Share this article

Traders should watch the $2.15 pivot, as holding this level could lead to a bounce, while a break below may trigger further declines.

By Shaurya Malwa, CD Analytics

Updated Nov 18, 2025, 7:00 a.m. Published Nov 18, 2025, 7:00 a.m.

- XRP’s price fell below critical support levels despite strong institutional ETF rollouts, indicating market weakness.

- Trading volumes surged, but diminishing retail enthusiasm and broader crypto market volatility limited XRP’s momentum.

- Traders should watch the $2.15 pivot, as holding this level could lead to a bounce, while a break below may trigger further declines.

Technical breakdown accelerates despite institutional product rollouts as XRP tests critical support amid broader market weakness.

- Multiple XRP ETFs launched throughout November, including Franklin Templeton’s EZRP on Nov. 18, joining Canary Capital’s XRPC and several Bitwise products.

- Combined first-week ETF flows exceeded $245 million, signaling substantial institutional interest during the rollout.

- Despite strong inflows, ETF trading volumes slid 55% from peak levels, reflecting diminishing retail enthusiasm.

- Broader crypto markets weakened as Bitcoin volatility increased ahead of its Death Cross event, dragging altcoins lower.

- ETF narratives created optimism, but market liquidity remained fragmented, limiting momentum for XRP despite increased institutional access.

