-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

XRP trades around $2.75 after intraday swings, with Martinez warning of a $2.40 downside risk if support fails and outlining a bullish path toward $3.70.

By Siamak Masnavi, AI Boost|Edited by Aoyon Ashraf

Sep 1, 2025, 5:57 p.m.

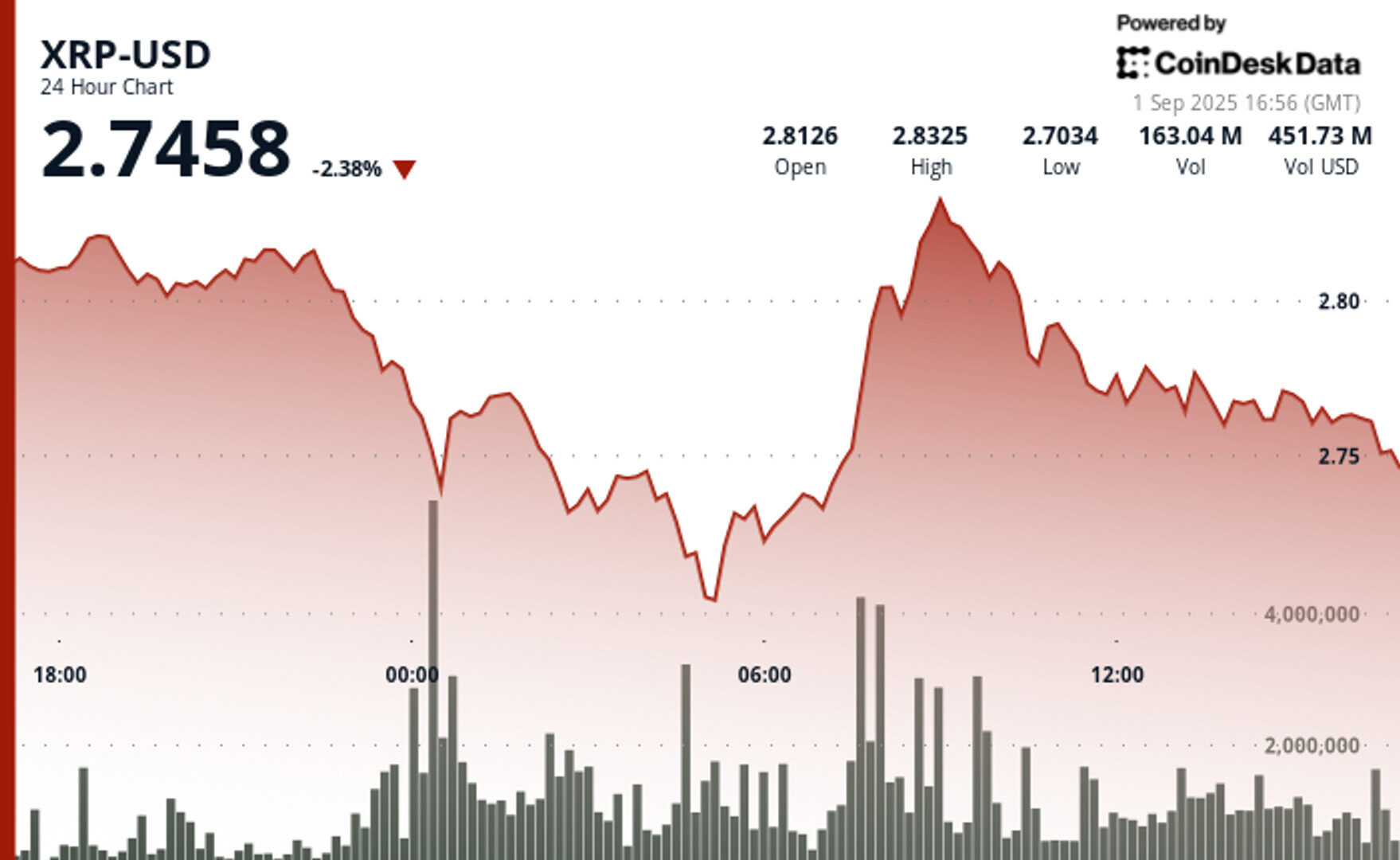

- XRP trades at $2.7458, down 2.38% in the past 24 hours, after an intraday high of $2.8325 and low of $2.7034.

- Martinez says losing $2.77 risks a slide to $2.40, while holding $2.70 and breaking $2.90 could unlock a push toward $3.70.

- CoinDesk Data’s 24-hour chart shows XRP stuck between buyers defending $2.70 and sellers capping gains above $2.80.

XRP hovered near $2.75 on Monday, down 2.38% over 24 hours, as traders weighed key support and resistance levels flagged by crypto analyst Ali Martinez.

In a post on Aug. 31, Martinez stressed that XRP “must hold above $2.77” or risk falling toward $2.40.

STORY CONTINUES BELOW

His chart illustrated a clear floor around $2.77 that had previously attracted buying interest. Breaking beneath that zone, he suggested, would take away the safety net and leave the token vulnerable to deeper losses.

For non-technical readers, the message was straightforward: $2.77 represents the line where bulls need to show strength, and if they don’t, the next major level of support sits all the way down at $2.40.

In a post on Sept. 1, Martinez followed up with a more optimistic roadmap.

His chart highlighted $2.70 as a crucial level to defend, a slightly lower support zone than before, and $2.90 as the barrier that XRP would need to break to turn momentum positive. If both conditions are met — holding the base and clearing the ceiling — his chart pointed to a potential rally toward $3.70.

In plain terms, Martinez laid out a step-by-step path: first avoid slipping lower, then push through resistance, and only then aim for a larger breakout.

CoinDesk’s 24-hour chart shows how this battle is playing out in real time. XRP reached as high as $2.8325 during the day before sellers pushed it back down, while the low of $2.7034 showed buyers stepping in to protect the lower end of the range.

That tug-of-war between bulls and bears fits neatly into Martinez’s framework. The $2.70–$2.77 area is being tested as a foundation, while the zone above $2.80 is acting as the ceiling. Trading volume spiked whenever XRP tried to break higher, reflecting resistance from sellers who are not yet willing to let the price climb further.

The price action underscores why Martinez’s levels matter: XRP is boxed in between the supports he identified and the resistance just overhead, leaving traders to watch whether buyers or sellers will seize control first.

For now, XRP’s direction hinges on whether it can stay anchored above its lower support zone long enough to gather the strength needed for a push toward $3.70.

AI Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

By CD Analytics, Francisco Rodrigues|Edited by Aoyon Ashraf

1 hour ago

Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

What to know:

- BNB’s price saw sharp intraday swings, trading between $849.88 and $868.76, but ultimately failed to hold gains.

- Underlying network activity surged, with daily active wallet addresses on BNB Chain more than doubling to 2.5 million, but transaction volumes have been dropping steadily since late June.

- The price action is ahead of key economic data from the US, including jobs data, which could influence the Federal Reserve’s interest rate decision, with a near 90% chance of a 25 bps cut currently priced in.