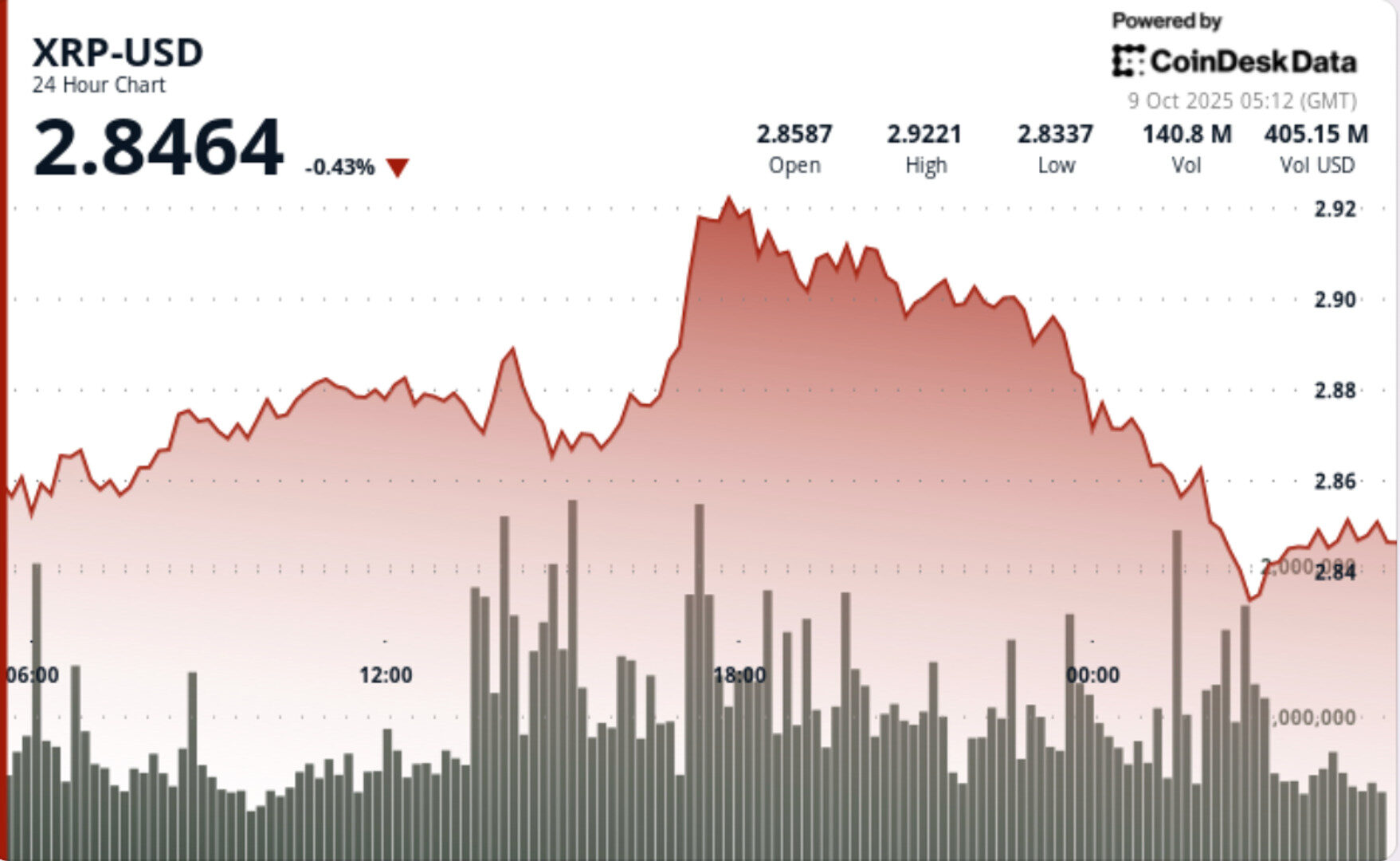

A fresh supply zone formed at $2.92–$2.93, while the $2.85 floor is now under scrutiny as macro headwinds weigh on flows.

Updated Oct 9, 2025, 5:23 a.m. Published Oct 9, 2025, 5:22 a.m.

- XRP spiked above $2.90 before profit-taking reversed gains, closing at $2.85.

- A new supply zone formed at $2.92–$2.93, with $2.85 now under scrutiny as a potential floor.

- Traders are watching macroeconomic factors and regulatory developments for future price movement.

XRP spiked above $2.90 on double-average volume before profit-taking reversed gains, leaving price back at $2.85. A fresh supply zone formed at $2.92–$2.93, while the $2.85 floor is now under scrutiny as macro headwinds weigh on flows.

XRP rallied 2% intraday on Oct. 8, jumping from $2.88 to $2.93 at 17:00 on 86.6M turnover — nearly double the 24-hour average of 48.3M. The move coincided with heightened geopolitical tensions and central bank maneuvering, which fueled broader volatility across risk assets. Traders noted that despite stronger institutional adoption trends, profit-taking dominated into the U.S. close.

STORY CONTINUES BELOW

- XRP traded a $0.08 corridor (3% range) between $2.85 and $2.93.

- Afternoon breakout through $2.90 resistance peaked at $2.926 before reversing.

- The rally established a supply zone at $2.92–$2.93.

- Closing hour saw price slip from $2.86 to $2.85, with 2.97M volume confirming a breakdown.

- XRP settled at $2.851, down 2.5% from intraday highs.

Support at $2.86 cracked under heavy sell pressure, turning that level into near-term resistance. The next floor sits at $2.85, with any decisive break opening risk toward $2.80. Resistance remains at $2.92–$2.93, where high-volume rejection printed. While price structure shows bearish momentum short term, institutional accumulation themes and regulatory catalysts still underpin broader positioning.

- Whether $2.85 holds as a near-term floor or yields to $2.80.

- A retest of $2.92–$2.93 supply zone if momentum returns.

- Macro catalysts: Fed policy expectations and trade tensions impacting risk flows.

- ETF and regulatory clarity themes that could re-anchor institutional bids.

More For You

Sep 9, 2025

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

By Omkar Godbole, AI Boost|Edited by Sam Reynolds

2 minutes ago

Arthur Hayes argues that Bitcoin’s traditional four-year market cycle has ended, as current shifts in global monetary policy indicate expanding fiat liquidity.

What to know:

- Arthur Hayes argues that bitcoin’s traditional four-year market cycle is no longer valid.

- Current shifts in global monetary policy indicate expanding fiat liquidity, he said.

- Previous bear markets were catalyzed by monetary tightening across the advanced world.