BTC

$101,691.99

+

0.82%

ETH

$2,265.87

+

3.00%

USDT

$1.0007

+

0.02%

XRP

$2.0190

+

3.02%

BNB

$620.04

+

0.60%

SOL

$135.32

+

5.22%

USDC

$1.0004

+

0.03%

TRX

$0.2699

+

0.85%

DOGE

$0.1538

+

3.31%

ADA

$0.5467

+

3.12%

HYPE

$35.66

+

10.28%

WBT

$47.75

–

1.02%

BCH

$455.32

+

1.07%

SUI

$2.5212

+

3.53%

LEO

$8.9888

+

0.70%

LINK

$11.96

+

3.74%

XLM

$0.2309

–

1.09%

AVAX

$17.04

+

1.97%

TON

$2.8049

–

1.03%

SHIB

$0.0₄1091

+

1.26%

By Shaurya Malwa, CD Analytics

Jun 23, 2025, 12:14 p.m.

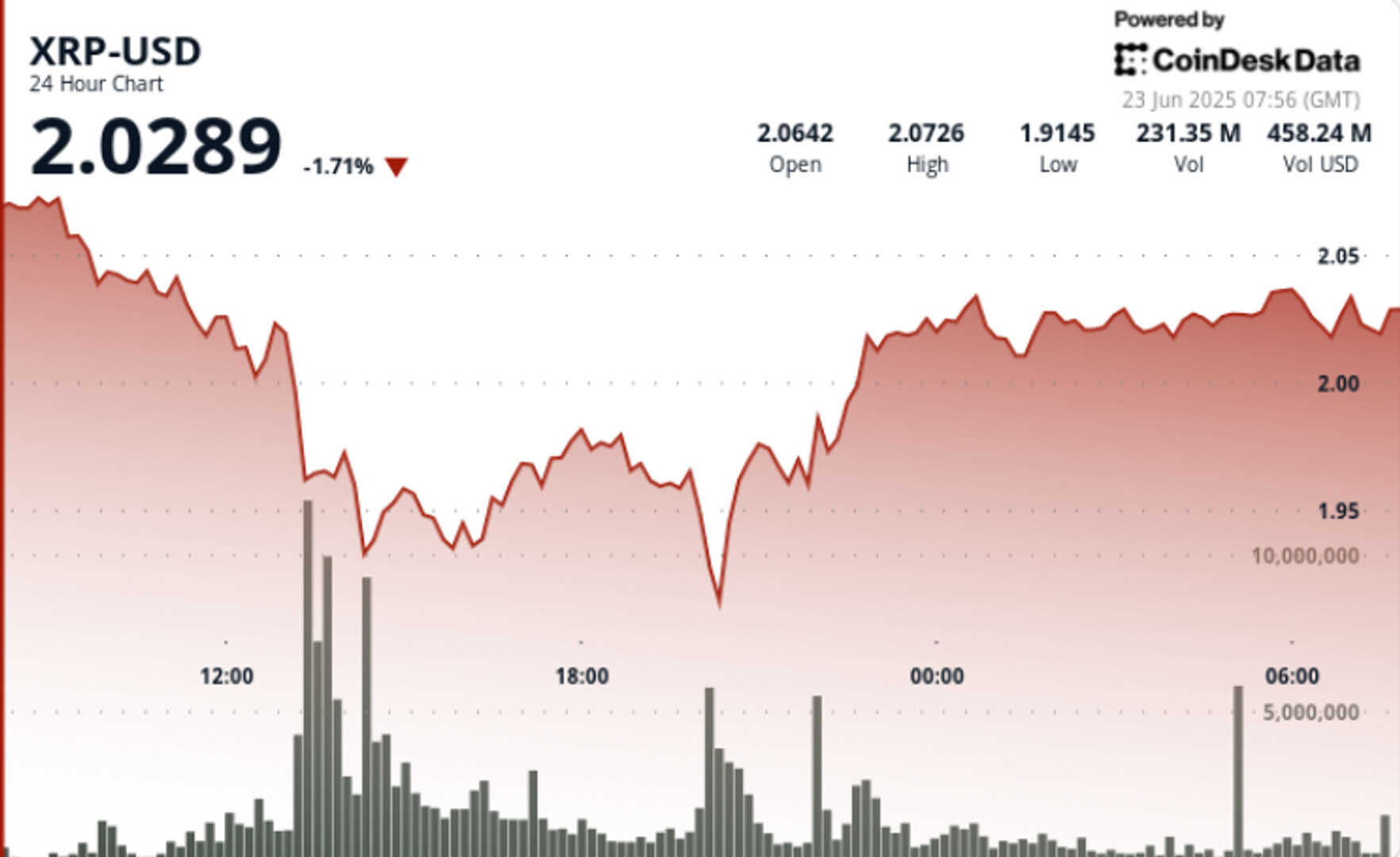

- XRP has shown resilience, recovering from a dip to reclaim the $2.00 support level amid global economic pressures.

- A surge in futures interest, with nearly $3.96 billion in derivatives traded, indicates renewed institutional interest in XRP.

- ETF developments in Canada and the U.S. suggest potential regulatory thawing, with new XRP ETFs launched and proposals under review.

XRP is showing strong resilience in the face of escalating global economic pressures, bouncing back from a steep correction to reclaim the key $2.00 support level.

The token traded within a 6.5% range over the past 24 hours, bottoming out at $1.91 before climbing to a high of $2.04. A sharp V-shaped recovery pattern has emerged, with increasing volume suggesting accumulation following the dip.

News Background

STORY CONTINUES BELOW

- Global markets remain rattled by geopolitical friction and trade uncertainty, triggering volatility across digital assets. XRP was no exception, briefly falling below the $2 threshold before mounting a recovery.

- That rebound has been bolstered by a massive spike in futures interest — nearly $3.96 billion in XRP derivatives changed hands, led by Binance (30.58%), Bybit, and OKX.

- Analysts see the surge as a sign of renewed institutional interest in the asset.

- ETF momentum is also building. In Canada, 3iQ and Purpose Investments have launched XRP ETFs on the Toronto Stock Exchange, while in the U.S., the SEC has opened a comment period on Franklin Templeton’s proposed XRP ETF — a move that could hint at regulatory thawing.

- Traders are now watching to see whether XRP can build enough momentum to retest the next major resistance level at $2.14.

Price Action

XRP rebounded from a low of $1.912 to a high of $2.040, forming a consolidation pattern around the $2.000 mark.

A V-shaped recovery began near $1.913, with the $2.020 level emerging as high-volume resistance during hours 22–23.

The $2.000 area remains a key pivot zone, with near-term resistance at $2.003 and volume-backed support at $1.989.

Price action in the final hours showed narrowing volatility — a potential sign of further consolidation or breakout prep.

Technical Analysis Recap

- 24-hour price range: $1.912–$2.040 (6.5%)

- Resistance confirmed at $2.020 with above-average volume

- $2.000 remains key psychological level; support held at $1.989

- V-shaped recovery pattern suggests buyer momentum

- Futures volume surged to $3.96B, indicating heavy derivatives activity

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.