-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 11, 2025, 4:40 a.m. Published Aug 11, 2025, 4:40 a.m.

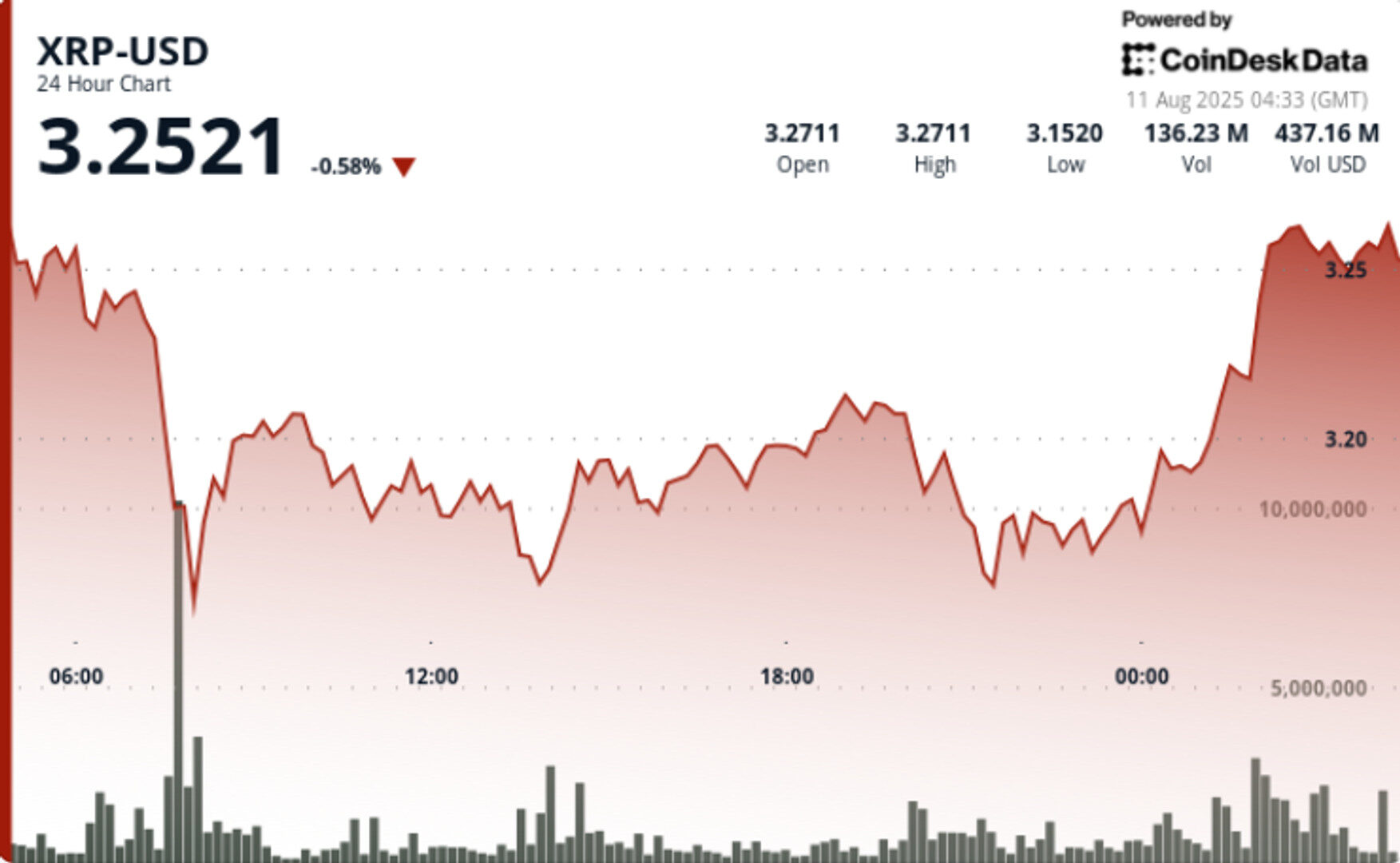

- XRP surged 11% after the SEC dismissed its case against Ripple Labs, with prices peaking at $3.27.

- Institutional trading volumes spiked 208% to $12.40 billion, indicating strong market interest.

- The $3.15-$3.16 zone emerged as a key support level, with resistance seen at $3.24-$3.27.

XRP jumps 11% in the 24-hour period ending August 11, moving from $2.90 to highs of $3.27 before settling at $3.22. The breakout comes as institutional trading volumes spike 208% to $12.40 billion following the formal dismissal of the SEC’s case against Ripple Labs.

Open interest in derivatives rises 15% to $5.90 billion, underscoring aggressive positioning from large players.

Price action shows early-session volatility, with a sharp drop from $3.24 to $3.16 during the 07:00 hour on 144.54 million volume. Buyers defend the $3.15-$3.16 zone, triggering a late-session push that breaks $3.22 resistance and holds above $3.24 into the close.

STORY CONTINUES BELOW

The Securities and Exchange Commission and Ripple Labs officially ended their multi-year legal battle, jointly dismissing appeals in the XRP case. The resolution removes a long-standing regulatory overhang and opens the door for broader corporate and institutional adoption.

The rally comes alongside heightened derivatives activity and bullish technical setups, with some institutional research desks targeting $4.50-$5.00 as potential medium-term upside.

• XRP gains 11% as price breaks above $3.00 psychological barrier on surging institutional volumes

• $3.15-$3.16 emerges as strong accumulation zone following 07:00 selloff from $3.24

• Late-session breakout clears $3.22 resistance on sustained large-order flow above 4 million units

• Session range spans $0.11 (3% volatility) between $3.27 high and $3.15 low

Regulatory clarity triggered aggressive corporate treasury rebalancing and new speculative inflows from institutional desks. The $3.15 support zone now acts as a key reference for short-term risk management, while $3.24-$3.27 serves as near-term resistance.

Breakout confirmation above this band could accelerate momentum toward higher technical targets, especially if ETF-related flows in Japan spill over into U.S. markets.

• Volume surge to $12.40B, up 208% from prior day

• Open interest climbs 15% to $5.90B, signaling leveraged positioning

• Resistance: $3.24-$3.27; Support: $3.15-$3.16

• Breakout above $3.22 confirmed by late-session institutional flows

• Technical setup aligns with breakout from multi-month consolidation

• Follow-through above $3.27 to validate breakout toward $3.50+

• Sustainability of large-holder accumulation post-regulatory resolution

• Impact of derivatives positioning on spot market volatility

• Potential spillover from Japan’s SBI Bitcoin-XRP ETF filing

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Shaurya Malwa|Edited by Parikshit Mishra

36 minutes ago

ETH’s strength has been underpinned by pro-crypto regulatory signals and heavy inflows into ETFs, with traders betting on a retest of its all-time high, some say.

What to know:

- Ether (ETH) surged over 21% in the past week, reaching $4,300, while Bitcoin (BTC) rose 3% to hit record highs.

- The S&P 500 and Nasdaq reached near all-time highs, driven by strong earnings despite political and economic challenges.

- ETH’s performance is bolstered by regulatory support and ETF inflows, with expectations of continued price increases for both ETH and BTC.