-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 20, 2025, 6:23 a.m. Published Aug 20, 2025, 6:23 a.m.

- XRP fell below $3.00 due to security concerns and regulatory delays.

- A security audit ranked XRP Ledger lowest among 15 blockchains, affecting investor confidence.

- The SEC’s delay on XRP ETF applications has increased market uncertainty.

XRP extended losses in the past 24 hours, slipping under the $3.00 mark after a sharp rejection at resistance. A combination of blockchain security concerns and delayed regulatory decisions drove heavy selling and profit-taking across institutional desks.

• A security audit ranked XRP Ledger lowest among 15 blockchains, eroding investor confidence.

• The SEC delayed rulings on multiple XRP ETF applications, including Nasdaq’s CoinShares filing, until October.

• Heightened regulatory ambiguity and security doubts fueled portfolio adjustments at major trading firms.

STORY CONTINUES BELOW

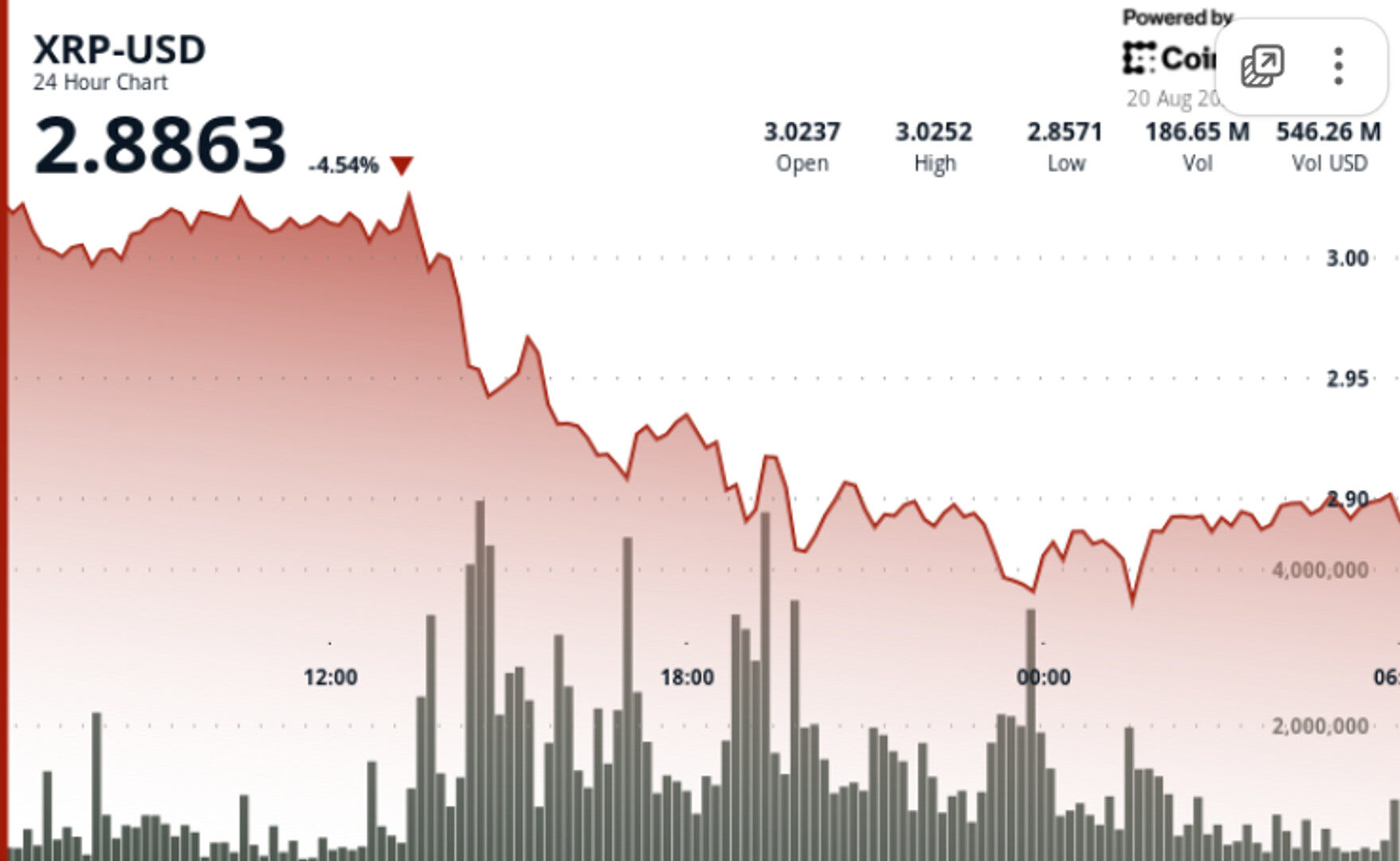

• XRP fell 4% from $3.02 to $2.90 between August 19 at 06:00 and August 20 at 05:00.

• The steepest drop came from 13:00–15:00 on August 19, when price collapsed from $3.04 to $2.93.

• Volume spiked to 137.18 million in the 14:00 hour, nearly double the daily average of 71.23 million.

• Buyers defended $2.85–$2.88 multiple times overnight.

• Price stabilized near $2.89–$2.90 in the final hour, showing balance just under $3.00.

• Resistance confirmed at $3.04 with volume-driven rejection.

• Support zone established at $2.85–$2.88 through repeated defenses.

• Consolidation at $2.89–$2.90 signals exhaustion of immediate selling pressure.

• Volume surge highlights institutional repositioning.

• Whether $3.00 flips back into support or remains a rejection barrier.

• Institutional flows at $2.85–$2.90 to determine if the level forms a base.

• SEC rulings in October as medium-term volatility drivers.

• Impact of security rankings on ETF approval prospects.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Shaurya Malwa, CD Analytics

1 hour ago

Security fears collided with broad crypto weakness, pushing DOGE into heavy sell pressure despite continued whale accumulation.

What to know:

- Dogecoin’s price fell sharply after the Qubic blockchain community voted to target it for a potential 51% attack.

- Despite security concerns, large holders accumulated 680 million DOGE in August, indicating long-term interest.

- DOGE futures open interest declined by 8%, reflecting reduced confidence in short-term gains.