130M in volume, setting the foundation for the surge.

Price has since consolidated above $2.13, with $2.154–$2.156 emerging as a new support zone defended by bulls.

In the last hour, XRP rose 1.2%, closing near highs after fending off a quick 1.7% pullback at 04:07.

Volume peaked during upward movement (748K units), indicating likely accumulation rather than distribution.

Technical Analysis Recap

- 24-hour price range: $1.967 – $2.173 (10.5%)

- Strong support confirmed at $1.97 and $2.154

- Resistance zone formed at $2.06 and $2.173

- Volume spike (217M) drove breakout at 22:00

- Momentum remains intact above $2.13 with bullish consolidation

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.