Share this article

Social sentiment for XRP has collapsed to extreme fear levels, historically preceding short-term rebounds.

By Shaurya Malwa, CD Analytics

Updated Dec 7, 2025, 1:05 p.m. Published Dec 7, 2025, 12:47 p.m.

- XRP faces structural weakness with a -7.4% weekly performance, despite strong institutional demand via U.S. spot XRP ETFs.

- Social sentiment for XRP has collapsed to extreme fear levels, historically preceding short-term rebounds.

- XRP’s price action shows a descending channel, with a critical pivot at $2.030 to avoid deeper declines.

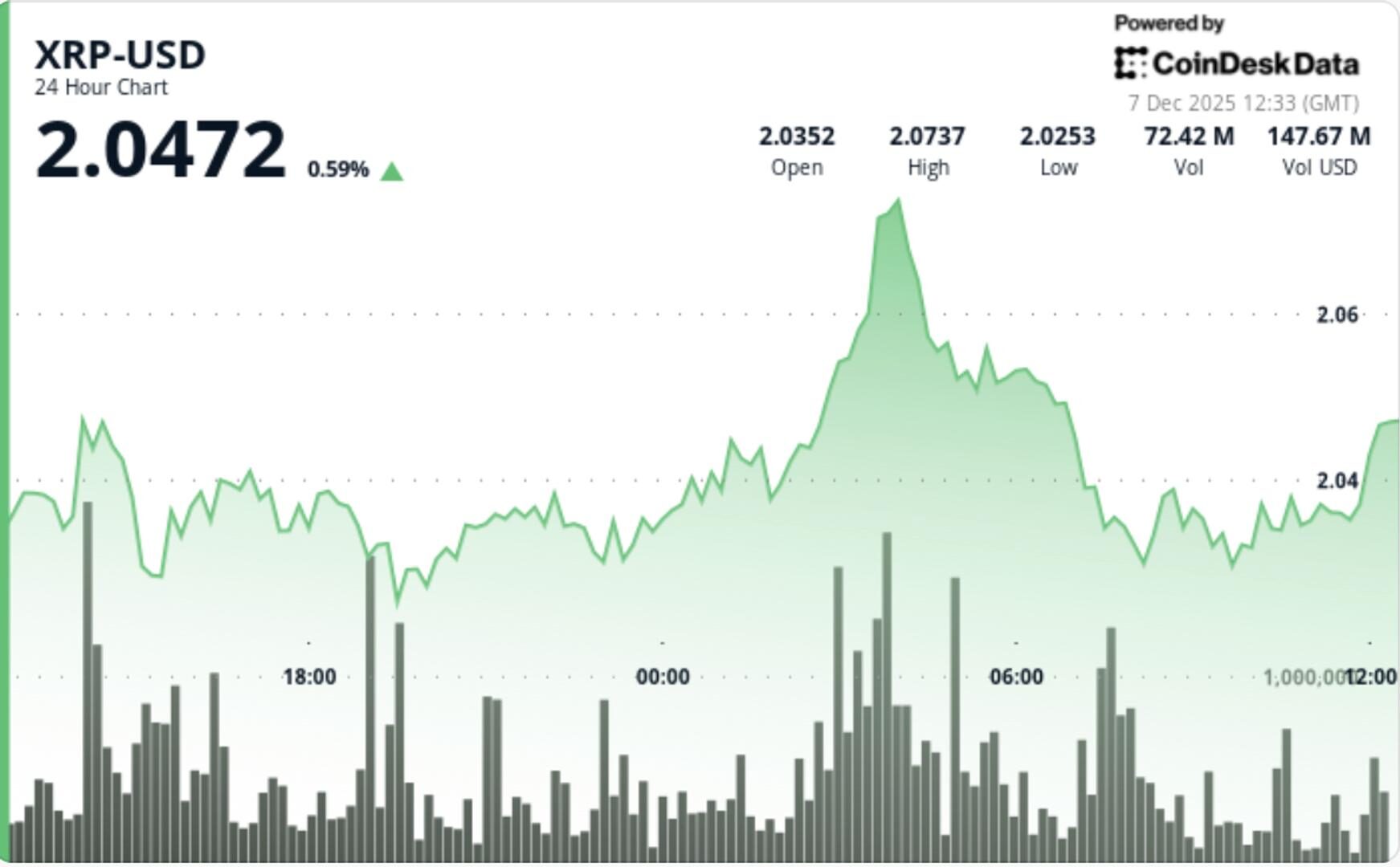

Technical indicators across multiple timeframes point to structural weakness despite brief breakout attempts above $2.05 resistance during overnight trading.

- XRP continues to face pressure as its weekly performance deteriorates to -7.4%, adding to the multi-session downtrend dominating early December.

- Despite persistent weakness in price, institutional demand remains strong via U.S. spot XRP ETFs, which have attracted $906 million in net inflows since launch — with no outflow days recorded.

- Meanwhile, social sentiment has collapsed to extreme fear readings matching October lows, with Santiment reporting the highest level of bearish commentary in over five weeks.

- Historically, such extremes preceded short-term rebounds, including the November 21 recovery.

- On-chain data shows mixed positioning: 6–12 month holders reduced exposure significantly, falling from 26.18% to 21.65%, while long-term ETF-driven demand continues to accumulate quietly in the background.

- XRP’s attempt to break higher was initially successful, with price pushing through $2.05 on a 68% above-average volume surge at 03:00. The breakout produced a sharp rally to $2.07, but the move lacked follow-through. Diminishing volume into the retrace revealed fading momentum, and sellers quickly regained control.

- A persistent descending channel has now formed on the 60-minute chart, featuring successive lower highs and tightening price compression. This structure reflects an orderly trend-driven decline rather than a panic liquidation.

- Each bounce has been met with distribution, particularly near $2.04–$2.05 — a zone that now doubles as immediate resistance.

Momentum oscillators trend downward across intraday timeframes, while the weekly TD Sequential indicator quietly flashes a potential reversal signal. - This creates an environment of short-term weakness paired with early-stage long-term stabilization signals.

- XRP traded within a $0.0563 range (2.8%), moving between $2.02 and $2.07 before closing near $2.032.

- The breakout to $2.07 was driven by a 44.99M volume spike (68% above SMA), but the rally fully retraced as volume decayed.

- The 60-minute structure shows XRP declining from $2.040 to a support test at $2.029, with 1.08M volume during the low — clear evidence of institutional distribution rather than opportunistic buying.

- XRP now consolidates around $2.030, where holding this pivot becomes critical to avoid deeper testing of the $2.020–$2.025 zone.

- XRP’s short-term trajectory remains fragile as technical forces overpower otherwise supportive fundamentals like ETF inflows and long-term accumulation.

- A reclaim of $2.035 is required to restore intraday momentum, while a clean break back above $2.05 would be needed to invalidate the descending channel.

- If $2.030 gives way, traders should anticipate a retest of $2.020–$2.025, with psychological support at $2.00 serving as the final line before wider downside opens.

- Sentiment is deeply negative, which historically has aligned with early reversal setups, but until a technical trigger emerges, the prevailing trend remains downward.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By James Van Straten, AI Boost|Edited by Stephen Alpher

23 minutes ago

Rising bitcoin supply in loss, weakening spot demand and cautious derivatives positioning were among the issues raised by the data provider in its weekly newsletter.

What to know:

- Glassnode’s weekly newsletter shows multiple onchain metrics now resemble conditions seen at the start of the 2022 bear market, including elevated top buyer stress and a sharp rise in supply held at a loss.

- Off chain indicators show softening demand and fading risk appetite, with declining ETF flows and weakening spot volumes.