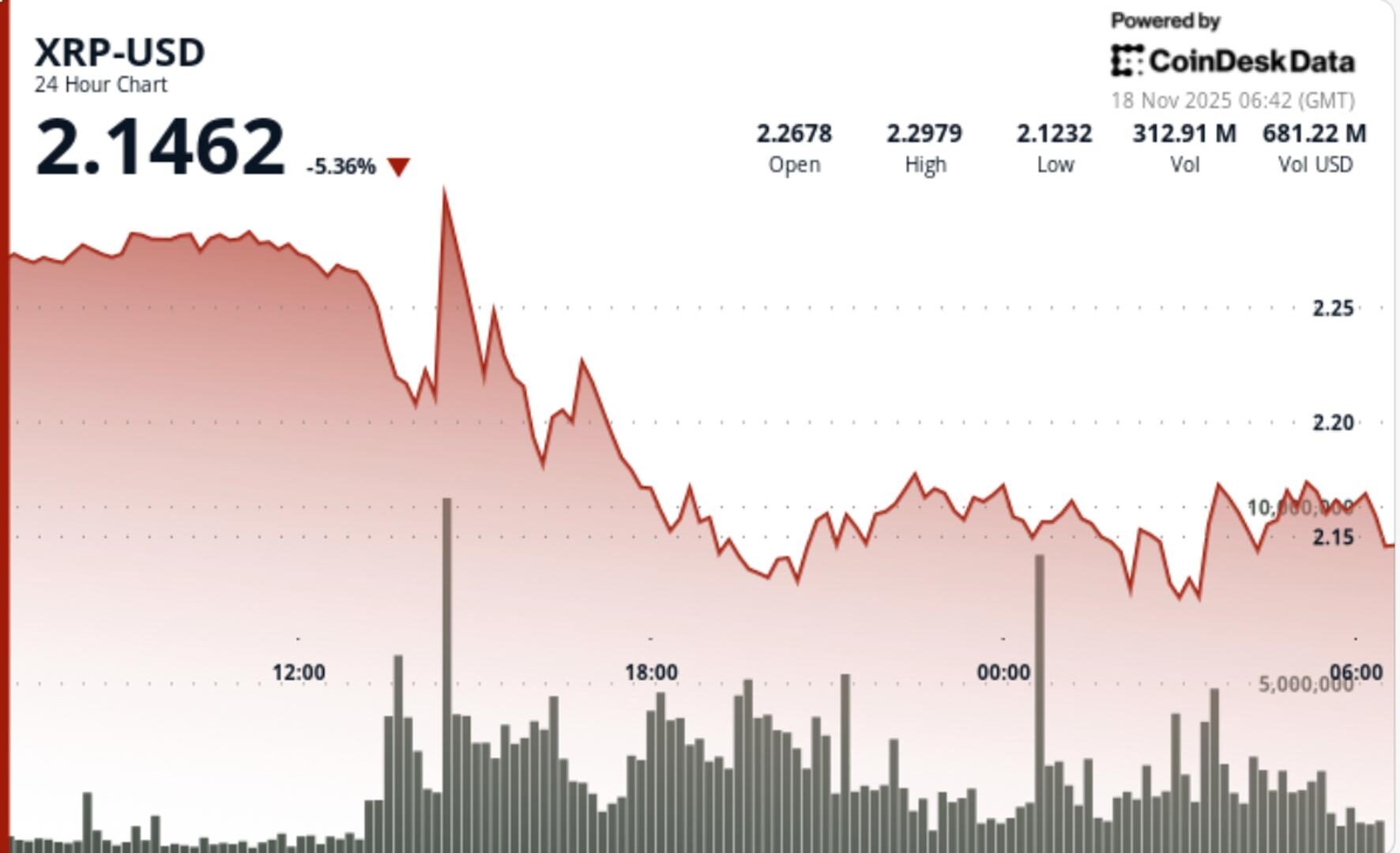

- XRP fell 4.96% from $2.27 → $2.16, breaking below the $2.20 support level.

- Total session volume surged 54.56% above monthly averages, reaching 236.6M XRP traded.

- Breakdown triggered a slide to intraday low of $2.11 before recovering to the $2.15–$2.17 zone.

- Resistance formed at $2.28, while stabilization attempts clustered around $2.155–$2.166.

- Post-breakdown consolidation printed a tight range, indicating temporary seller exhaustion but no confirmed reversal.

- XRP’s reversal from $2.27 into a sharp decline toward $2.16 confirmed a full breakdown of its short-term bullish structure.

- The failure to reclaim the $2.28 resistance zone—coinciding with early-session ETF excitement—revealed that institutional product launches were insufficient to offset technical fragility in the underlying spot market.

- Volume expansion of 54.56% above monthly norms validated the selloff, particularly as the breach of $2.20 unleashed cascading stops and forced long liquidations.

- The intraday rebound from $2.11 demonstrated that buyers remain active beneath key support levels, but the recovery lacked volume conviction, stalling almost immediately at $2.18.

- This lack of follow-through underscores the current imbalance: strong ETF flows create structural demand, yet broader crypto risk-off conditions overpower near-term bullish catalysts.

- A bearish pennant formed through compression between $2.155 support and descending resistance at $2.18, suggesting that the market is coiling for another directional move.

- Momentum indicators remain bearish with price trading below key EMAs and showing no signs of trend reversal.

- The inability to lift beyond $2.18–$2.20 keeps XRP vulnerable to further decline, while the tightening range reflects market indecision rather than accumulation.

- For bulls to regain control, price must break above the pennant’s upper boundary and reclaim $2.28—a threshold that now represents structural confirmation of regained upward momentum.

- Traders must monitor whether XRP’s consolidation above $2.155 represents stabilization or simply a pause before continuation lower.

- The next catalysts remain ETF-related, with additional Bitwise launches scheduled through Nov. 25, though recent declines in ETF trading activity suggest diminishing short-term impact unless broader market sentiment improves.

- The $2.15 pivot is critical: holding the level offers potential for a bounce toward the $2.28–$2.30 corridor, while a decisive break below opens the door to a rapid selloff toward the $1.98 structural support cluster.

- XRP’s near-term trajectory will also depend on Bitcoin’s volatility regime—particularly whether BTC stabilizes after its Death Cross event or drags altcoins into deeper retracement phases.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By Sam Reynolds|Edited by Omkar Godbole

28 minutes ago

The country has added nearly 100 million dollars to the national bitcoin treasury as BTC trades below $90k.

What to know:

- El Salvador has increased its bitcoin holdings by over 1,000 BTC, despite a significant market selloff.

- The country’s total bitcoin reserves now approach 7,500 BTC, maintained by a policy of buying one BTC per day.

- President Bukele’s recent bitcoin purchase comes amid discussions with U.S. officials on digital asset regulation.